Question: + ions for the Worksheet # Populate the Worksheet for each item as appropriate 1 This is the start of a new calendar year for

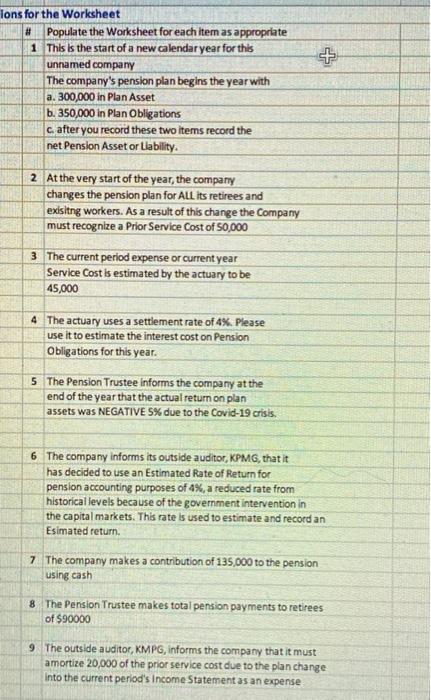

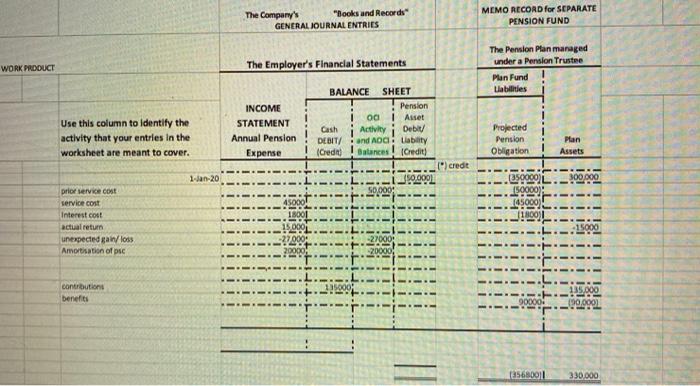

+ ions for the Worksheet # Populate the Worksheet for each item as appropriate 1 This is the start of a new calendar year for this unnamed company The company's pension plan begins the year with a. 300,000 in Plan Asset b. 350,000 in Plan Obligations c. after you record these two items record the net Pension Asset or Liability 2 At the very start of the year, the company changes the pension plan for All its retirees and exisitng workers. As a result of this change the Company must recognize a Prior Service Cost of 50,000 3. The current period expense or current year Service Cost is estimated by the actuary to be 45,000 4 The actuary uses a settlement rate of 4%. Please use it to estimate the interest cost on Pension Obligations for this year. 5 The Pension Trustee Informs the company at the end of the year that the actual return on plan assets was NEGATIVE S% due to the Covid-19 crisis 6 The company informs its outside auditor, KPMG, that it has decided to use an Estimated Rate of Return for pension accounting purposes of 4%, a reduced rate from historical levels because of the government intervention in the capital markets. This rate is used to estimate and record an Esimated return 7 The company makes a contribution of 135,000 to the pension using cash 8 The Pension Trustee makes total pension payments to retirees of $90000 9 The outside auditor, KMPG, informs the company that it must amortize 20,000 of the prior service cost due to the plan change into the current period's Income Statement as an expense The Company's "Books and Records GENERAL JOURNAL ENTRIES MEMO RECORD for SEPARATE PENSION FUND WORK PRODUCT The Employer's Financial Statements The Pension Plan managed under a Pension Trustee Plan Fund Liabilities Use this column to identify the activity that your entries in the worksheet are meant to cover. INCOME STATEMENT Annual Pension Expense BALANCE SHEET Pension Asset Cash Activity Deble DEBIT/ and ADG: Liability (Credit) Batances ! Credit) Projected Pension Obligation Plan Assets L") credit 1-Jan-20 150.000) 300.000 50.000 (25000 150000 145000 prior service cost Lervice cost Interest cost actual return unexpected gain/loss Amortisation of psc 27000 -20000 iii IIIIII iii UTILIIT iiii iiii 18 LI LIII11 ! ! L!!!! controutions benefits Lii 5.000 190.000 . 185680011 330.000 is this right so far + ions for the Worksheet # Populate the Worksheet for each item as appropriate 1 This is the start of a new calendar year for this unnamed company The company's pension plan begins the year with a. 300,000 in Plan Asset b. 350,000 in Plan Obligations c. after you record these two items record the net Pension Asset or Liability 2 At the very start of the year, the company changes the pension plan for All its retirees and exisitng workers. As a result of this change the Company must recognize a Prior Service Cost of 50,000 3. The current period expense or current year Service Cost is estimated by the actuary to be 45,000 4 The actuary uses a settlement rate of 4%. Please use it to estimate the interest cost on Pension Obligations for this year. 5 The Pension Trustee Informs the company at the end of the year that the actual return on plan assets was NEGATIVE S% due to the Covid-19 crisis 6 The company informs its outside auditor, KPMG, that it has decided to use an Estimated Rate of Return for pension accounting purposes of 4%, a reduced rate from historical levels because of the government intervention in the capital markets. This rate is used to estimate and record an Esimated return 7 The company makes a contribution of 135,000 to the pension using cash 8 The Pension Trustee makes total pension payments to retirees of $90000 9 The outside auditor, KMPG, informs the company that it must amortize 20,000 of the prior service cost due to the plan change into the current period's Income Statement as an expense The Company's "Books and Records GENERAL JOURNAL ENTRIES MEMO RECORD for SEPARATE PENSION FUND WORK PRODUCT The Employer's Financial Statements The Pension Plan managed under a Pension Trustee Plan Fund Liabilities Use this column to identify the activity that your entries in the worksheet are meant to cover. INCOME STATEMENT Annual Pension Expense BALANCE SHEET Pension Asset Cash Activity Deble DEBIT/ and ADG: Liability (Credit) Batances ! Credit) Projected Pension Obligation Plan Assets L") credit 1-Jan-20 150.000) 300.000 50.000 (25000 150000 145000 prior service cost Lervice cost Interest cost actual return unexpected gain/loss Amortisation of psc 27000 -20000 iii IIIIII iii UTILIIT iiii iiii 18 LI LIII11 ! ! L!!!! controutions benefits Lii 5.000 190.000 . 185680011 330.000 is this right so far

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts