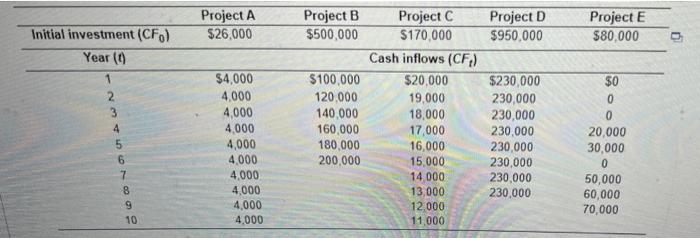

Question: IRR for projects A-E, and should the projects be accepted. Net present value Using a cost of capital of 14%, calculate the internal Rate of

Net present value Using a cost of capital of 14%, calculate the internal Rate of Retum (IRR) for each of the independent projects shown in the following table and indicate whether each is acceptable, Initial investment (CFO) Year (1) 34567BSG 8 9 10 Project A $26,000 $4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 4,000 Project B $500,000 $100,000 120,000 140,000 160,000 180,000 200,000 Project C $170,000 Cash inflows (CF) $20,000 19,000 18,000 17,000 16,000 15,000 14,000 13,000 12,000 11,000. Project D $950,000 $230,000 230,000 230,000 230,000 230,000 230,000 230,000 230,000 Project E $80,000 $0 0 0 20,000 30,000 0 50,000 60,000 70,000 n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts