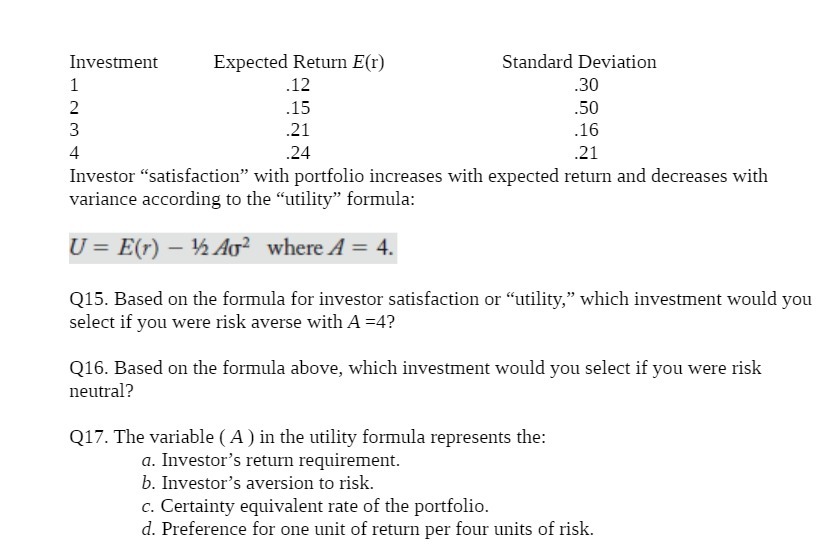

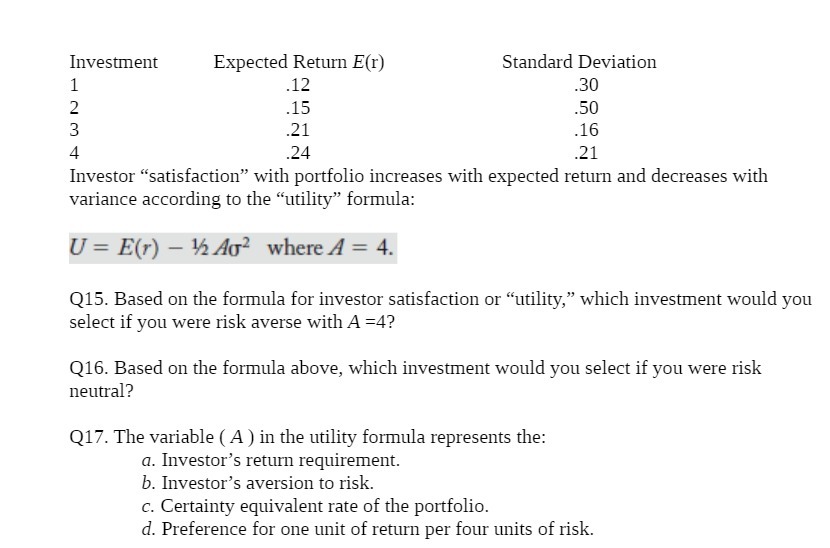

Question: Investment Expected Return E{r) Standard Deviation 1 .12 .30 2 .15 .50 3 .21 .16 4 .24 .21 Investor satisfaction with portfolio increases with expected

Investment Expected Return E{r) Standard Deviation 1 .12 .30 2 .15 .50 3 .21 .16 4 .24 .21 Investor \"satisfaction\" with portfolio increases with expected return and decreases with variance according to the \"utility\" formula: U=E(r) H3110: whereA= 4. Q15. Based on the formula for investor satisfaction or \"utility,\" which investment would you select if you were risk averse with A =4? Q16. Based on the formula above, which investment would you select if you were risk neutral? Q1?. The variable ( A] in the utility formula represents the: a. Investor's return requirement. 1). Investor's aversion to risk. (3. Certainty equivalent rate of the portfolio. (1'. Preference for one unit of return per four units of risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts