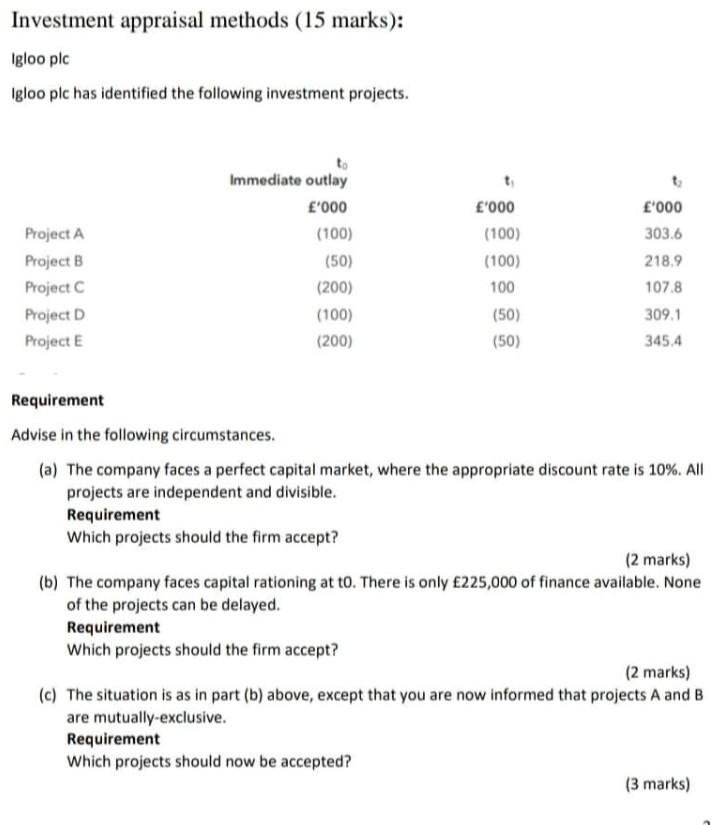

Question: Investment appraisal methods (15 marks): Igloo plc Igloo plc has identified the following investment projects. Project A Project B Project C Project D Project E

Investment appraisal methods (15 marks): Igloo plc Igloo plc has identified the following investment projects. Project A Project B Project C Project D Project E Immediate outlay '000 (100) (50) (200) (100) (200) '000 (100) (100) 100 (50) (50) '000 303.6 218.9 107.8 309.1 345.4 Requirement Advise in the following circumstances. (a) The company faces a perfect capital market, where the appropriate discount rate is 10%. All projects are independent and divisible. Requirement Which projects should the firm accept? (2 marks) (b) The company faces capital rationing at to. There is only 225,000 of finance available. None of the projects can be delayed. Requirement Which projects should the firm accept? (2 marks) (c) The situation is as in part (b) above, except that you are now informed that projects A and B are mutually-exclusive. Requirement Which projects should now be accepted? (3 marks) (d) The situation is as in part (b) above, except that you are now told that all projects are independent but indivisible. Requirement Which projects should be accepted? What will be the maximum NPV available to the company? (4 marks) (e) All projects are independent and divisible. There is capital rationing at t1 only. No project can be delayed or brought forward. There is only 150,000 of external finance available at t1. Requirement Which projects should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts