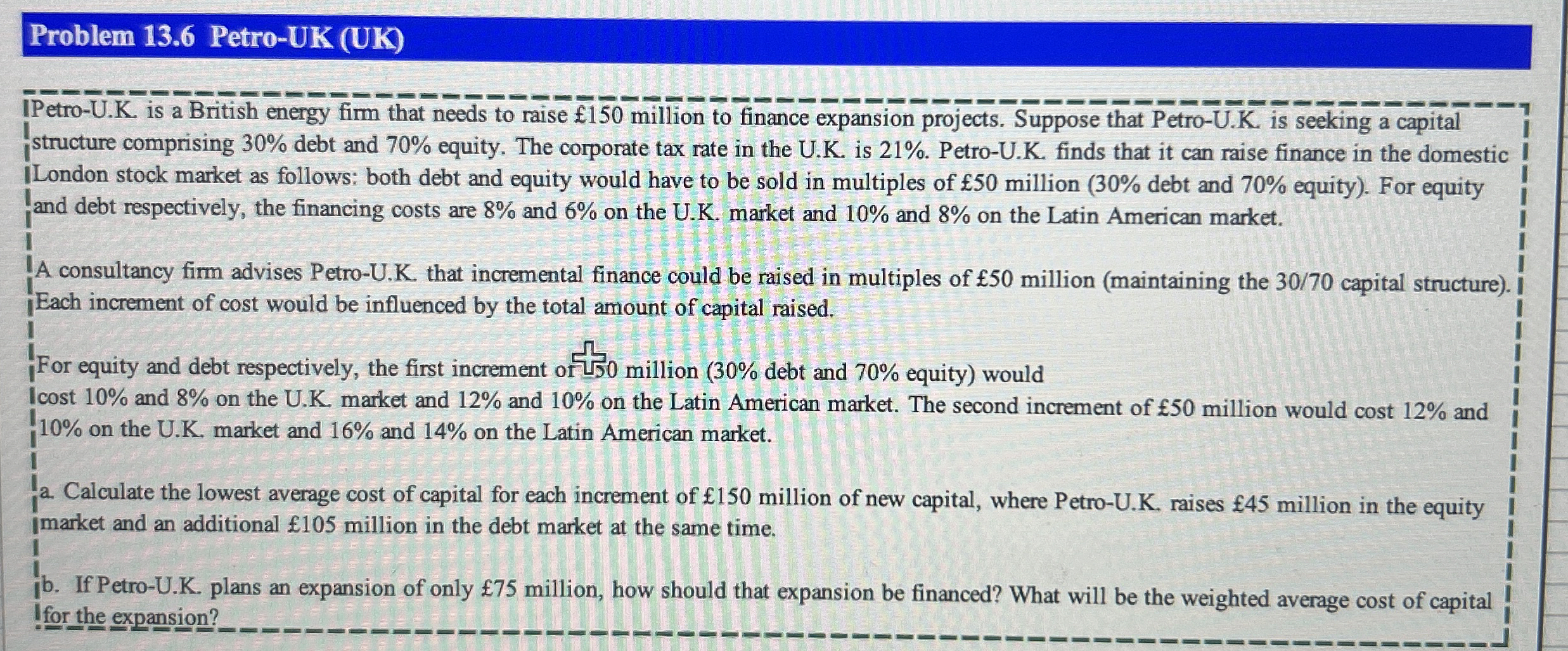

Question: IPetro - U . K . is a British energy firm that needs to raise 1 5 0 million to finance expansion projects. Suppose that

IPetroUK is a British energy firm that needs to raise million to finance expansion projects. Suppose that PetroUK is seeking a capital

structure comprising debt and equity. The corporate tax rate in the UK is PetroUK finds that it can raise finance in the domestic

ILondon stock market as follows: both debt and equity would have to be sold in multiples of million debt and equity For equity

and debt respectively, the financing costs are and on the UK market and and on the Latin American market.

A consultancy firm advises PetroUK that incremental finance could be raised in multiples of million maintaining the capital structure

Each increment of cost would be influenced by the total amount of capital raised.

For equity and debt respectively, the first increment or million debt and equity would

cost and on the UK market and and on the Latin American market. The second increment of million would cost and

on the UK market and and on the Latin American market.

a Calculate the lowest average cost of capital for each increment of million of new capital, where PetroUK raises million in the equity

imarket and an additional million in the debt market at the same time.

b If PetroUK plans an expansion of only million, how should that expansion be financed? What will be the weighted average cost of capital

Ifor the expansion?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock