Question: Investment Comparison Part II Instructions (Note: This document is not to be submitted but is to be used as an aid to complete the discussion

Investment Comparison Part II Instructions

(Note: This document is not to be submitted but is to be used as an aid to complete the discussion form.)

This document is copyrighted. Sharing without permission is not permitted.

Peter Lawson

In this part of the discussion, part II, you will act as a financial advisor. The case is a friend who is looking for advice and has a list of various ETFs and mutual funds as investments. Your job is to analyze and provide advice as to what you think would be strong options in which they could invest. Your friend has not invested in the past and tells you they are looking for broad exposure to sectors in the economy and are conservative when it comes to risk. They think they would like some companies with growth potential and some dividend income.

This assignment will look at different funds and you will provide the profile and top 10 holdings of each option. In addition, you will compare the option on returns, and fees. You will need to use web search engines to find the profile and top 10 holdings.

Part II List of funds to consider:

You will analyze the following five Mutual Funds or ETF.

SPDR S&P 500 ETF Trust ticker symbol SPY

American Growth Fund Series One ticker symbol AMRBX

Fidelity Fund Ticker symbol FFIDX

Invesco KBW

Proshares Bitcoin Strategy ETF BITO

I. In relation to your friend's goals list and what you find out about the five mutual fund choices. Use the table in the Investment Comparison Discussion Form, and list from strongest to weakest recommendation, with number one being the strongest fund. Analyze the funds using the following criteria.

A. Provide a profile or strategy for the fund, meaning describe in what assets it invests. And mention its diversification by the number of companies and sectors of its investments.

B. List its fees and expense ratio. Include any front-end load, sometimes called Purchase fee, back-end load, sometimes called Redemption Fee, and any 12b-1 fee.

C a. Give your recommendation for the fund as an investment. This is either yes, or no.

C b. Give reasons for your recommendation. Why did you either recommend it or not recommend it as an investment?

You can find information by doing Google searches and finding information from the fund prospectus summaries. Also, the following link may be useful to find the funds' returns and fees. But this information is also available in other sources.

https://www.marketwatch.com/tools/fund-comparison

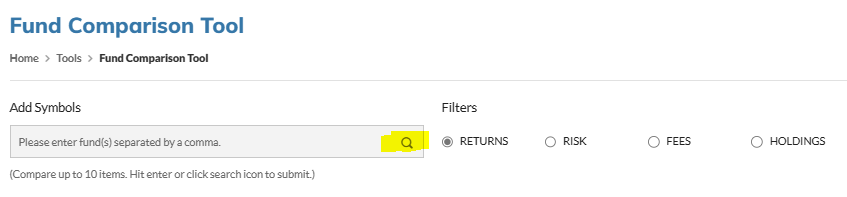

To use the MarketWatch tool you need to enter the ticker symbol of the funds or ETF choose the filter, in this case either returns or fees, and then hit the search icon.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts