Question: iports plans to raise $5,000,000 in an initial public offering of its common stock. The company is considering three options: sue 100,000 shares of $1

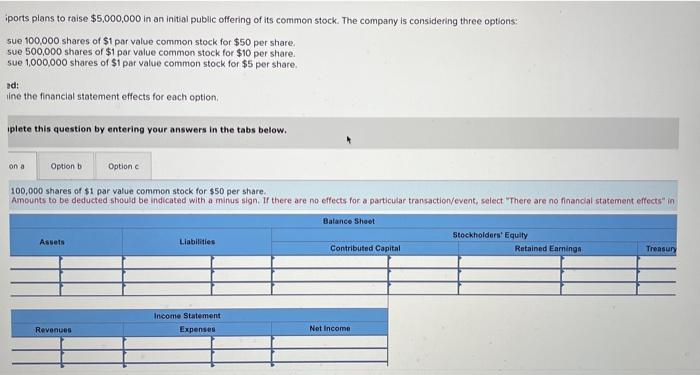

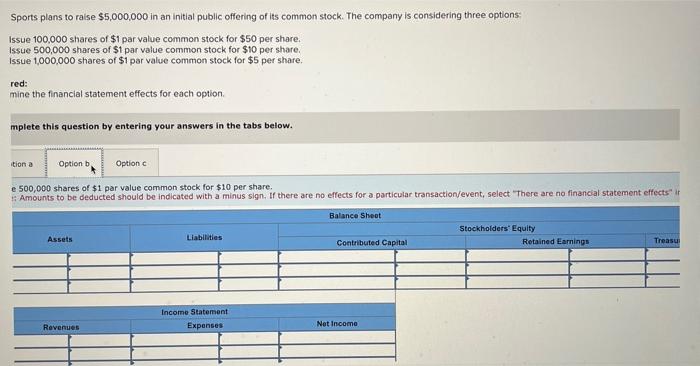

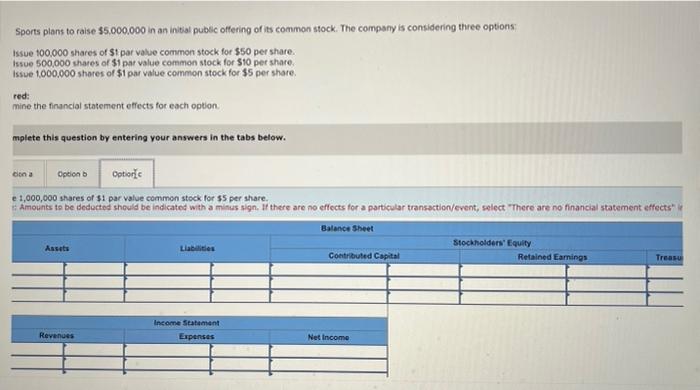

iports plans to raise $5,000,000 in an initial public offering of its common stock. The company is considering three options: sue 100,000 shares of $1 par value common stock for $50 per share, sue 500,000 shares of $1 par value common stock for $10 per share. sue 1,000,000 shares of $1 par value common stock for $5 per share, ad: ine the financial statement effects for each option, iplete this question by entering your answers in the tabs below. 100,000 shares of $1 par value common stock for $50 per share. Amounts to be deducted shousd be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects" in Sports plans to raise $5,000,000 in an initial public offering of its common stock. The company is considering three options: Issue 100,000 shares of $1 par value common stock for $50 per share. Issue 500,000 shares of $1 par value common stock for $10 per share. Issue 1,000,000 shares of $1 par value common stock for $5 per share. red: mine the financial statement effects for each option. mplete this question by entering your answers in the tabs below. e 500,000 shares of $1 par value common stock for $10 per share. I: Amounts to be deducted should be indicated with a minus sign. If there are no effects for a particular transaction/event, select There are no financial statement effects Sports plans to raise 55.000.000 in an initial pubic offering of its common stock. The company is considering thiree options: Issue 100.000 shares of $1 par value common stock for $50 per share. issue 500.000 thares of $1 par value common stock for $10 per share. issue 1,000,000 shores of $1 par value common stock for $5 per share. red: mine the financial statement effects for each option. mplete this question by entering your answers in the tabs below. e 1,000,000 shares of $1 par value common stock for $5 per thare. Ii Amounts to be dedoctes should be indicated with a minus sign. If there are no effects for a particular transaction/event, select "There are no financial statement effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts