Question: irue/False: 1) When selling a bear spread, the profit graph is always lower than the payoff graph. 2) Chandrika goes short a bull spread on

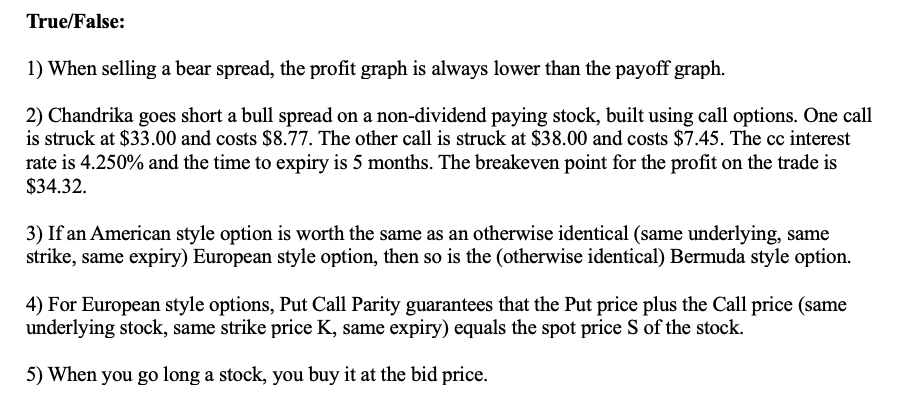

irue/False: 1) When selling a bear spread, the profit graph is always lower than the payoff graph. 2) Chandrika goes short a bull spread on a non-dividend paying stock, built using call options. One call is struck at $33.00 and costs $8.77. The other call is struck at $38.00 and costs $7.45. The cc interest rate is 4.250% and the time to expiry is 5 months. The breakeven point for the profit on the trade is $34.32. 3) If an American style option is worth the same as an otherwise identical (same underlying, same strike, same expiry) European style option, then so is the (otherwise identical) Bermuda style option. 4) For European style options, Put Call Parity guarantees that the Put price plus the Call price (same underlying stock, same strike price K, same expiry) equals the spot price S of the stock. 5) When you go long a stock, you buy it at the bid price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts