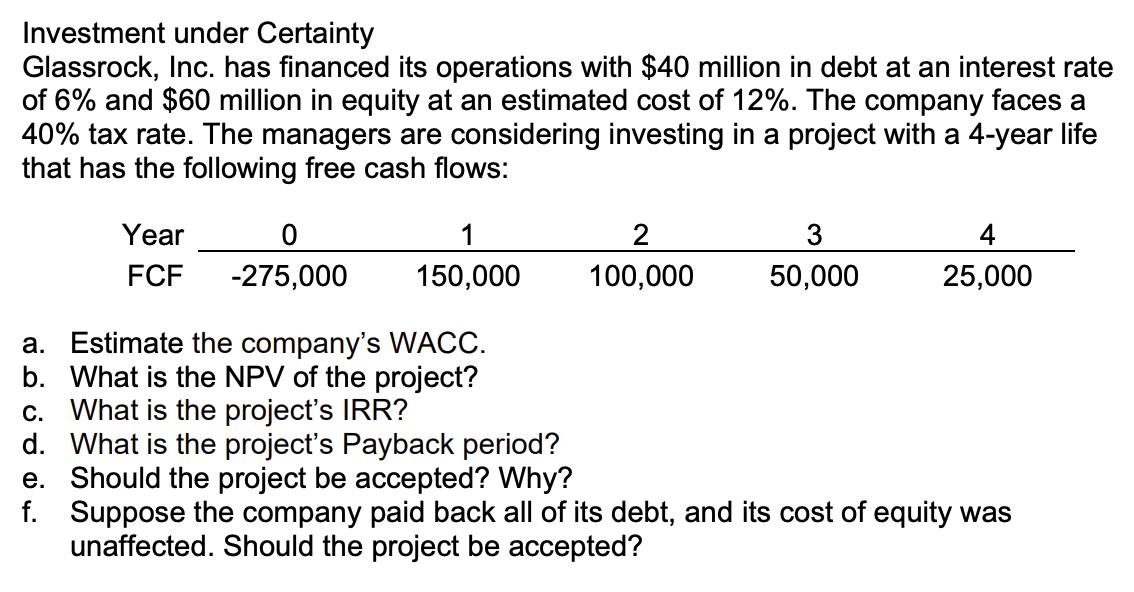

Question: Investment under Certainty Glassrock, Inc. has financed its operations with $40 million in debt at an interest rate of 6% and $60 million in

Investment under Certainty Glassrock, Inc. has financed its operations with $40 million in debt at an interest rate of 6% and $60 million in equity at an estimated cost of 12%. The company faces a 40% tax rate. The managers are considering investing in a project with a 4-year life that has the following free cash flows: Year FCF 0 -275,000 1 150,000 a. Estimate the company's WACC. b. What is the NPV of the project? c. What is the project's IRR? d. What is the project's Payback period? e. Should the project be accepted? Why? 2 100,000 3 50,000 4 25,000 f. Suppose the company paid back all of its debt, and its cost of equity was unaffected. Should the project be accepted?

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

a To estimate the companys Weighted Average Cost of Capital WACC we need to calculate the cost of debt cost of equity and the proportion of debt and e... View full answer

Get step-by-step solutions from verified subject matter experts