Question: IRAC method for this case please Robert Jackson, Sharon Magee, and another person agreed to raise a herd of bison. Magee owned land across the

IRAC method for this case please

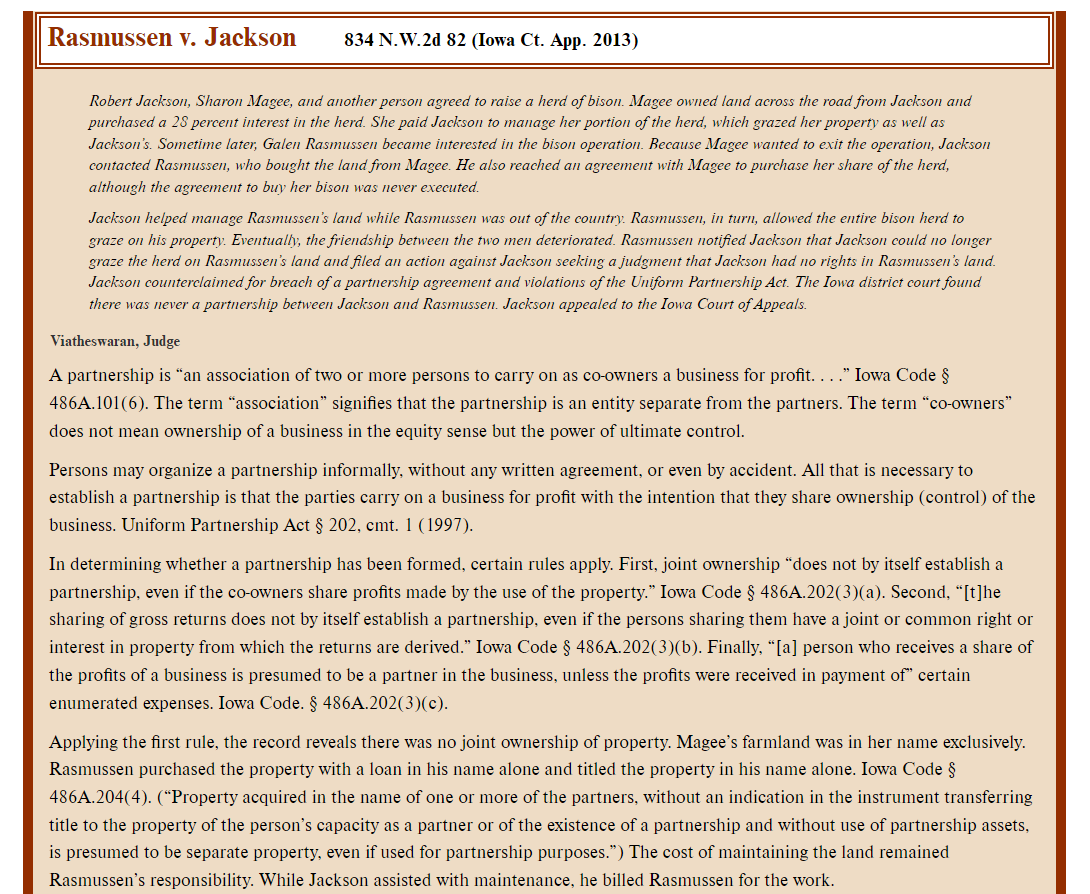

Robert Jackson, Sharon Magee, and another person agreed to raise a herd of bison. Magee owned land across the road from Jackson and purchased a 28 percent interest in the herd. She paid Jackson to manage her portion of the herd, which grazed her property as well as Jackson's. Sometime later, Galen Rasmussen became interested in the bison operation. Because Magee wanted to exit the operation, Jackson contacted Rasmussen, who bought the land from Magee. He also reached an agreement with Magee to purchase her share of the herd, although the agreement to buy her bison was never executed. Jackson helped manage Rasmussen's land while Rasmussen was out of the country. Rasmussen, in turn, allowed the entire bison herd to graze on his property. Eventually, the friendship between the two men deteriorated. Rasmussen notified Jackson that Jackson could no longer graze the herd on Rasmussen's land and filed an action against Jackson seeking a judgment that Jackson had no rights in Rasmussen's land. Jackson counterclaimed for breach of a partnership agreement and violations of the Uniform Partnership Act. The Iowa district court found there was never a partnership between Jackson and Rasmussen. Jackson appealed to the Iowa Court of Appeals. Viatheswaran, Judge A partnership is "an association of two or more persons to carry on as co-owners a business for profit. ..." Iowa Code 486A.101(6). The term "association" signifies that the partnership is an entity separate from the partners. The term "co-owners" does not mean ownership of a business in the equity sense but the power of ultimate control. Persons may organize a partnership informally, without any written agreement, or even by accident. All that is necessary to establish a partnership is that the parties carry on a business for profit with the intention that they share ownership (control) of the business. Uniform Partnership Act 202, cmt. 1 (1997). In determining whether a partnership has been formed, certain rules apply. First, joint ownership "does not by itself establish a partnership, even if the co-owners share profits made by the use of the property." Iowa Code $486A.202(3) (a). Second, "[t]he sharing of gross returns does not by itself establish a partnership, even if the persons sharing them have a joint or common right or interest in property from which the returns are derived." Iowa Code $486A.202(3) (b). Finally, "[a] person who receives a share of the profits of a business is presumed to be a partner in the business, unless the profits were received in payment of" certain enumerated expenses. Iowa Code. 486A.202(3)(c). Applying the first rule, the record reveals there was no joint ownership of property. Magee's farmland was in her name exclusively. Rasmussen purchased the property with a loan in his name alone and titled the property in his name alone. Iowa Code 486A.204(4). ("Property acquired in the name of one or more of the partners, without an indication in the instrument transferring title to the property of the person's capacity as a partner or of the existence of a partnership and without use of partnership assets, is presumed to be separate property, even if used for partnership purposes.") The cost of maintaining the land remained Rasmussen's responsibility. While Jackson assisted with maintenance. he billed Rasmussen for the work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts