Question: Ippo Ltd is a UK - based private - equity firm that has recently grown considerably during its short life. Ippo Ltd . has made

Ippo Ltd is a UKbased privateequity firm that has recently grown considerably during

its short life. Ippo Ltd has made an agreement to sell its US subsidiary to Universal

Development Plc in September The treasury department expects to receive $

million representing the sale of its subsidiaries in the USA by the end of August

Due to general economic uncertainty in the UK and the USA, there is some concern

that the dollar $ will weaken against the pound although this is not the consensus

of the whole management team. However, they all agree that a currency hedge would

be sensible

It is now of March The board of directors asks you, the newly appointed

financial manager, to write a report discussing the financial implication of both a

strengthening and a weakening of the dollar.

Required:

Using the information below, write a report to the board of Directors explaining the

different alternatives the company has to manage this risk. In particular, you should

discuss the following:

a Do nothing

b Forward Rate Agreement

c Money Market Hedge

d Futures Contract

e Options Contract

Spot rate:

$ $

months forward rate:

$ $

Money market rates Annual rates:

The company is able to obtain a sixmonth future quotation of $

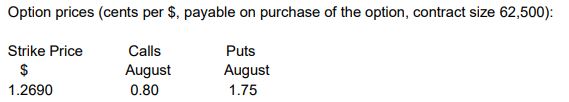

The quoted option premiums for US $ and GBP showed as follow:

Option prices cents per $ payable on purchase of the option, contract size :

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock