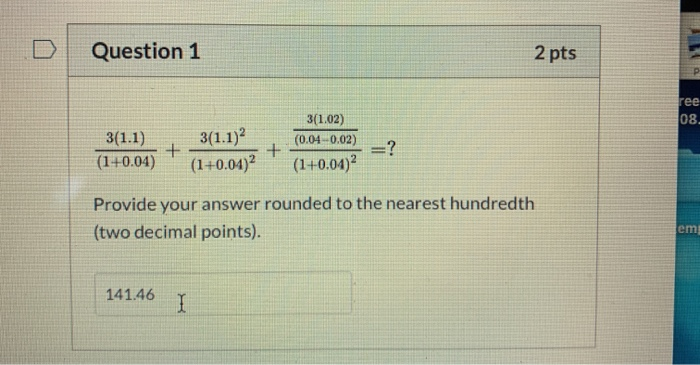

Question: Is 1 correct? Need 4,10 Question 1 2 pts ree 08 3(1.02) 3(1.1)2 3(1.1) + (1+0.04) (1+0.04)2 (0.04-0.02)? (1+0.04)2 Provide your answer rounded to the

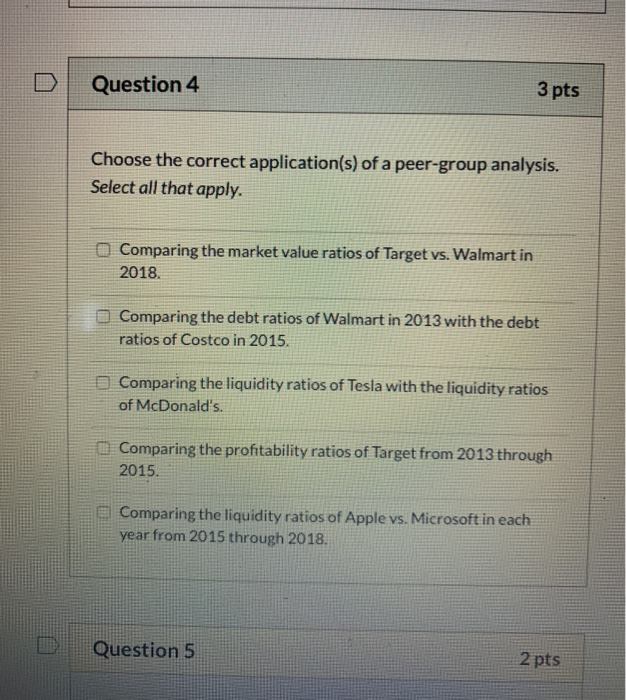

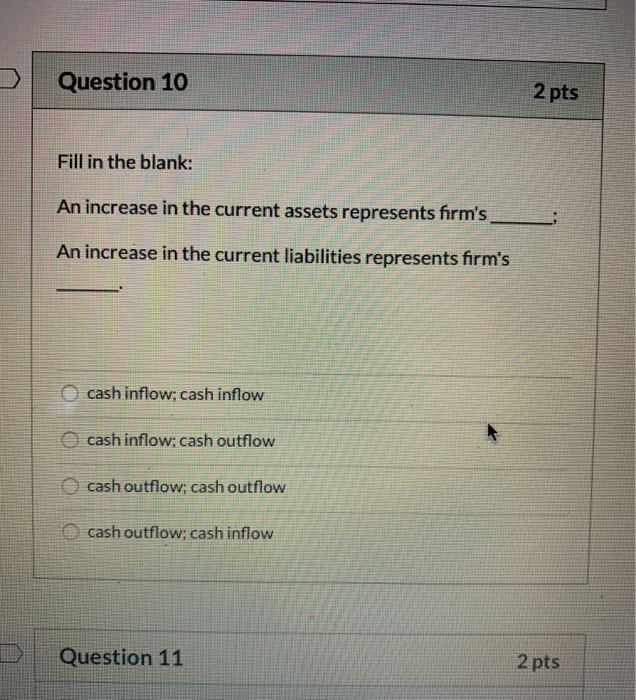

Question 1 2 pts ree 08 3(1.02) 3(1.1)2 3(1.1) + (1+0.04) (1+0.04)2 (0.04-0.02)? (1+0.04)2 Provide your answer rounded to the nearest hundredth em (two decimal points). 141.46 I Question 4 3 pts Choose the correct application(s) of a peer-group analysis. Select all that apply. O Comparing the market value ratios of Target vs. Walmart in 2018. Comparing the debt ratios of Walmart in 2013 with the debt ratios of Costco in 2015. Comparing the liquidity ratios of Tesla with the liquidity ratios of McDonald's. Comparing the profitability ratios of Target from 2013 through 2015. Comparing the liquidity ratios of Apple vs. Microsoft in each year from 2015 through 2018 Question 5 2 pts Question 10 2 pts Fill in the blank: An increase in the current assets represents firm's An increase in the current liabilities represents firm's O cash inflow; cash inflow O cash inflow; cash outflow O cash outflow; cash outflow cash outflow; cash inflow Question 11 2 pts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts