Question: Is my solution and answer correct? If not, why? What two (2) equal payments at the end of 15 months and 3 years, respectively, will

Is my solution and answer correct? If not, why?

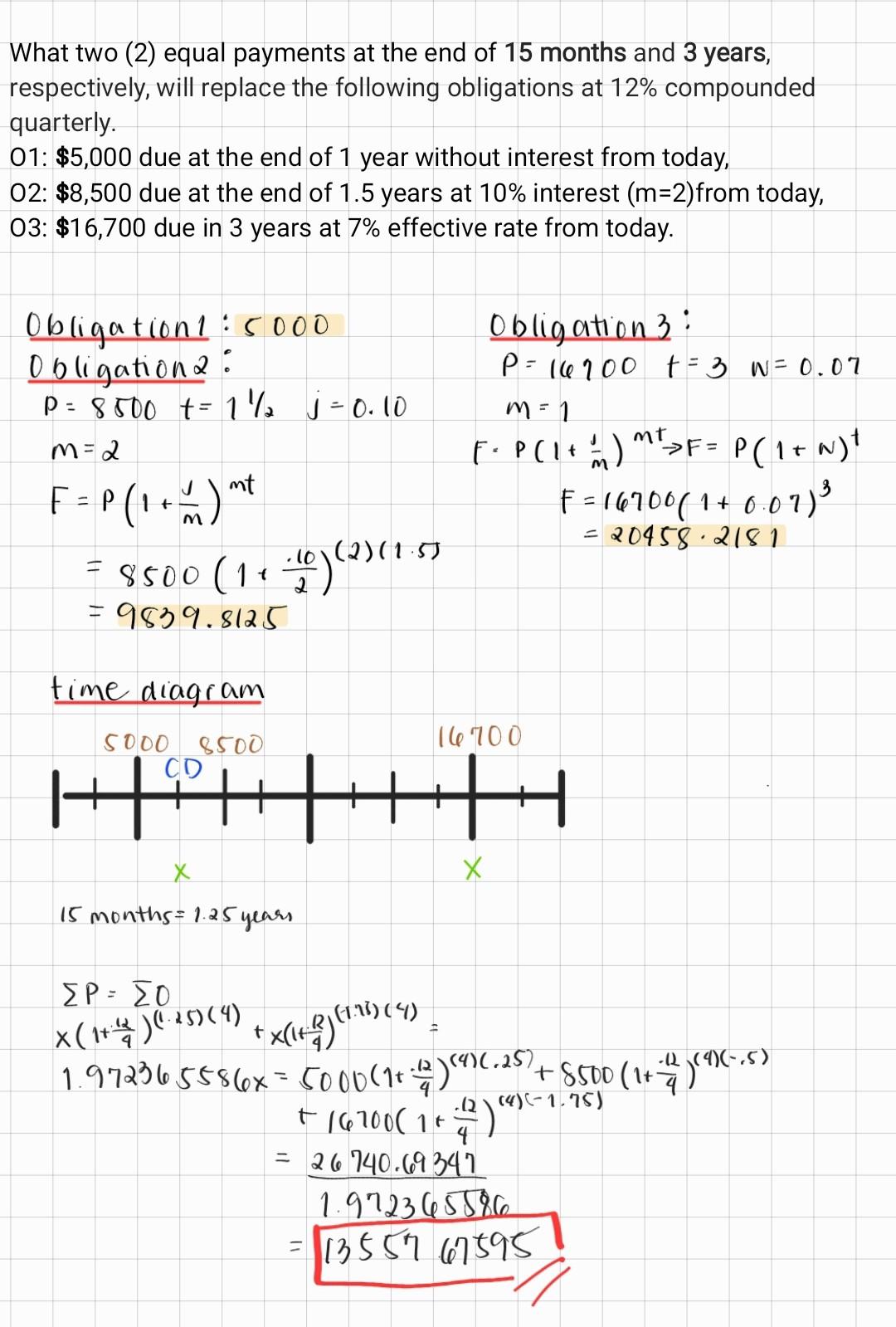

What two (2) equal payments at the end of 15 months and 3 years, respectively, will replace the following obligations at 12% compounded quarterly. 01: $5,000 due at the end of 1 year without interest from today, 02: $8,500 due at the end of 1.5 years at 10% interest (m=2)from today, 03: $16,700 due in 3 years at 7% effective rate from today. Obligation 3 P: 16900 t - 3 w=0.07 m-1 FP(1) M'>F= P( 1+ N) Ita F = 16700( 1+ 0.07) 20458.2181 mt t Obligation15000 Obligation 2 : P=8500 t= 1/2 j - 0.10 m=2 FP) -10 1.57 =$500 (1 : 0) (236151 - 9539.8125 ) mt M t - time diagram 16100 S000 8500 CD HT H X 15 months 1.25 years - t *( 1* p ) (25)(4) * x(36423cy) 1.972365656* = 5000(1+34 746.387 +5.500 (14 41(-5) ) 14)-1.75) + 167000 it 4. = 26 740.69 342 1.9723688C =135510595

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts