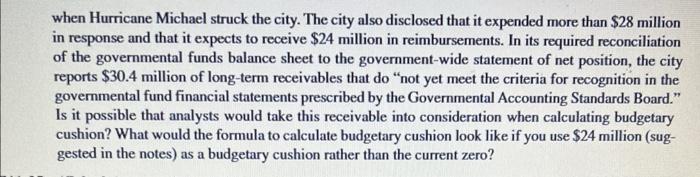

Question: is it possibly that analysts would take this receivable into considerstion when calculating budgetary cushion? what would the formula to calculate budgetary cushion look like

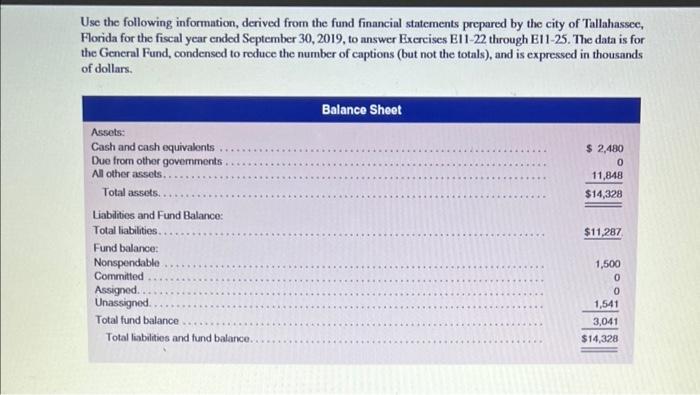

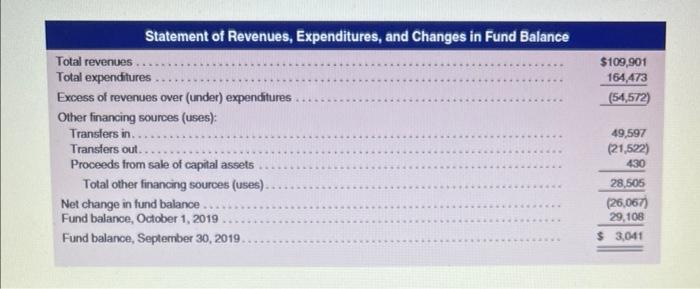

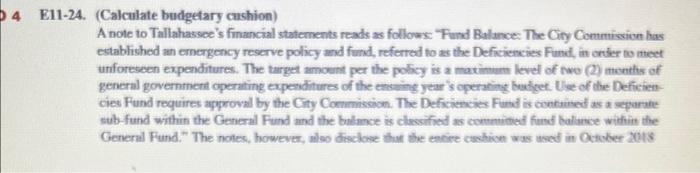

Use the following information, derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30,2019, to answer Exercises E11-22 through E11-25. The data is for the General Fund, condensed to roduce the number of captions (but not the totals), and is expressed in thousands of dollars. 1-24. (Calculate budgetary cushion) A note to Tallahassee's financial statements reads as followx " Fund Balunce: The City Comumissive has established an emergency reserve policy and fund, referred to as the Deficiencies Fund, in crier oo meet unforeseen expenditures. The target amount per the poficy is a matimum level of noo (2) menths of general government cperating expesditures of the enseing year's operating budget. Use of dhe Deficiencies Fund requires approval by the City Conmiscion. The Deficiencies Fund is contaised as a separate sub-fund within the General Fund and the bulmoce is clessified as comnithed fund balance within the Gencenal Fund." The notec, however, also disclose thut the encire coshion was used in Octuler auts when Hurricane Michael struck the city. The city also disclosed that it expended more than $28 million in response and that it expects to receive $24 million in reimbursements. In its required reconciliation of the governmental funds balance sheet to the government-wide statement of net position, the city reports $30.4 million of long-term receivables that do "not yet meet the criteria for recognition in the governmental fund financial statements prescribed by the Governmental Accounting Standards Board." Is it possible that analysts would take this receivable into consideration when calculating budgetary cushion? What would the formula to calculate budgetary cushion look like if you use $24 million (suggested in the notes) as a budgetary cushion rather than the current zero? Use the following information, derived from the fund financial statements prepared by the city of Tallahassee, Florida for the fiscal year ended September 30,2019, to answer Exercises E11-22 through E11-25. The data is for the General Fund, condensed to roduce the number of captions (but not the totals), and is expressed in thousands of dollars. 1-24. (Calculate budgetary cushion) A note to Tallahassee's financial statements reads as followx " Fund Balunce: The City Comumissive has established an emergency reserve policy and fund, referred to as the Deficiencies Fund, in crier oo meet unforeseen expenditures. The target amount per the poficy is a matimum level of noo (2) menths of general government cperating expesditures of the enseing year's operating budget. Use of dhe Deficiencies Fund requires approval by the City Conmiscion. The Deficiencies Fund is contaised as a separate sub-fund within the General Fund and the bulmoce is clessified as comnithed fund balance within the Gencenal Fund." The notec, however, also disclose thut the encire coshion was used in Octuler auts when Hurricane Michael struck the city. The city also disclosed that it expended more than $28 million in response and that it expects to receive $24 million in reimbursements. In its required reconciliation of the governmental funds balance sheet to the government-wide statement of net position, the city reports $30.4 million of long-term receivables that do "not yet meet the criteria for recognition in the governmental fund financial statements prescribed by the Governmental Accounting Standards Board." Is it possible that analysts would take this receivable into consideration when calculating budgetary cushion? What would the formula to calculate budgetary cushion look like if you use $24 million (suggested in the notes) as a budgetary cushion rather than the current zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts