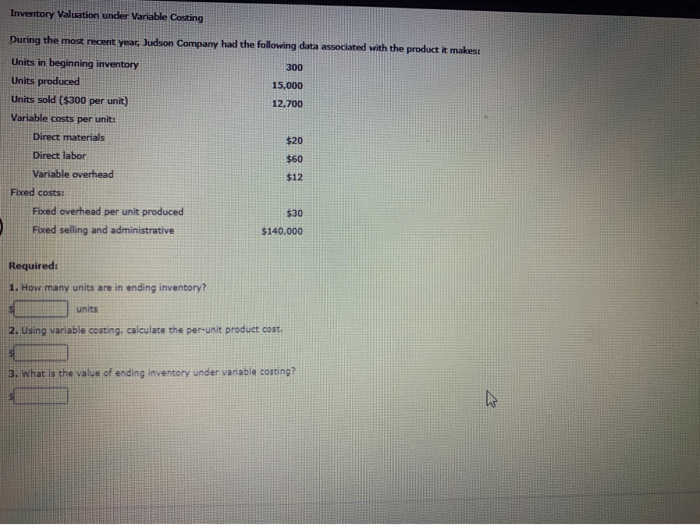

Question: Inventory Valuation under Variable Costing During the most recent year, Judson Company had the following data associated with the product it makes 300 15,000 12,700

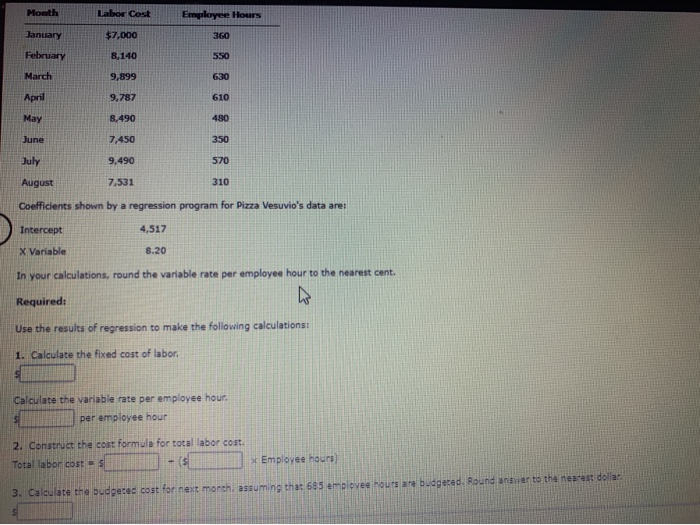

Inventory Valuation under Variable Costing During the most recent year, Judson Company had the following data associated with the product it makes 300 15,000 12,700 Units in beginning inventory Units produced Units sold ($300 per unit) Variable costs per unit: Direct materials Direct labor Variable overhead Fixed costs: Fixed overhead per unit produced Fixed selling and administrative $30 $140,000 Required: 1. How many units are in ending inventory? units 2. Using variable costing, calculate the per-unit product cost 3. What is the value of ending inventory under variable conting? Employee Hours January $7,000 February 8,140 March 9,899 April 9,787 May 8,490 June 7,450 July 9,490 August 7.531 310 Coefficients shown by a regression program for Pizza Vesuvio's data are: Intercept 4,517 X Variable 8.20 In your calculations, round the variable rate per employee hour to the nearest cent. Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of labor. Calculate the variable rate per employee hour. per employee hour 2. Construct the cost formula for total labor cost. Total labor cost = -($ Employee hours) 3. Calculate the budgeted cost for next month assuming that 685 emplove houtsan budgered. Round answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts