Question: Investment Analysis Practice Problem Suppose that you are contemplating an investment in an office building. Use the information provided below to answer the questions that

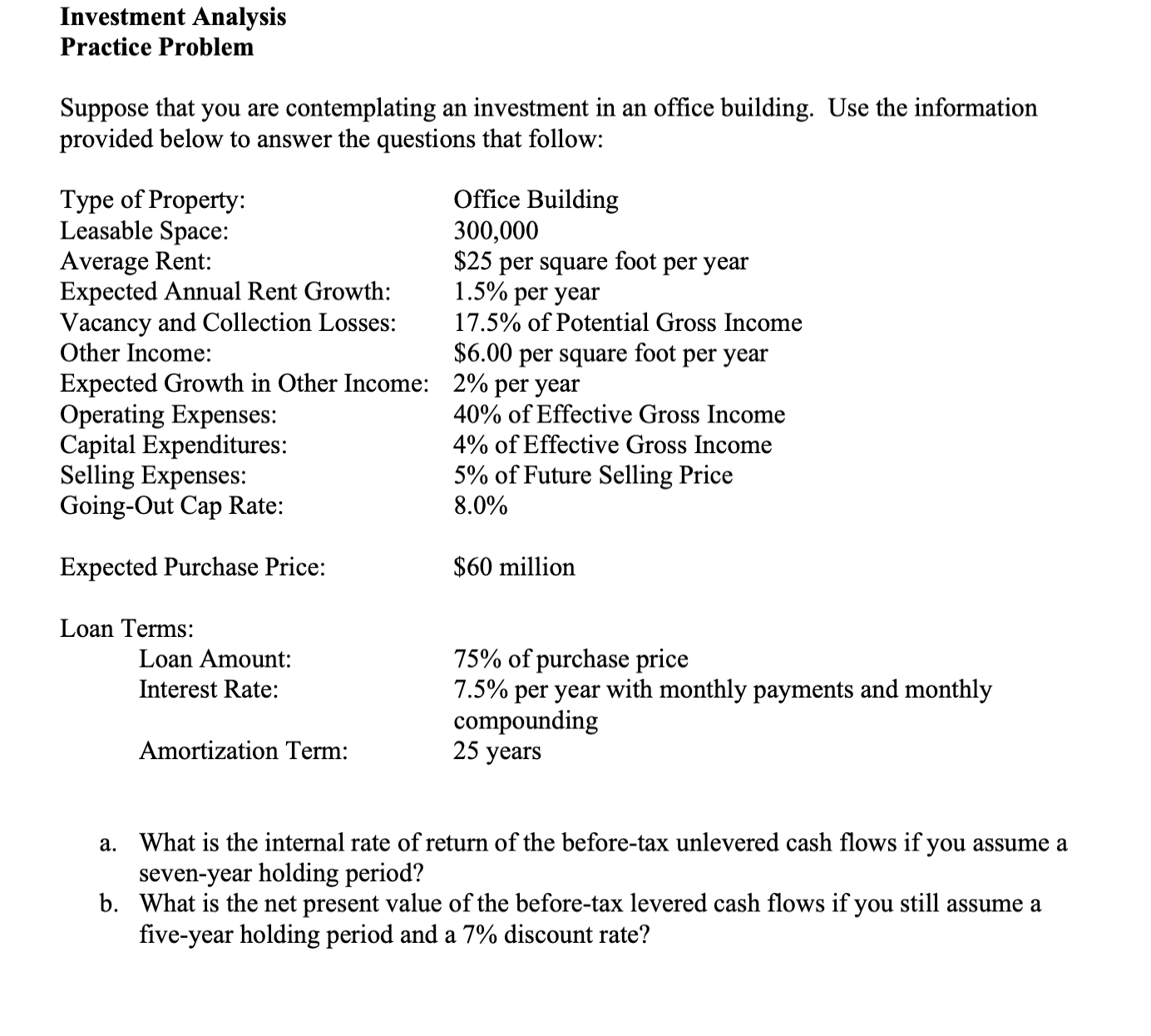

Investment Analysis Practice Problem Suppose that you are contemplating an investment in an office building. Use the information provided below to answer the questions that follow:

Type of Property: Office Building

Leasable Space:

Average Rent: $ per square foot per year

Expected Annual Rent Growth: per year

Vacancy and Collection Losses: of Potential Gross Income

Other Income: $ per square foot per year

Expected Growth in Other Income: per year

Operating Expenses: of Effective Gross Income

Capital Expenditures: of Effective Gross Income

Selling Expenses: of Future Selling Price

GoingOut Cap Rate:

Expected Purchase Price: $ million

Loan Terms:

Loan Amount: Interest Rate: of purchase price

per year with monthly payments and monthly compounding

Amortization Term: years

a What is the internal rate of return of the beforetax unlevered cash flows if you assume a sevenyear holding period?

b What is the net present value of the beforetax levered cash flows if you still assume a fiveyear holding period and a discount rate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock