Question: ion Text You work as an inter in the treasury department of X Co. X company is into three different lines of business: Cement, Power,

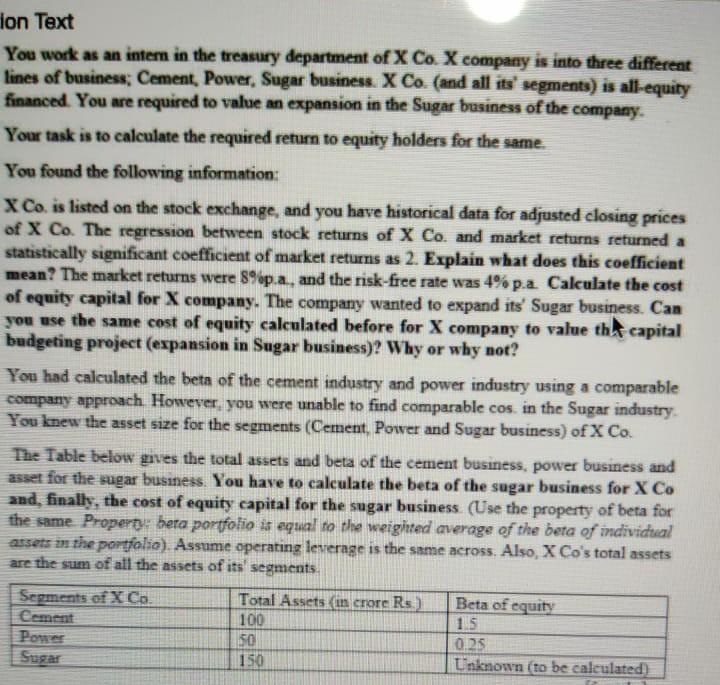

ion Text You work as an inter in the treasury department of X Co. X company is into three different lines of business: Cement, Power, Sugar business. X Co. (and all its' segments) is all-equity financed. You are required to value an expansion in the Sugar business of the company. Your task is to calculate the required return to equity holders for the same. You found the following information: X Co. is listed on the stock exchange, and you have historical data for adjusted closing prices of X Co. The regression between stock returns of X Co. and market returns returned a statistically significant coefficient of market returns as 2. Explain what does this coefficient mean? The market returns were %p.a., and the risk-free rate was 4% p.a. Calculate the cost of equity capital for X company. The company wanted to expand its' Sugar business. Can you use the same cost of equity calculated before for X company to value the capital budgeting project (expansion in Sugar business)? Why or why not? You had calculated the beta of the cement industry and power industry using a comparable company approach. However, you were unable to find comparable cos in the Sugar industry You knew the asset size for the segments (Cement, Power and Sugar business) of X Co. The Table below gives the total assets and beta of the cement business, power business and asset for the sugar business. You have to calculate the beta of the sugar business for X Co and, finally, the cost of equity capital for the sugar business. (Use the property of beta for the same. Propert: heta portfolio is equal to the weiginted average of the beta of individual assets in the portfolio). Assume operating leverage is the same across. Also, X Co's total assets are the sum of all the assets of its' segments. Segments of X Co. Total Assets in crore Rs.) Beta of equity Cement 100 1.5 Power 50 0.25 Sugar 150 Unknown (to be calculated) ion Text You work as an inter in the treasury department of X Co. X company is into three different lines of business: Cement, Power, Sugar business. X Co. (and all its' segments) is all-equity financed. You are required to value an expansion in the Sugar business of the company. Your task is to calculate the required return to equity holders for the same. You found the following information: X Co. is listed on the stock exchange, and you have historical data for adjusted closing prices of X Co. The regression between stock returns of X Co. and market returns returned a statistically significant coefficient of market returns as 2. Explain what does this coefficient mean? The market returns were %p.a., and the risk-free rate was 4% p.a. Calculate the cost of equity capital for X company. The company wanted to expand its' Sugar business. Can you use the same cost of equity calculated before for X company to value the capital budgeting project (expansion in Sugar business)? Why or why not? You had calculated the beta of the cement industry and power industry using a comparable company approach. However, you were unable to find comparable cos in the Sugar industry You knew the asset size for the segments (Cement, Power and Sugar business) of X Co. The Table below gives the total assets and beta of the cement business, power business and asset for the sugar business. You have to calculate the beta of the sugar business for X Co and, finally, the cost of equity capital for the sugar business. (Use the property of beta for the same. Propert: heta portfolio is equal to the weiginted average of the beta of individual assets in the portfolio). Assume operating leverage is the same across. Also, X Co's total assets are the sum of all the assets of its' segments. Segments of X Co. Total Assets in crore Rs.) Beta of equity Cement 100 1.5 Power 50 0.25 Sugar 150 Unknown (to be calculated)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts