Question: IRA and Roth IRA https://apply.gsas.h.. Home - Students eBook Calculator Problem 9-41 (LO. 6) Carri and Dane, ages 34 and 32, respectively, have been married

IRA and Roth IRA

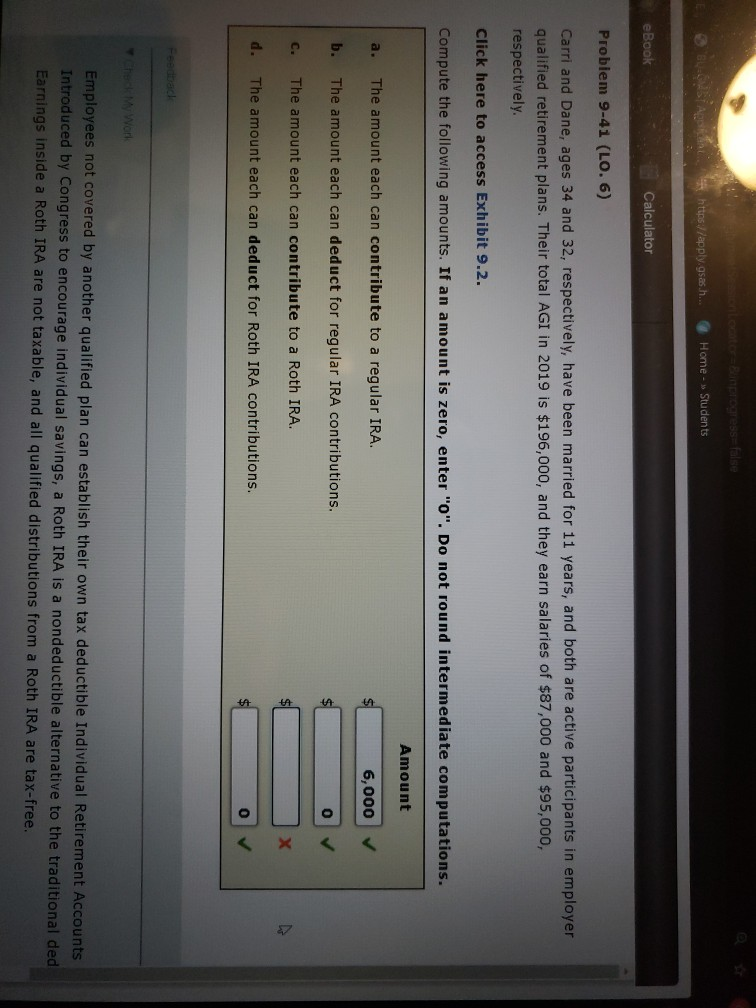

https://apply.gsas.h.. Home - Students eBook Calculator Problem 9-41 (LO. 6) Carri and Dane, ages 34 and 32, respectively, have been married for 11 years, and both are active participants in employer qualified retirement plans. Their total AGI in 2019 is $196,000, and they earn salaries of $87,000 and $95,000, respectively. Click here to access Exhibit 9.2. Compute the following amounts. If an amount is zero, enter "o". Do not round intermediate computations. Amount a. The amount each can contribute to a regular IRA. 6,000 b. The amount each can deduct for regular IRA contributions. 0 c. The amount each can contribute to a Roth IRA. x d. The amount each can deduct for Roth IRA contributions. o Feedback Check My Work Employees not covered by another qualified plan can establish their own tax deductible Individual Retirement Accounts Introduced by Congress to encourage individual savings, a Roth IRA is a nondeductible alternative to the traditional ded Earnings inside a Roth IRA are not taxable, and all qualified distributions from a Roth IRA are tax-free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts