Question: Is anyone able to help me solve practice question. Kind of having a hard time understanding. Its a derivatives and securities problem Practice questions MSFT

Is anyone able to help me solve practice question. Kind of having a hard time understanding. Its a derivatives and securities problem

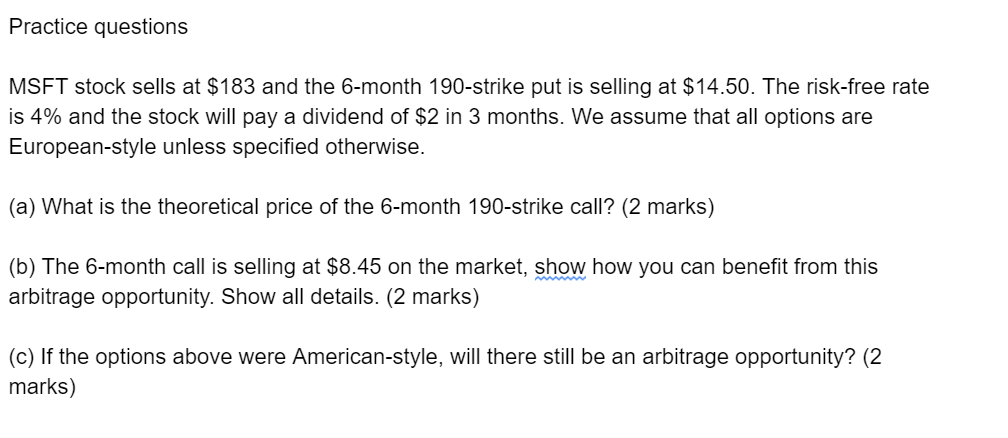

Practice questions MSFT stock sells at $183 and the 6-month 190-strike put is selling at $14.50. The risk-free rate is 4% and the stock will pay a dividend of $2 in 3 months. We assume that all options are European-style unless specified otherwise. (a) What is the theoretical price of the 6-month 190-strike call? (2 marks) (b) The 6-month call is selling at $8.45 on the market, show how you can benefit from this arbitrage opportunity. Show all details. (2 marks) (c) If the options above were American-style, will there still be an arbitrage opportunity? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts