Question: is a multiple choice question your fast reply is much thank QUESTION 1 (CHAPTER 1) A financial manager's goal of maximizing current or short-term earnings

is a multiple choice question your fast reply is much thank

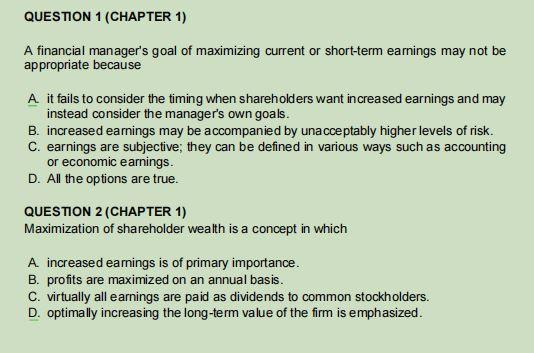

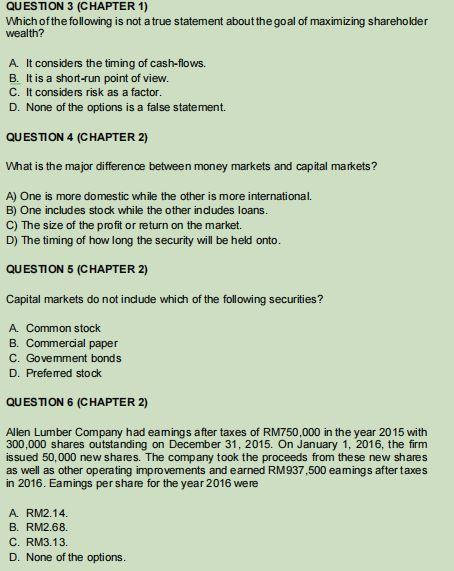

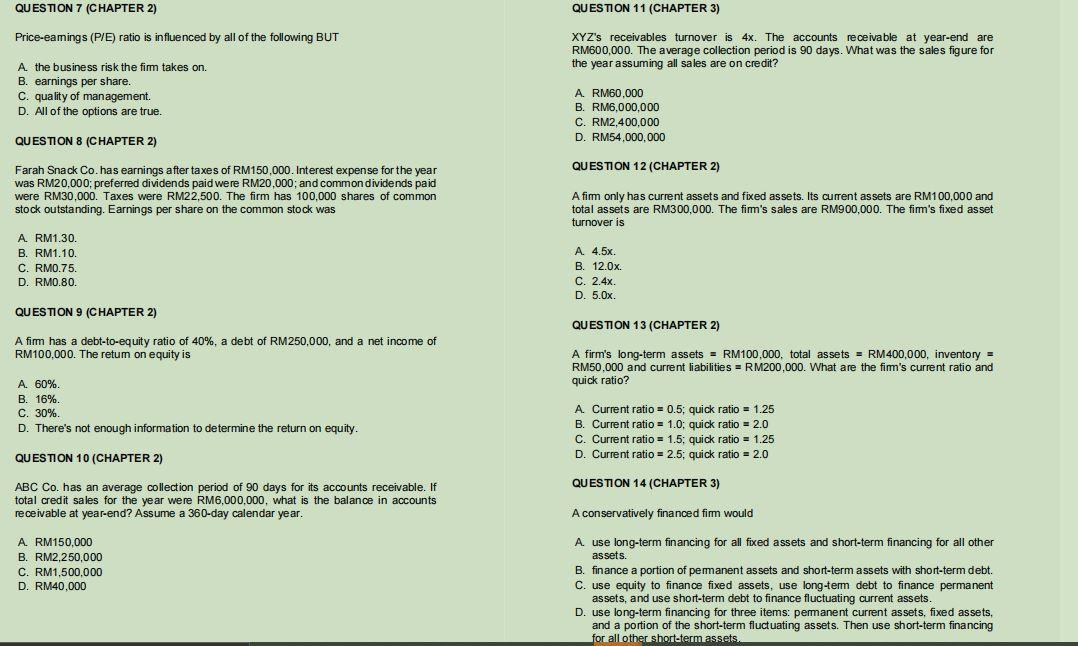

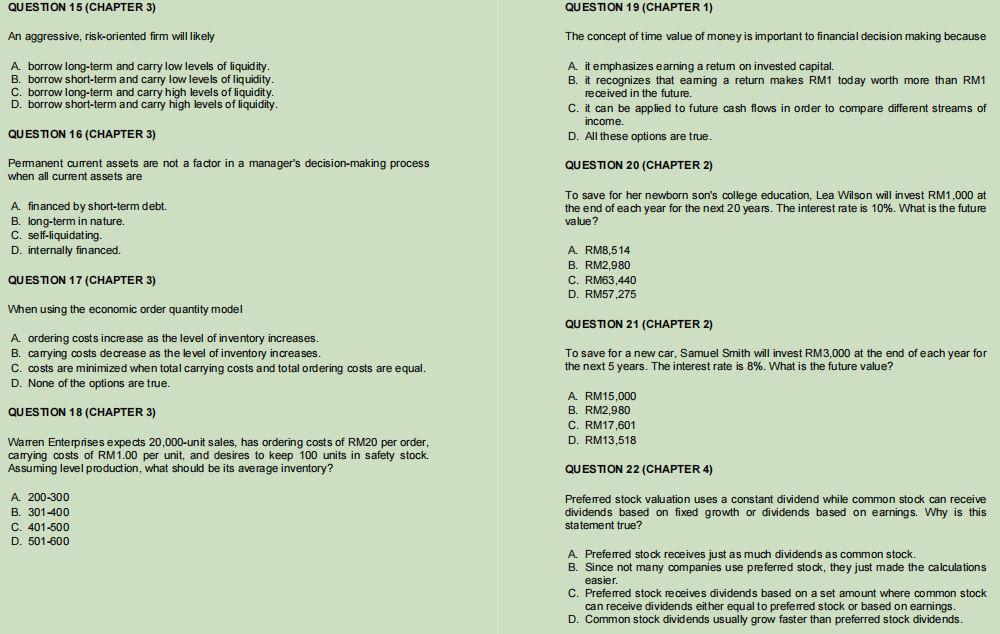

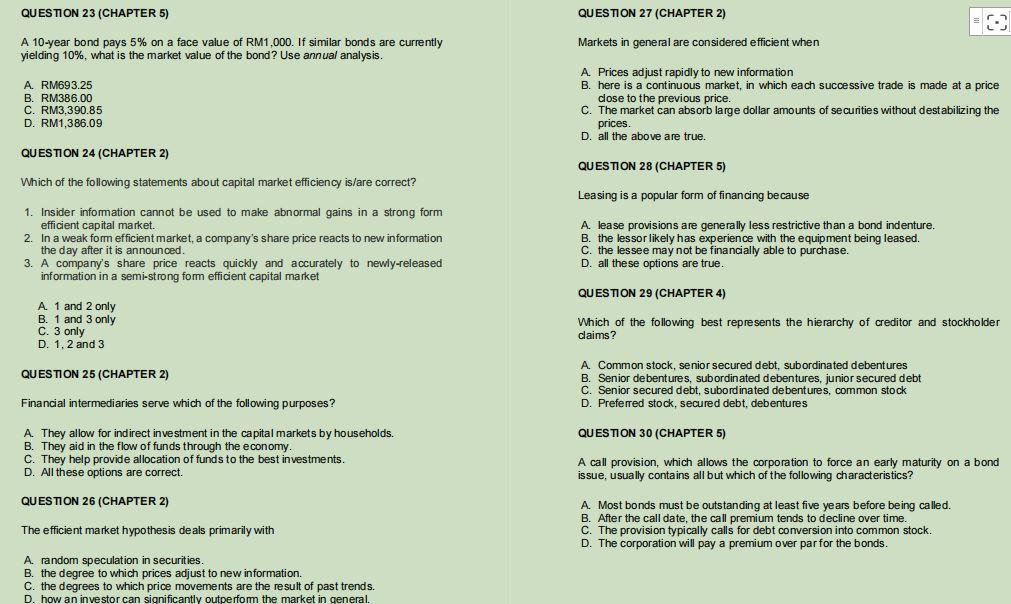

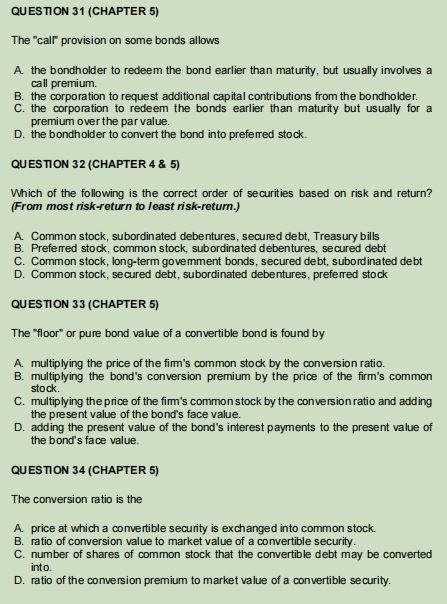

QUESTION 1 (CHAPTER 1) A financial manager's goal of maximizing current or short-term earnings may not be appropriate because A it fails to consider the timing when shareholders want increased earnings and may instead consider the manager's own goals. B. increased earnings may be accompanied by unacceptably higher levels of risk. C. earnings are subjective; they can be defined in various ways such as accounting or economic earnings. D. All the options are true. QUESTION 2 (CHAPTER 1) Maximization of shareholder wealth is a concept in which A increased earnings is of primary importance. B. profits are maximized on an annual basis. C. virtually all earnings are paid as dividends to common stockholders. D. optimally increasing the long-term value of the firm is emphasized. QUESTION 3 (CHAPTER 1) Which of the following is not a true statement about the goal of maximizing shareholder wealth? A. It considers the timing of cash-flows. B. It is a short-run point of view. C. It considers risk as a factor. D. None of the options is a false statement. QUESTION 4 (CHAPTER 2) What is the major difference between money markets and capital markets? A) One is more domestic while the other is more international. B) One includes stock while the other includes loans. C) The size of the profit or return on the market. D) The timing of how long the security will be held onto. QUESTION 5 (CHAPTER 2) Capital markets do not include which of the following securities? A Common stock B. Commercial paper C. Govemment bonds D. Preferred stock QUESTION 6 (CHAPTER 2) Allen Lumber Company had eamings after taxes of RM750,000 in the year 2015 with 300,000 shares outstanding on December 31, 2015. On January 1, 2016, the firm issued 50,000 new shares. The company took the proceeds from these new shares as well as other operating improvements and earned RM937,500 eamings after taxes in 2016. Eamings per share for the year 2016 were A RM2.14. B. RM2.68. C. RM3.13. D. None of the options. QUESTION 7 (CHAPTER 2) QUESTION 11 (CHAPTER 3) Price-eamings (P/E) ratio is influenced by all of the following BUT XYZ's receivables turnover is 4x. The accounts receivable at year-end are RM600,000. The average collection period is 90 days. What was the sales figure for the year assuming all sales are on credit? A. the business risk the firm takes on. B. earnings per share. C. quality of management D. All of the options are true. A RM60,000 B. RM6,000,000 C. RM2,400,000 D. RM54,000,000 QUESTION 8 (CHAPTER 2) QUESTION 12 (CHAPTER 2) Farah Snack Co. has earnings after taxes of RM150,000. Interest expense for the year was RM20,000; preferred dividends paid were RM20,000; and common dividends paid were RM30,000. Taxes were RM22,500. The firm has 100,000 shares of common stock outstanding. Earnings per share on the common stock was A fim only has current assets and fixed assets. Its current assets are RM100,000 and total assets are RM300,000. The fim's sales are RM900,000. The fim's fixed asset turnover is A. RM1.30. B. RM1.10. C. RM0.75 D. RM0.80 A 4.5x. B. 12.0x C. 2.4x. D. 5.Ox. QUESTION 9 (CHAPTER 2) QUESTION 13 (CHAPTER 2) A firm has a debt-to-equity ratio of 40%, a debt of RM250,000, and a net income of RM100,000. The retum on equity is A firm's long-term assets = RM100,000, total assets = RM 400,000, inventory = RM50.000 and current liabilities = RM200,000. What are the fim's current ratio and quick ratio? A. 60% B. 16% C. 30% D. There's not enough information to determine the return on equity. A Current ratio = 0.5; quick ratio = 1.25 B. Current ratio = 1.0: quick ratio = 2.0 C. Current ratio = 1.5: quick ratio = 1.25 D. Current ratio = 2.5; quick ratio = 2.0 QUESTION 10 (CHAPTER 2) QUESTION 14 (CHAPTER 3) ABC Co. has an average collection period of 90 days for its accounts receivable. If total credit sales for the year were RM6,000,000, what is the balance in accounts receivable at year-end? Assume a 360-day calendar year. A conservatively financed firm would A RM150,000 B. RM2,250,000 C. RM1,500,000 D. RM40,000 A use long-term financing for all fixed assets and short-term financing for all other assets. B. finance a portion of permanent assets and short-term assets with short-term debt. C. use equity to finance fixed assets, use long-term debt to finance permanent assets, and use short-term debt to finance fluctuating current assets. D. use long-term financing for three items: permanent current assets, fixed assets, and a portion of the short-term fluctuating assets. Then use short-term financing for all other short-term assets QUESTION 15 (CHAPTER 3) QUESTION 19 (CHAPTER 1) An aggressive, risk-oriented firm will likely The concept of time value of money is important to financial decision making because A borrow long-term and carry low levels of liquidity. B. borrow short-term and carry low levels of liquidity. C. borrow long-term and carry high levels of liquidity. D. borrow short-term and carry high levels of liquidity. A it emphasizes earning a retum on invested capital. B. it recognizes that eaming a return makes RM1 today worth more than RM1 received in the future. C. it can be applied to future cash flows in order to compare different streams of income. D. All these options are true. QUESTION 16 (CHAPTER 3) Permanent current assets are not a factor in a manager's decision-making process when all current assets are QUESTION 20 (CHAPTER 2) To save for her newborn son's college education, Lea Wilson will invest RM1.000 at the end of each year for the next 20 years. The interest rate is 10%. What is the future value? A financed by short-term debt. B. long-term in nature. C. self-liquidating D. internally financed. A. RM8,514 B. RM2,980 C. RM63,440 D. RM57 275 QUESTION 17 (CHAPTER 3) When using the economic order quantity model QUESTION 21 (CHAPTER 2) A ordering costs increase as the level of inventory increases. B. carrying costs decrease as the level of inventory increases. C. costs are minimized when total carrying costs and total ordering costs are equal. D. None of the options are true. To save for a new car, Samuel Smith will invest RM3,000 at end of each year for the next 5 years. The interest rate is 8%. What is the future value? QUESTION 18 (CHAPTER 3) A RM15,000 B. RM2,980 C. RM17,601 D. RM13,518 Warren Enterprises expects 20.000-unit sales, has ordering costs of RM20 per order, carrying costs of RM 1.00 per unit, and desires to keep 100 units in safety stock. Assuming level production, what should be its average inventory? QUESTION 22 (CHAPTER 4) A 200-300 B. 301-400 C. 401-500 D. 501-600 Preferred stock valuation uses constant dividend while common stock can receive dividends based on fixed growth or dividends based on earnings. Why is this statement true? A. Preferred stock receives just as much dividends as common stock B. Since not many companies use preferred stock, they just made the calculations easier. C. Preferred stock receives dividends based on a set amount where common stock can receive dividends either equal to preferred stock or based on earnings. D. Common stock dividends usually grow faster than preferred stock dividends. QUESTION 23 (CHAPTER 5) QUESTION 27 (CHAPTER 2) A 10-year bond pays 5% on a face value of RM1.000. If similar bonds are currently yielding 10%, what is the market value of the bond? Use annual analysis. Markets in general are considered efficient when A. RM693.25 B. RM386.00 C. RM3,390.85 D. RM1,386.09 A. Prices adjust rapidly to new information B. here is a continuous market, in which each successive trade is made at a price close to the previous price. C. The market can absorb large dollar amounts of securities without destabilizing the prices. D. all the above are true. QUESTION 24 (CHAPTER 2) QUESTION 28 (CHAPTER 5) Which of the following statements about capital market efficiency is/are correct? Leasing is a popular form of financing because 1. Insider information cannot be used to make abnormal gains in a strong form efficient capital market. 2. In a weak form efficient market, a company's share price reacts to new information the day after it is announced. 3. A company's share price reacts quickly and accurately to newly-released information in a semi-strong for efficient capital market A lease provisions are generally less restrictive than a bond indenture. B. the lessor likely has experience with the equipment being leased. C. the lessee may not be financially able to purchase. D. all these options are true. QUESTION 29 (CHAPTER 4) A 1 and 2 only B. 1 and 3 only C. 3 only D. 1, 2 and 3 Which of the following best represents the hierarchy of creditor and stockholder claims? QUESTION 25 (CHAPTER 2) A. Common stock, senior secured debt, subordinated debentures B. Senior debentures, subordinated debentures, junior secured debt C. Senior secured debt, subordinated debentures, common stock D. Preferred stock, secured debt, debentures Financial intermediaries serve which of the following purposes? QUESTION 30 (CHAPTER 5) A. They allow for indirect investment in the capital markets by households. B. They aid in the flow of funds through the economy. C. They help provide allocation of funds to the best investments D. All these options are correct. QUESTION 26 (CHAPTER 2) A call provision, which allows the corporation to force an early maturity on a bond issue, usually contains all but which of the following characteristics? The efficient market hypothesis deals primarily with A. Most bonds must be outstanding at least five years before being called. B. After the call date, the call premium tends to decline over time. C. The provision typically calls for debt conversion into common stock. D. The corporation will pay a premium over par for the bonds. A. random speculation in securities. . B. the degree to which prices adjust to new information. C. the degrees to which price movements are the result of past trends. D. how an investor can significantly outperfom the market in general. QUESTION 31 (CHAPTER 5) The "call" provision on some bonds allows A the bondholder to redeem the bond earlier than maturity, but usually involves a call premium B. the corporation to request additional capital contributions from the bondholder. C. the corporation to redeem the bonds earlier than maturity but usually for a premium over the par value. D. the bondholder to convert the bond into preferred stock. QUESTION 32 (CHAPTER 4 & 5) Which of the following is the correct order of securities based on risk and return? (From most risk-return to least risk-return.) A. Common stock, subordinated debentures, secured debt, Treasury bills B. Preferred stock, common stock, subordinated debentures, secured debt C. Common stock, long-term govemment bonds, secured debt, subordinated debt D. Common stock, secured debt, subordinated debentures, preferred stock QUESTION 33 (CHAPTER 5) The "floor" or pure bond value of a convertible bond is found by A multiplying the price of the firm's common stock by the conversion ratio. B. multiplying the bond's conversion premium by the price of the firm's common stock. C. multiplying the price of the fim's common stock by the conversion ratio and adding the present value of the bond's face value. D. adding the present value of the bond's interest payments to the present value of the bond's face value. QUESTION 34 (CHAPTER 5) The conversion ratio is the A. price at which a convertible security is exchanged into common stock. B. ratio of conversion value to market value of a convertible security. C. number of shares of common stock that the convertible debt may be converted D. ratio of the conversion premium to market value of a convertible security. into. QUESTION 1 (CHAPTER 1) A financial manager's goal of maximizing current or short-term earnings may not be appropriate because A it fails to consider the timing when shareholders want increased earnings and may instead consider the manager's own goals. B. increased earnings may be accompanied by unacceptably higher levels of risk. C. earnings are subjective; they can be defined in various ways such as accounting or economic earnings. D. All the options are true. QUESTION 2 (CHAPTER 1) Maximization of shareholder wealth is a concept in which A increased earnings is of primary importance. B. profits are maximized on an annual basis. C. virtually all earnings are paid as dividends to common stockholders. D. optimally increasing the long-term value of the firm is emphasized. QUESTION 3 (CHAPTER 1) Which of the following is not a true statement about the goal of maximizing shareholder wealth? A. It considers the timing of cash-flows. B. It is a short-run point of view. C. It considers risk as a factor. D. None of the options is a false statement. QUESTION 4 (CHAPTER 2) What is the major difference between money markets and capital markets? A) One is more domestic while the other is more international. B) One includes stock while the other includes loans. C) The size of the profit or return on the market. D) The timing of how long the security will be held onto. QUESTION 5 (CHAPTER 2) Capital markets do not include which of the following securities? A Common stock B. Commercial paper C. Govemment bonds D. Preferred stock QUESTION 6 (CHAPTER 2) Allen Lumber Company had eamings after taxes of RM750,000 in the year 2015 with 300,000 shares outstanding on December 31, 2015. On January 1, 2016, the firm issued 50,000 new shares. The company took the proceeds from these new shares as well as other operating improvements and earned RM937,500 eamings after taxes in 2016. Eamings per share for the year 2016 were A RM2.14. B. RM2.68. C. RM3.13. D. None of the options. QUESTION 7 (CHAPTER 2) QUESTION 11 (CHAPTER 3) Price-eamings (P/E) ratio is influenced by all of the following BUT XYZ's receivables turnover is 4x. The accounts receivable at year-end are RM600,000. The average collection period is 90 days. What was the sales figure for the year assuming all sales are on credit? A. the business risk the firm takes on. B. earnings per share. C. quality of management D. All of the options are true. A RM60,000 B. RM6,000,000 C. RM2,400,000 D. RM54,000,000 QUESTION 8 (CHAPTER 2) QUESTION 12 (CHAPTER 2) Farah Snack Co. has earnings after taxes of RM150,000. Interest expense for the year was RM20,000; preferred dividends paid were RM20,000; and common dividends paid were RM30,000. Taxes were RM22,500. The firm has 100,000 shares of common stock outstanding. Earnings per share on the common stock was A fim only has current assets and fixed assets. Its current assets are RM100,000 and total assets are RM300,000. The fim's sales are RM900,000. The fim's fixed asset turnover is A. RM1.30. B. RM1.10. C. RM0.75 D. RM0.80 A 4.5x. B. 12.0x C. 2.4x. D. 5.Ox. QUESTION 9 (CHAPTER 2) QUESTION 13 (CHAPTER 2) A firm has a debt-to-equity ratio of 40%, a debt of RM250,000, and a net income of RM100,000. The retum on equity is A firm's long-term assets = RM100,000, total assets = RM 400,000, inventory = RM50.000 and current liabilities = RM200,000. What are the fim's current ratio and quick ratio? A. 60% B. 16% C. 30% D. There's not enough information to determine the return on equity. A Current ratio = 0.5; quick ratio = 1.25 B. Current ratio = 1.0: quick ratio = 2.0 C. Current ratio = 1.5: quick ratio = 1.25 D. Current ratio = 2.5; quick ratio = 2.0 QUESTION 10 (CHAPTER 2) QUESTION 14 (CHAPTER 3) ABC Co. has an average collection period of 90 days for its accounts receivable. If total credit sales for the year were RM6,000,000, what is the balance in accounts receivable at year-end? Assume a 360-day calendar year. A conservatively financed firm would A RM150,000 B. RM2,250,000 C. RM1,500,000 D. RM40,000 A use long-term financing for all fixed assets and short-term financing for all other assets. B. finance a portion of permanent assets and short-term assets with short-term debt. C. use equity to finance fixed assets, use long-term debt to finance permanent assets, and use short-term debt to finance fluctuating current assets. D. use long-term financing for three items: permanent current assets, fixed assets, and a portion of the short-term fluctuating assets. Then use short-term financing for all other short-term assets QUESTION 15 (CHAPTER 3) QUESTION 19 (CHAPTER 1) An aggressive, risk-oriented firm will likely The concept of time value of money is important to financial decision making because A borrow long-term and carry low levels of liquidity. B. borrow short-term and carry low levels of liquidity. C. borrow long-term and carry high levels of liquidity. D. borrow short-term and carry high levels of liquidity. A it emphasizes earning a retum on invested capital. B. it recognizes that eaming a return makes RM1 today worth more than RM1 received in the future. C. it can be applied to future cash flows in order to compare different streams of income. D. All these options are true. QUESTION 16 (CHAPTER 3) Permanent current assets are not a factor in a manager's decision-making process when all current assets are QUESTION 20 (CHAPTER 2) To save for her newborn son's college education, Lea Wilson will invest RM1.000 at the end of each year for the next 20 years. The interest rate is 10%. What is the future value? A financed by short-term debt. B. long-term in nature. C. self-liquidating D. internally financed. A. RM8,514 B. RM2,980 C. RM63,440 D. RM57 275 QUESTION 17 (CHAPTER 3) When using the economic order quantity model QUESTION 21 (CHAPTER 2) A ordering costs increase as the level of inventory increases. B. carrying costs decrease as the level of inventory increases. C. costs are minimized when total carrying costs and total ordering costs are equal. D. None of the options are true. To save for a new car, Samuel Smith will invest RM3,000 at end of each year for the next 5 years. The interest rate is 8%. What is the future value? QUESTION 18 (CHAPTER 3) A RM15,000 B. RM2,980 C. RM17,601 D. RM13,518 Warren Enterprises expects 20.000-unit sales, has ordering costs of RM20 per order, carrying costs of RM 1.00 per unit, and desires to keep 100 units in safety stock. Assuming level production, what should be its average inventory? QUESTION 22 (CHAPTER 4) A 200-300 B. 301-400 C. 401-500 D. 501-600 Preferred stock valuation uses constant dividend while common stock can receive dividends based on fixed growth or dividends based on earnings. Why is this statement true? A. Preferred stock receives just as much dividends as common stock B. Since not many companies use preferred stock, they just made the calculations easier. C. Preferred stock receives dividends based on a set amount where common stock can receive dividends either equal to preferred stock or based on earnings. D. Common stock dividends usually grow faster than preferred stock dividends. QUESTION 23 (CHAPTER 5) QUESTION 27 (CHAPTER 2) A 10-year bond pays 5% on a face value of RM1.000. If similar bonds are currently yielding 10%, what is the market value of the bond? Use annual analysis. Markets in general are considered efficient when A. RM693.25 B. RM386.00 C. RM3,390.85 D. RM1,386.09 A. Prices adjust rapidly to new information B. here is a continuous market, in which each successive trade is made at a price close to the previous price. C. The market can absorb large dollar amounts of securities without destabilizing the prices. D. all the above are true. QUESTION 24 (CHAPTER 2) QUESTION 28 (CHAPTER 5) Which of the following statements about capital market efficiency is/are correct? Leasing is a popular form of financing because 1. Insider information cannot be used to make abnormal gains in a strong form efficient capital market. 2. In a weak form efficient market, a company's share price reacts to new information the day after it is announced. 3. A company's share price reacts quickly and accurately to newly-released information in a semi-strong for efficient capital market A lease provisions are generally less restrictive than a bond indenture. B. the lessor likely has experience with the equipment being leased. C. the lessee may not be financially able to purchase. D. all these options are true. QUESTION 29 (CHAPTER 4) A 1 and 2 only B. 1 and 3 only C. 3 only D. 1, 2 and 3 Which of the following best represents the hierarchy of creditor and stockholder claims? QUESTION 25 (CHAPTER 2) A. Common stock, senior secured debt, subordinated debentures B. Senior debentures, subordinated debentures, junior secured debt C. Senior secured debt, subordinated debentures, common stock D. Preferred stock, secured debt, debentures Financial intermediaries serve which of the following purposes? QUESTION 30 (CHAPTER 5) A. They allow for indirect investment in the capital markets by households. B. They aid in the flow of funds through the economy. C. They help provide allocation of funds to the best investments D. All these options are correct. QUESTION 26 (CHAPTER 2) A call provision, which allows the corporation to force an early maturity on a bond issue, usually contains all but which of the following characteristics? The efficient market hypothesis deals primarily with A. Most bonds must be outstanding at least five years before being called. B. After the call date, the call premium tends to decline over time. C. The provision typically calls for debt conversion into common stock. D. The corporation will pay a premium over par for the bonds. A. random speculation in securities. . B. the degree to which prices adjust to new information. C. the degrees to which price movements are the result of past trends. D. how an investor can significantly outperfom the market in general. QUESTION 31 (CHAPTER 5) The "call" provision on some bonds allows A the bondholder to redeem the bond earlier than maturity, but usually involves a call premium B. the corporation to request additional capital contributions from the bondholder. C. the corporation to redeem the bonds earlier than maturity but usually for a premium over the par value. D. the bondholder to convert the bond into preferred stock. QUESTION 32 (CHAPTER 4 & 5) Which of the following is the correct order of securities based on risk and return? (From most risk-return to least risk-return.) A. Common stock, subordinated debentures, secured debt, Treasury bills B. Preferred stock, common stock, subordinated debentures, secured debt C. Common stock, long-term govemment bonds, secured debt, subordinated debt D. Common stock, secured debt, subordinated debentures, preferred stock QUESTION 33 (CHAPTER 5) The "floor" or pure bond value of a convertible bond is found by A multiplying the price of the firm's common stock by the conversion ratio. B. multiplying the bond's conversion premium by the price of the firm's common stock. C. multiplying the price of the fim's common stock by the conversion ratio and adding the present value of the bond's face value. D. adding the present value of the bond's interest payments to the present value of the bond's face value. QUESTION 34 (CHAPTER 5) The conversion ratio is the A. price at which a convertible security is exchanged into common stock. B. ratio of conversion value to market value of a convertible security. C. number of shares of common stock that the convertible debt may be converted D. ratio of the conversion premium to market value of a convertible security. into

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts