Question: is my buddy correct? Consider the following data for a single-index economy. All portfolios are well diversifie3d. Suppose that another portfolio E is well diversified

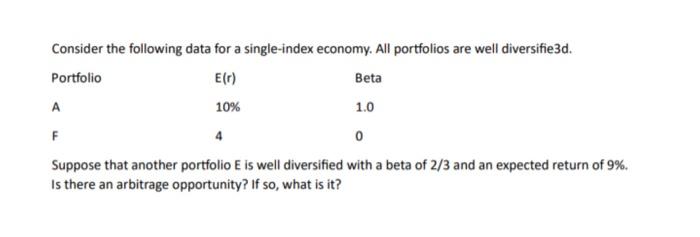

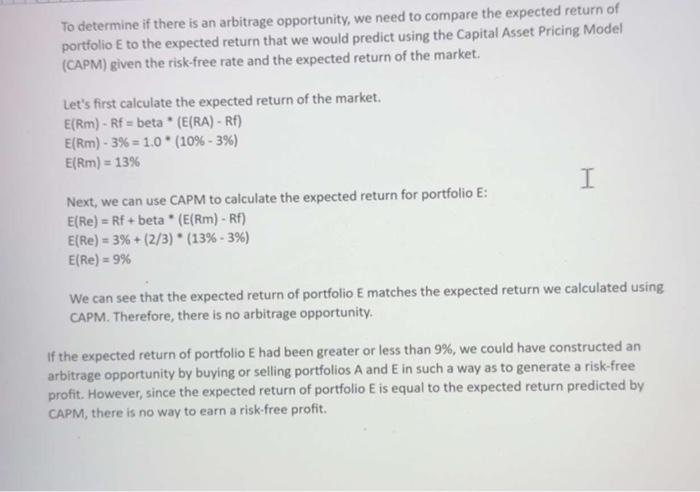

Consider the following data for a single-index economy. All portfolios are well diversifie3d. Suppose that another portfolio E is well diversified with a beta of 2/3 and an expected return of 9%. Is there an arbitrage opportunity? If so, what is it? To determine if there is an arbitrage opportunity, we need to compare the expected return of portfolio E to the expected return that we would predict using the Capital Asset Pricing Model (CAPM) given the risk-free rate and the expected return of the market. Let's first calculate the expected return of the market. E(Rm)Rf=beta*(E(RA)Rf)E(Rm)3%=1.0(10%3%)E(Rm)=13% Next, we can use CAPM to calculate the expected return for portfolio E : E(Re)=Rf+beta(E(Rm)Rf)E(Re)=3%+(2/3)(13%3%)E(Re)=9% We can see that the expected return of portfolio E matches the expected return we calculated using CAPM. Therefore, there is no arbitrage opportunity. If the expected return of portfolio E had been greater or less than 9%, we could have constructed an arbitrage opportunity by buying or selling portfolios A and E in such a way as to generate a risk-free profit. However, since the expected return of portfolio E is equal to the expected return predicted by CAPM, there is no way to earn a risk-free profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts