Question: Iris Baer, MD, opened a medical practice. The business completed the following transactions: July 1 Baer invested $26,000 cash to start her medical practice. The

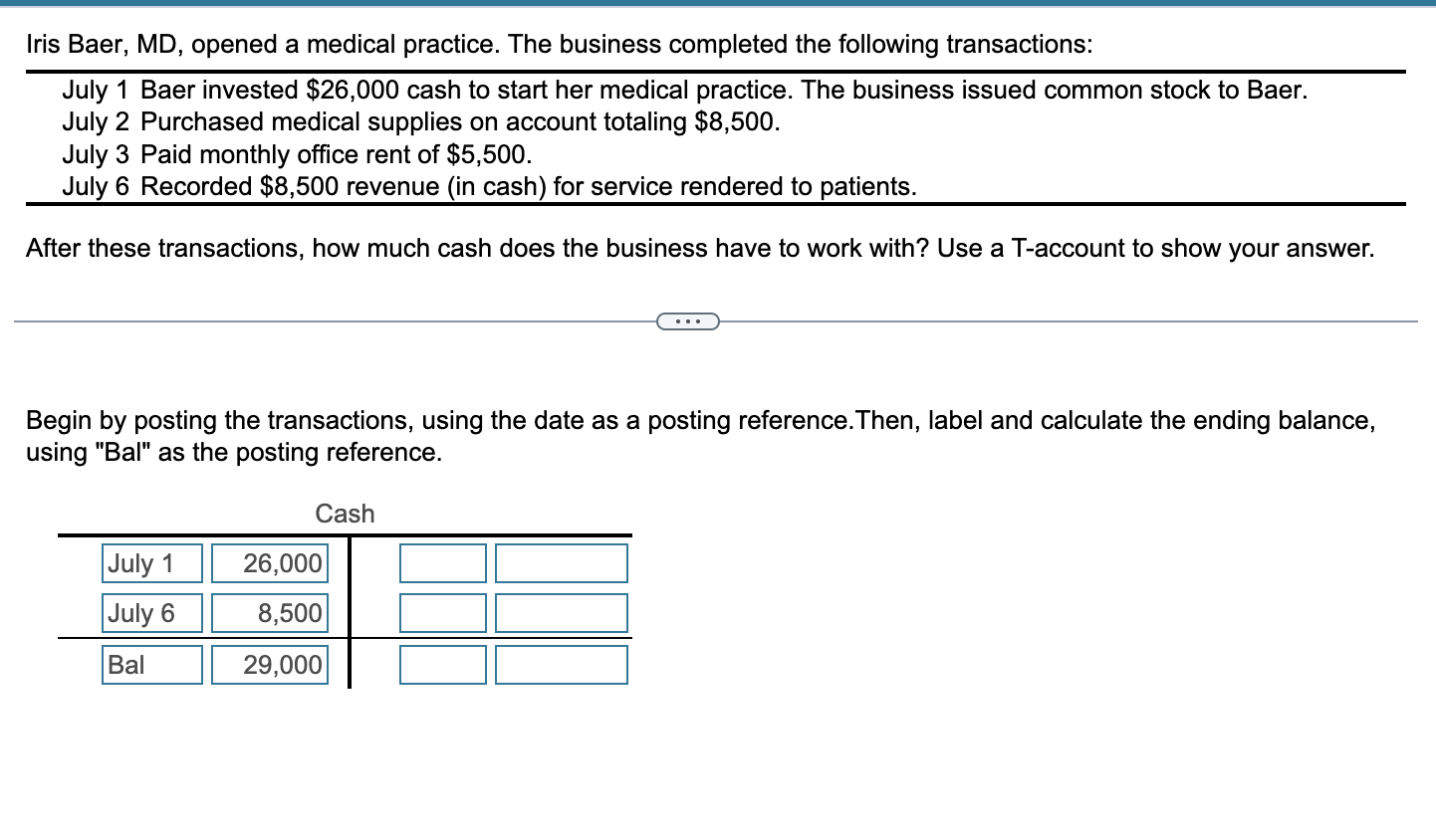

Iris Baer, MD, opened a medical practice. The business completed the following transactions: July 1 Baer invested $26,000 cash to start her medical practice. The business issued common stock to Baer. July 2 Purchased medical supplies on account totaling $8,500. July 3 Paid monthly office rent of $5,500. July 6 Recorded $8,500 revenue (in cash) for service rendered to patients. After these transactions, how much cash does the business have to work with? Use a T-account to show your answer. Begin by posting the transactions, using the date as a posting reference.Then, label and calculate the ending balance, using "Bal" as the posting reference. Iris Baer, MD, opened a medical practice. The business completed the following transactions: July 1 Baer invested $26,000 cash to start her medical practice. The business issued common stock to Baer. July 2 Purchased medical supplies on account totaling $8,500. July 3 Paid monthly office rent of $5,500. July 6 Recorded $8,500 revenue (in cash) for service rendered to patients. After these transactions, how much cash does the business have to work with? Use a T-account to show your answer. Begin by posting the transactions, using the date as a posting reference.Then, label and calculate the ending balance, using "Bal" as the posting reference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts