Question: Is my answer right or wrong? If wrong, can you please explain what to do? Problem 14 [sale with time value of money, IE-type II

Is my answer right or wrong? If wrong, can you please explain what to do?

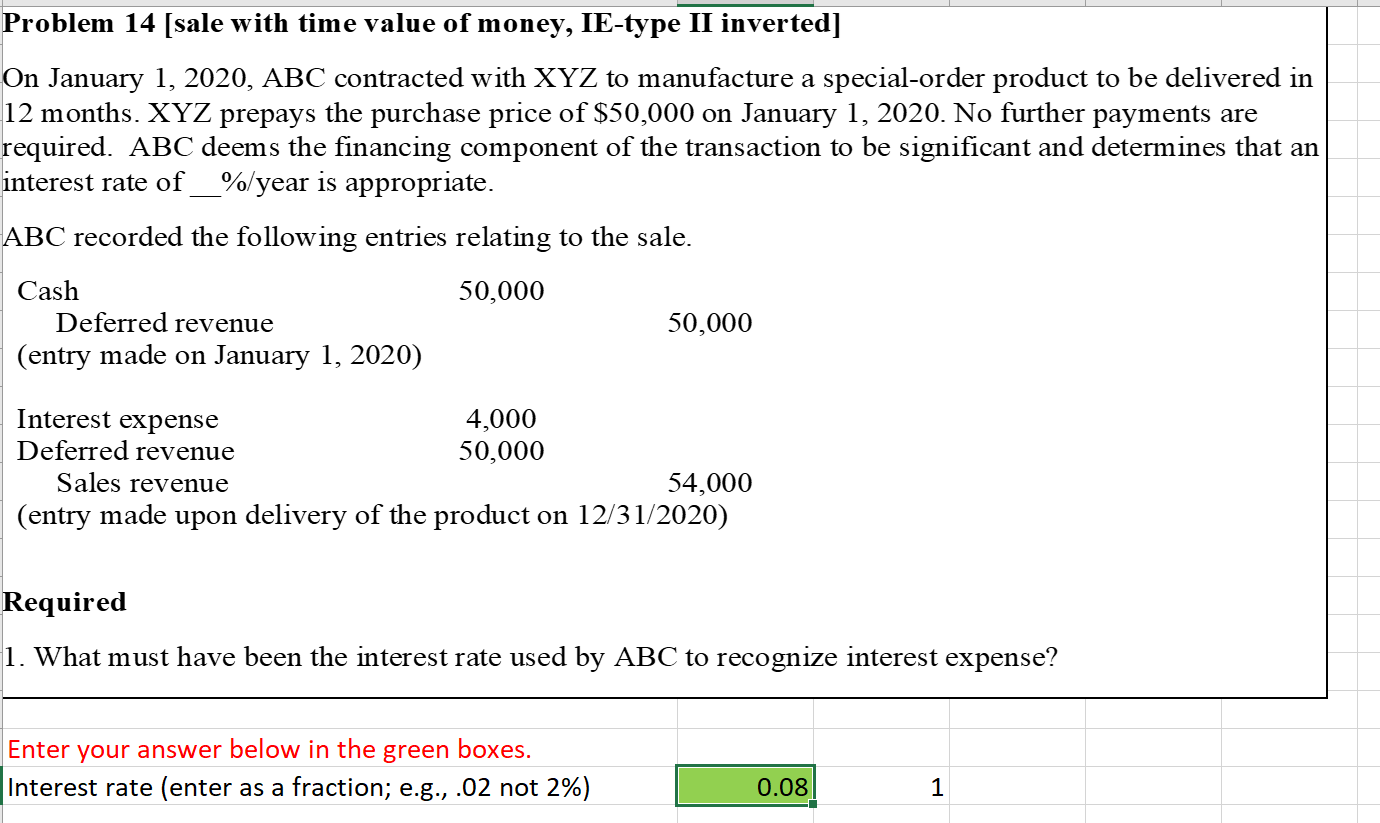

Problem 14 [sale with time value of money, IE-type II inverted] On January 1, 2020, ABC contracted with XYZ to manufacture a special-order product to be delivered in 12 months. XYZ prepays the purchase price of $50,000 on January 1, 2020. No further payments are required. ABC deems the financing component of the transaction to be significant and determines that an interest rate of __%/year is appropriate. ABC recorded the following entries relating to the sale. 50,000 Cash Deferred revenue (entry made on January 1, 2020) 50,000 Interest expense 4,000 Deferred revenue 50,000 Sales revenue 54,000 (entry made upon delivery of the product on 12/31/2020) Required 1. What must have been the interest rate used by ABC to recognize interest expense? Enter your answer below in the green boxes. Interest rate (enter as a fraction; e.g., .02 not 2%) 0.08 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts