Question: IRAC method for: In 1992, brothers Mark, Matthew, and Patrick McDonough established TASC, a corporation that provides technical engineering services. In September 1995, the brothers

IRAC method for:

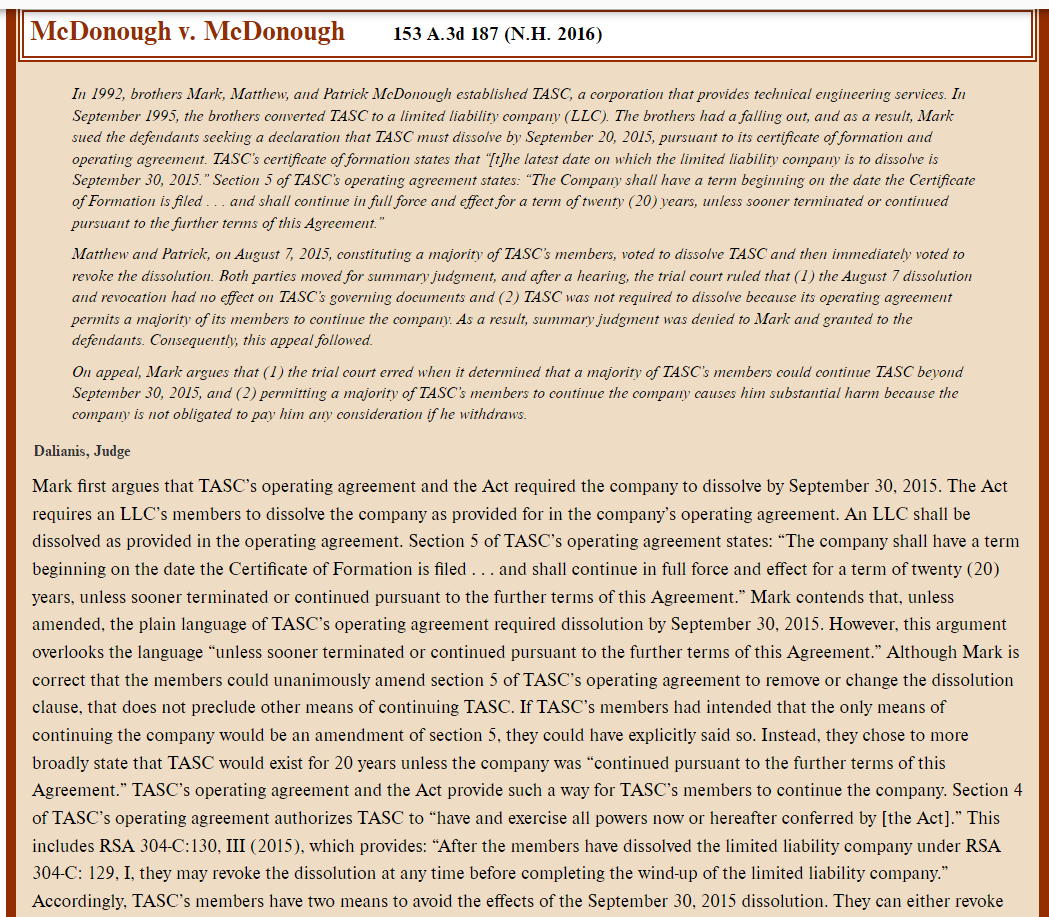

In 1992, brothers Mark, Matthew, and Patrick McDonough established TASC, a corporation that provides technical engineering services. In September 1995, the brothers converted TASC to a limited liability company (LLC). The brothers had a falling out, and as a result, Mark sued the defendants seeking a declaration that TASC must dissolve by September 20, 2015, pursuant to its certificate of formation and operating agreement. TASC's certificate of formation states that "It]he latest date on which the limited liability company is to dissolve is September 30, 2015." Section 5 of TASC's operating agreement states: "The Company shall have a term beginning on the date the Certificate of Formation is filed... and shall continue in full force and effect for a term of twenty (20) years, unless sooner terminated or continued pursuant to the further terms of this Agreement." Matthew and Patrick, on August 7, 2015, constituting a majority of TASC's members, voted to dissolve TASC and then immediately voted to revoke the dissolution. Both parties moved for summary judgment, and after a hearing, the trial court ruled that (1) the August 7 dissolution and revocation had no effect on TASC's governing documents and (2) TASC was not required to dissolve because its operating agreement permits a majority of its members to continue the company. As a result, summary judgment was denied to Mark and granted to the defendants. Consequently, this appeal followed. On appeal, Mark argues that (1) the trial court erred when it determined that a majority of TASC's members could continue TASC beyond September 30, 2015, and (2) permitting a majority of TASC's members to continue the company causes him substantial harm because the company is not obligated to pay him any consideration if he withdraws. Dalianis, Judge Mark first argues that TASC's operating agreement and the Act required the company to dissolve by September 30, 2015. The Act requires an LLC's members to dissolve the company as provided for in the company's operating agreement. An LLC shall be dissolved as provided in the operating agreement. Section 5 of TASC's operating agreement states: "The company shall have a terl beginning on the date the Certificate of Formation is filed ... and shall continue in full force and effect for a term of twenty (20) years, unless sooner terminated or continued pursuant to the further terms of this Agreement." Mark contends that, unless amended, the plain language of TASC's operating agreement required dissolution by September 30, 2015. However, this argument overlooks the language "unless sooner terminated or continued pursuant to the further terms of this Agreement." Although Mark correct that the members could unanimously amend section 5 of TASC's operating agreement to remove or change the dissolutioi clause, that does not preclude other means of continuing TASC. If TASC's members had intended that the only means of continuing the company would be an amendment of section 5 , they could have explicitly said so. Instead, they chose to more broadly state that TASC would exist for 20 years unless the company was "continued pursuant to the further terms of this Agreement." TASC's operating agreement and the Act provide such a way for TASC's members to continue the company. Section of TASC's operating agreement authorizes TASC to "have and exercise all powers now or hereafter conferred by [the Act]." This includes RSA 304-C:130, III (2015), which provides: "After the members have dissolved the limited liability company under RSA 304-C: 129, I, they may revoke the dissolution at any time before completing the wind-up of the limited liability company." Accordingly, TASC's members have two means to avoid the effects of the September 30,2015 dissolution. They can either revoke

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts