Question: Is a management science question. it can't get more specific than that Question 1 The government of Ghana has available GH 1 billion earmarked for

Is a management science question. it can't get more specific than that

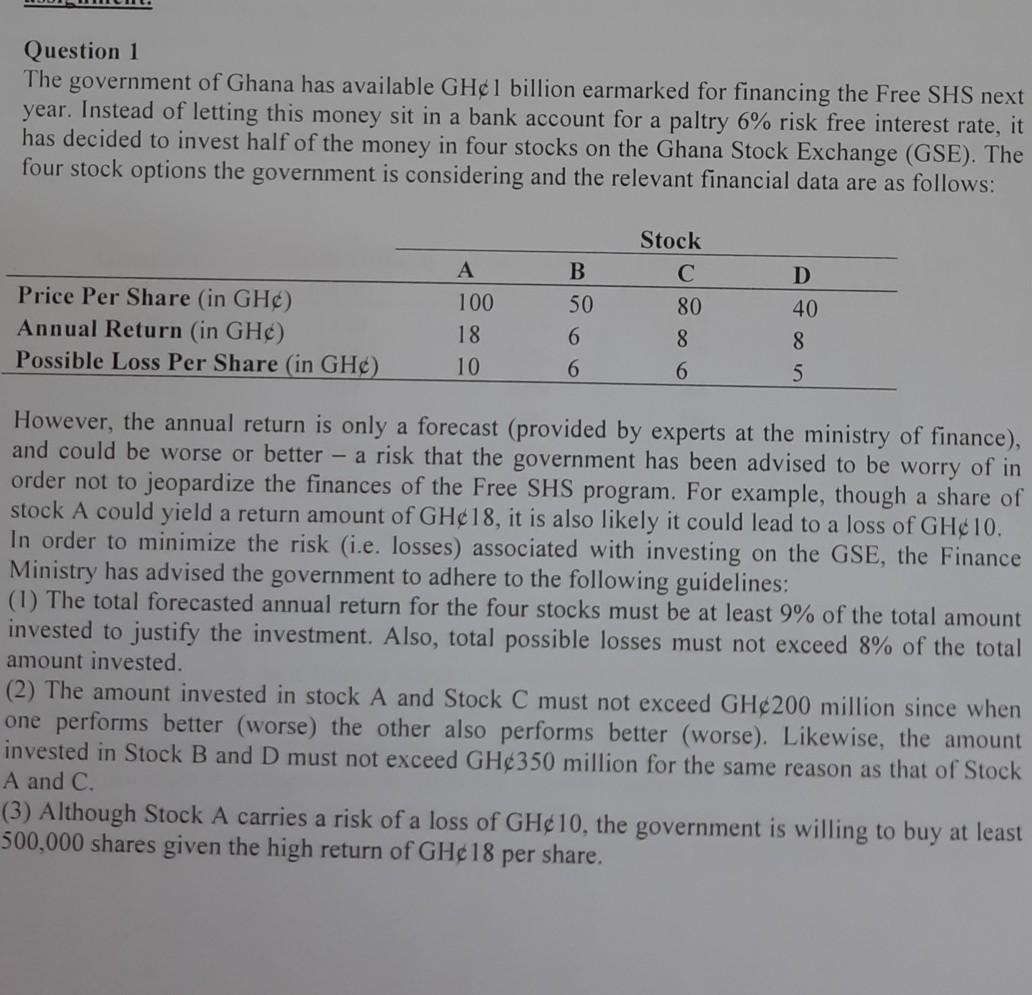

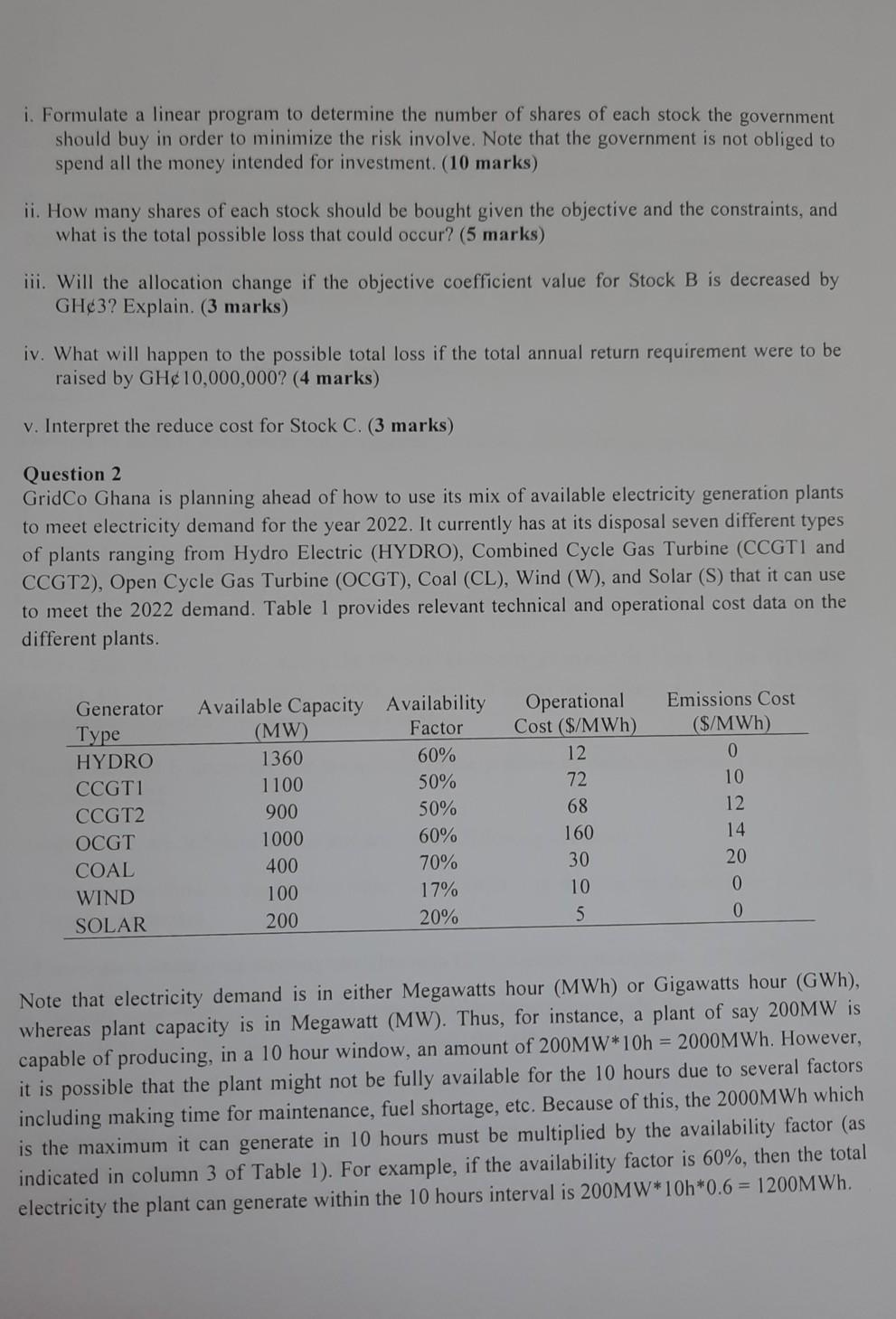

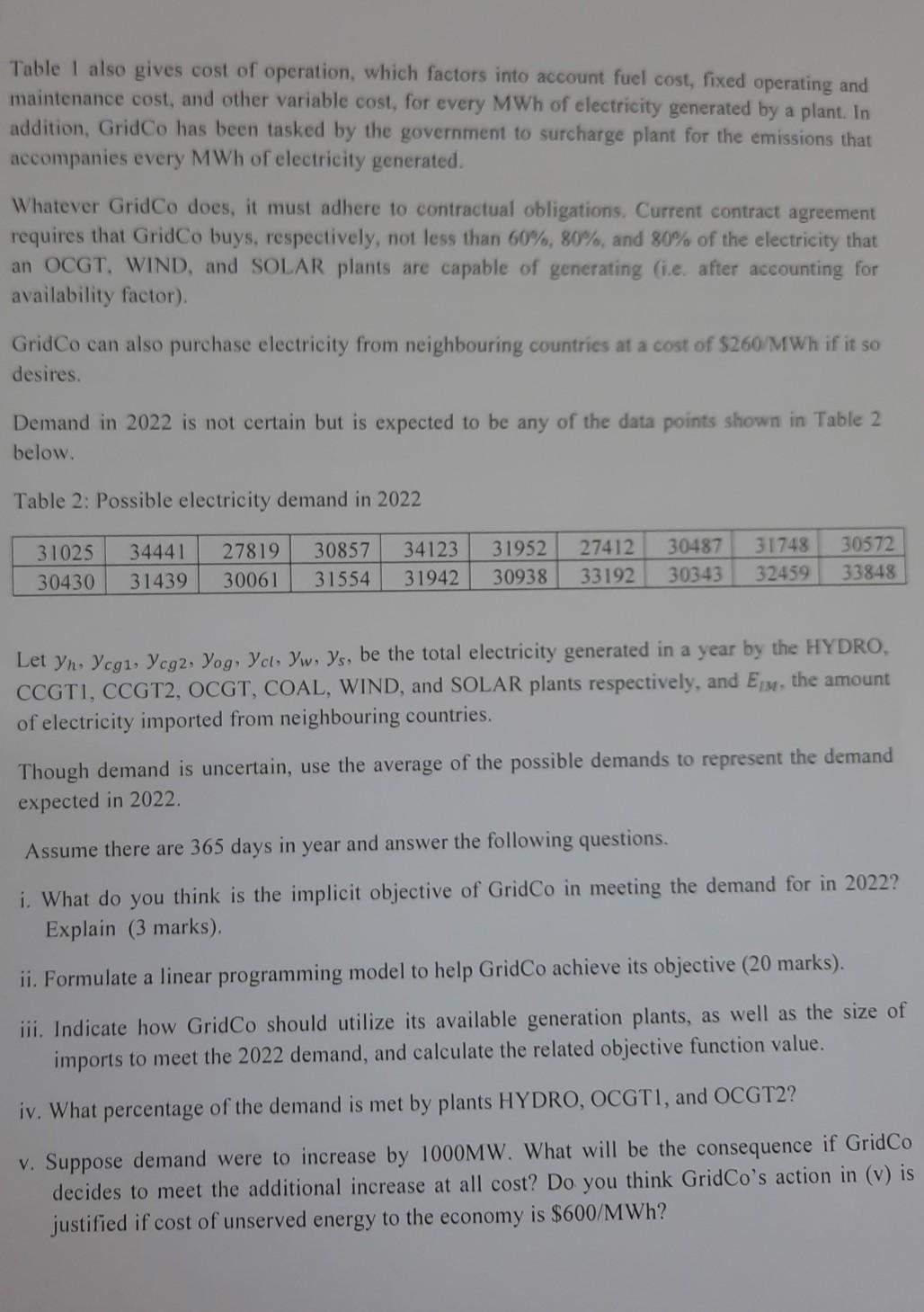

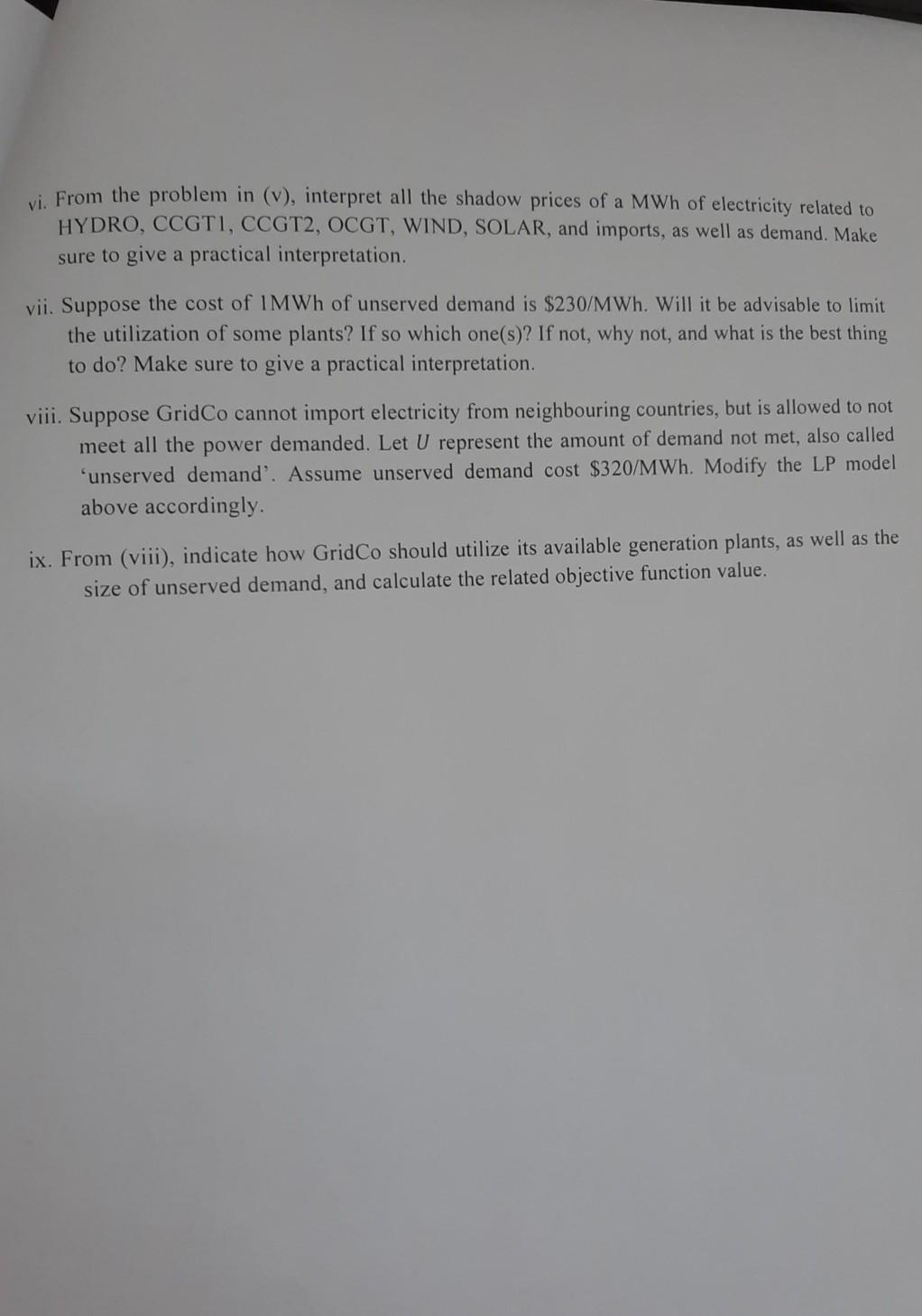

Question 1 The government of Ghana has available GH 1 billion earmarked for financing the Free SHS next year. Instead of letting this money sit in a bank account for a paltry 6% risk free interest rate, it has decided to invest half of the money in four stocks on the Ghana Stock Exchange (GSE). The four stock options the government is considering and the relevant financial data are as follows: A B Stock C 80 D Price Per Share (in GH) Annual Return (in GH) Possible Loss Per Share (in GH) 100 18 10 50 6 6 8 6 40 8 5 However, the annual return is only a forecast (provided by experts at the ministry of finance), and could be worse or better - a risk that the government has been advised to be worry of in order not to jeopardize the finances of the Free SHS program. For example, though a share of stock A could yield a return amount of GH18, it is also likely it could lead to a loss of GH10. In order to minimize the risk (i.e. losses) associated with investing on the GSE, the Finance Ministry has advised the government to adhere to the following guidelines: (1) The total forecasted annual return for the four stocks must be at least 9% of the total amount invested to justify the investment. Also, total possible losses must not exceed 8% of the total amount invested. (2) The amount invested in stock A and Stock C must not exceed GH200 million since when one performs better (worse) the other also performs better (worse). Likewise, the amount invested in Stock B and D must not exceed GH350 million for the same reason as that of Stock A and C. (3) Although Stock A carries a risk of a loss of GH10, the government is willing to buy at least 500,000 shares given the high return of GH18 per share. i. Formulate a linear program to determine the number of shares of each stock the government should buy in order to minimize the risk involve. Note that the government is not obliged to spend all the money intended for investment. (10 marks) ii. How many shares of each stock should be bought given the objective and the constraints, and what is the total possible loss that could occur? (5 marks) iii. Will the allocation change if the objective coefficient value for Stock B is decreased by GH3? Explain. (3 marks) iv. What will happen to the possible total loss if the total annual return requirement were to be raised by GH10,000,000? (4 marks) v. Interpret the reduce cost for Stock C. (3 marks) Question 2 GridCo Ghana is planning ahead of how to use its mix of available electricity generation plants to meet electricity demand for the year 2022. It currently has at its disposal seven different types of plants ranging from Hydro Electric (HYDRO), Combined Cycle Gas Turbine (CCGT1 and CCGT2), Open Cycle Gas Turbine (OCGT), Coal (CL), Wind (w), and Solar (S) that it can use to meet the 2022 demand. Table 1 provides relevant technical and operational cost data on the different plants. Generator Type HYDRO CCGTI CCGT2 OCGT COAL WIND SOLAR Available Capacity Availability (MW) Factor 1360 60% 1100 50% 50% 1000 60% 400 70% 100 17% 200 20% Operational Cost ($/MWh) 12 72 68 160 30 10 5 Emissions Cost ($/MWh) 0 10 12 14 20 0 900 0 Note that electricity demand is in either Megawatts hour (MWh) or Gigawatts hour (GWh), whereas plant capacity is in Megawatt (MW). Thus, for instance, a plant of say 200MW is capable of producing, in a 10 hour window, an amount of 200MW*10h = 2000MWh. However, it is possible that the plant might not be fully available for the 10 hours due to several factors including making time for maintenance, fuel shortage, etc. Because of this, the 2000MWh which is the maximum it can generate in 10 hours must be multiplied by the availability factor (as indicated in column 3 of Table 1). For example, if the availability factor is 60%, then the total electricity the plant can generate within the 10 hours interval is 200MW*10h*0.6 = 1200MWh. Table 1 also gives cost of operation, which factors into account fuel cost, fixed operating and maintenance cost, and other variable cost, for every MWh of electricity generated by a plant. In addition, GridCo has been tasked by the government to surcharge plant for the emissions that accompanies every MWh of electricity generated. Whatever GridCo does, it must adhere to contractual obligations. Current contract agreement requires that GridCo buys, respectively, not less than 60%, 80%, and 80% of the electricity that an OCGT, WIND, and SOLAR plants are capable of generating i.e. after accounting for availability factor). GridCo can also purchase electricity from neighbouring countries at a cost of $260/MWh if it so desires. Demand in 2022 is not certain but is expected to be any of the data points shown in Table 2 below. Table 2: Possible electricity demand in 2022 31025 30430 34441 31439 27819 30061 30857 31554 34123 31942 31952 30938 27412 33192 30487 30343 31748 32459 30572 33848 Let Yn. Ycg1, Ycg2, yog, Ycl yw, ys, be the total electricity generated in a year by the HYDRO, CCGTI, CCGT2, OCGT, COAL, WIND, and SOLAR plants respectively, and Em, the amount of electricity imported from neighbouring countries. Though demand is uncertain, use the average of the possible demands to represent the demand expected in 2022 Assume there are 365 days in year and answer the following questions. i. What do you think is the implicit objective of GridCo in meeting the demand for in 2022? Explain (3 marks) ii. Formulate a linear programming model to help GridCo achieve its objective (20 marks). iii. Indicate how GridCo should utilize its available generation plants, as well as the size of imports to meet the 2022 demand, and calculate the related objective function value. iv. What percentage of the demand is met by plants HYDRO, OCGT1, and OCGT2? v. Suppose demand were to increase by 1000MW. What will be the consequence if GridCo decides to meet the additional increase at all cost? Do you think GridCo's action in (v) is justified if cost of unserved energy to the economy is $600/MWh? vi. From the problem in (v), interpret all the shadow prices of a MWh of electricity related to HYDRO, CCGTI, CCGT2, OCGT, WIND, SOLAR, and imports, as well as demand. Make sure to give a practical interpretation. vii. Suppose the cost of IMWh of unserved demand is $230/MWh. Will it be advisable to limit the utilization of some plants? If so which one(s)? If not, why not, and what is the best thing to do? Make sure to give a practical interpretation. viii. Suppose GridCo cannot import electricity from neighbouring countries, but is allowed to not meet all the power demanded. Let U represent the amount of demand not met, also called 'unserved demand'. Assume unserved demand cost $320/MWh. Modify the LP model above accordingly. ix. From (viii), indicate how GridCo should utilize its available generation plants, as well as the size of unserved demand, and calculate the related objective function value. Question 1 The government of Ghana has available GH 1 billion earmarked for financing the Free SHS next year. Instead of letting this money sit in a bank account for a paltry 6% risk free interest rate, it has decided to invest half of the money in four stocks on the Ghana Stock Exchange (GSE). The four stock options the government is considering and the relevant financial data are as follows: A B Stock C 80 D Price Per Share (in GH) Annual Return (in GH) Possible Loss Per Share (in GH) 100 18 10 50 6 6 8 6 40 8 5 However, the annual return is only a forecast (provided by experts at the ministry of finance), and could be worse or better - a risk that the government has been advised to be worry of in order not to jeopardize the finances of the Free SHS program. For example, though a share of stock A could yield a return amount of GH18, it is also likely it could lead to a loss of GH10. In order to minimize the risk (i.e. losses) associated with investing on the GSE, the Finance Ministry has advised the government to adhere to the following guidelines: (1) The total forecasted annual return for the four stocks must be at least 9% of the total amount invested to justify the investment. Also, total possible losses must not exceed 8% of the total amount invested. (2) The amount invested in stock A and Stock C must not exceed GH200 million since when one performs better (worse) the other also performs better (worse). Likewise, the amount invested in Stock B and D must not exceed GH350 million for the same reason as that of Stock A and C. (3) Although Stock A carries a risk of a loss of GH10, the government is willing to buy at least 500,000 shares given the high return of GH18 per share. i. Formulate a linear program to determine the number of shares of each stock the government should buy in order to minimize the risk involve. Note that the government is not obliged to spend all the money intended for investment. (10 marks) ii. How many shares of each stock should be bought given the objective and the constraints, and what is the total possible loss that could occur? (5 marks) iii. Will the allocation change if the objective coefficient value for Stock B is decreased by GH3? Explain. (3 marks) iv. What will happen to the possible total loss if the total annual return requirement were to be raised by GH10,000,000? (4 marks) v. Interpret the reduce cost for Stock C. (3 marks) Question 2 GridCo Ghana is planning ahead of how to use its mix of available electricity generation plants to meet electricity demand for the year 2022. It currently has at its disposal seven different types of plants ranging from Hydro Electric (HYDRO), Combined Cycle Gas Turbine (CCGT1 and CCGT2), Open Cycle Gas Turbine (OCGT), Coal (CL), Wind (w), and Solar (S) that it can use to meet the 2022 demand. Table 1 provides relevant technical and operational cost data on the different plants. Generator Type HYDRO CCGTI CCGT2 OCGT COAL WIND SOLAR Available Capacity Availability (MW) Factor 1360 60% 1100 50% 50% 1000 60% 400 70% 100 17% 200 20% Operational Cost ($/MWh) 12 72 68 160 30 10 5 Emissions Cost ($/MWh) 0 10 12 14 20 0 900 0 Note that electricity demand is in either Megawatts hour (MWh) or Gigawatts hour (GWh), whereas plant capacity is in Megawatt (MW). Thus, for instance, a plant of say 200MW is capable of producing, in a 10 hour window, an amount of 200MW*10h = 2000MWh. However, it is possible that the plant might not be fully available for the 10 hours due to several factors including making time for maintenance, fuel shortage, etc. Because of this, the 2000MWh which is the maximum it can generate in 10 hours must be multiplied by the availability factor (as indicated in column 3 of Table 1). For example, if the availability factor is 60%, then the total electricity the plant can generate within the 10 hours interval is 200MW*10h*0.6 = 1200MWh. Table 1 also gives cost of operation, which factors into account fuel cost, fixed operating and maintenance cost, and other variable cost, for every MWh of electricity generated by a plant. In addition, GridCo has been tasked by the government to surcharge plant for the emissions that accompanies every MWh of electricity generated. Whatever GridCo does, it must adhere to contractual obligations. Current contract agreement requires that GridCo buys, respectively, not less than 60%, 80%, and 80% of the electricity that an OCGT, WIND, and SOLAR plants are capable of generating i.e. after accounting for availability factor). GridCo can also purchase electricity from neighbouring countries at a cost of $260/MWh if it so desires. Demand in 2022 is not certain but is expected to be any of the data points shown in Table 2 below. Table 2: Possible electricity demand in 2022 31025 30430 34441 31439 27819 30061 30857 31554 34123 31942 31952 30938 27412 33192 30487 30343 31748 32459 30572 33848 Let Yn. Ycg1, Ycg2, yog, Ycl yw, ys, be the total electricity generated in a year by the HYDRO, CCGTI, CCGT2, OCGT, COAL, WIND, and SOLAR plants respectively, and Em, the amount of electricity imported from neighbouring countries. Though demand is uncertain, use the average of the possible demands to represent the demand expected in 2022 Assume there are 365 days in year and answer the following questions. i. What do you think is the implicit objective of GridCo in meeting the demand for in 2022? Explain (3 marks) ii. Formulate a linear programming model to help GridCo achieve its objective (20 marks). iii. Indicate how GridCo should utilize its available generation plants, as well as the size of imports to meet the 2022 demand, and calculate the related objective function value. iv. What percentage of the demand is met by plants HYDRO, OCGT1, and OCGT2? v. Suppose demand were to increase by 1000MW. What will be the consequence if GridCo decides to meet the additional increase at all cost? Do you think GridCo's action in (v) is justified if cost of unserved energy to the economy is $600/MWh? vi. From the problem in (v), interpret all the shadow prices of a MWh of electricity related to HYDRO, CCGTI, CCGT2, OCGT, WIND, SOLAR, and imports, as well as demand. Make sure to give a practical interpretation. vii. Suppose the cost of IMWh of unserved demand is $230/MWh. Will it be advisable to limit the utilization of some plants? If so which one(s)? If not, why not, and what is the best thing to do? Make sure to give a practical interpretation. viii. Suppose GridCo cannot import electricity from neighbouring countries, but is allowed to not meet all the power demanded. Let U represent the amount of demand not met, also called 'unserved demand'. Assume unserved demand cost $320/MWh. Modify the LP model above accordingly. ix. From (viii), indicate how GridCo should utilize its available generation plants, as well as the size of unserved demand, and calculate the related objective function value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts