Question: Is it correct or not? Use the information for the question(s) below. JR Industries has a $20 million loan due at the end of the

Is it correct or not?

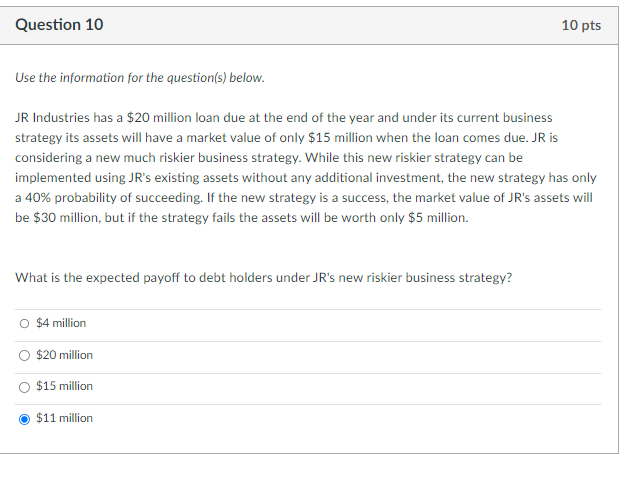

Use the information for the question(s) below. JR Industries has a $20 million loan due at the end of the year and under its current business strategy its assets will have a market value of only $15 million when the loan comes due. JR is considering a new much riskier business strategy. While this new riskier strategy can be implemented using JR's existing assets without any additional investment, the new strategy has only a 40% probability of succeeding. If the new strategy is a success, the market value of JR 's assets will be $30 million, but if the strategy fails the assets will be worth only $5 million. What is the expected payoff to debt holders under JR's new riskier business strategy? $4 million $20 million $15 million $11 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts