Question: is shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 11 Return to que Corporation

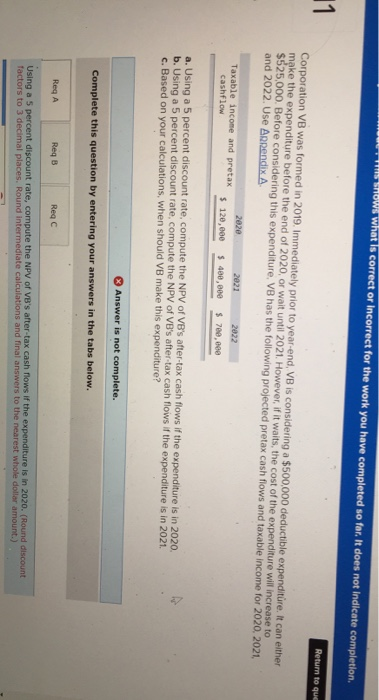

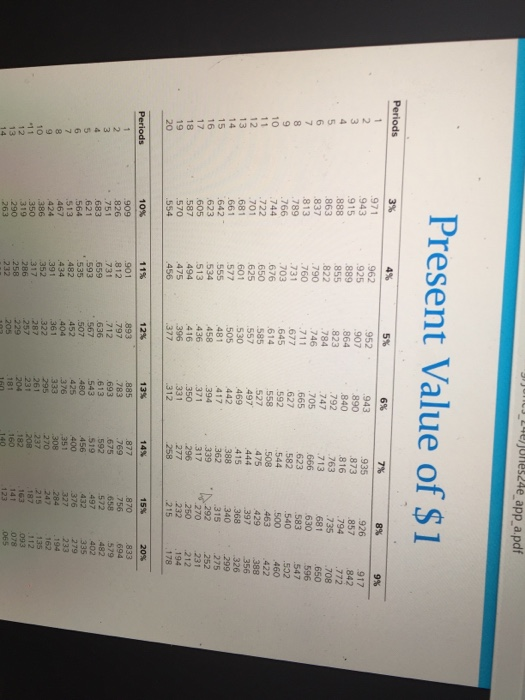

is shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 11 Return to que Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2020, or wait until 2021. However, if it waits, the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pretax cash flows and taxable income for 2020, 2021, and 2022. Use Appendix A. Taxable income and pretax cashflow 2020 $ 120,000 2021 $ 400,000 2022 $ 700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2021. c. Based on your calculations, when should VB make this expenditure? Answer is not complete. Complete this question by entering your answers in the tabs below. Req A ReqB Reqc Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. (Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.) Doncs 240) June 24e_app_a.pdf Present Value of $1 Periods 3% 4% 5% 6% 7% 9% 1 2 3 4 5 6 7 8 9 10 11 12 13 971 943 915 .888 863 837 813 789 766 744 .722 .701 681 661 .642 623 .605 587 .570 554 962 925 889 855 .822 .790 .760 .731 .703 676 650 625 601 577 555 534 513 494 .475 456 952 907 864 823 784 746 711 677 645 .614 585 557 530 505 481 458 436 416 396 377 943 890 .840 792 747 .705 665 627 .592 558 527 497 469 442 .417 394 371 .350 331 312 935 .873 816 763 .713 666 .623 582 544 .508 475 444 415 388 362 8% 926 857 .794 .735 681 630 583 .540 500 463 429 397 917 842 .772 .708 .650 596 547 592 460 422 388 356 326 299 275 252 231 212 194 178 368 340 315 339 292 15 16 17 18 19 20 270 317 296 277 258 250 232 215 Periods 10% 11% 14% 15% 20% 909 826 751 901 812 731 .659 593 535 .482 1 2. 3 4 5 6 7 8 9 10 "11 12 13 14 .870 756 658 572 497 12% 893 .797 .712 636 567 .507 452 404 361 322 287 257 229 .683 621 564 .513 467 424 386 .350 319 290 263 13% 885 783 .693 .613 543 .480 425 376 333 295 261 231 204 181 .877 769 675 592 519 .456 400 351 308 270 694 579 482 402 335 279 233 .376 327 284 247 215 .391 352 317 286 258 232 208 182 160 140 162 135 112 093 078 065 163 141 123 205 is shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. 11 Return to que Corporation VB was formed in 2019. Immediately prior to year-end, VB is considering a $500,000 deductible expenditure. It can either make the expenditure before the end of 2020, or wait until 2021. However, if it waits, the cost of the expenditure will increase to $525,000. Before considering this expenditure, VB has the following projected pretax cash flows and taxable income for 2020, 2021, and 2022. Use Appendix A. Taxable income and pretax cashflow 2020 $ 120,000 2021 $ 400,000 2022 $ 700,000 a. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. b. Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2021. c. Based on your calculations, when should VB make this expenditure? Answer is not complete. Complete this question by entering your answers in the tabs below. Req A ReqB Reqc Using a 5 percent discount rate, compute the NPV of VB's after-tax cash flows if the expenditure is in 2020. (Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount.) Doncs 240) June 24e_app_a.pdf Present Value of $1 Periods 3% 4% 5% 6% 7% 9% 1 2 3 4 5 6 7 8 9 10 11 12 13 971 943 915 .888 863 837 813 789 766 744 .722 .701 681 661 .642 623 .605 587 .570 554 962 925 889 855 .822 .790 .760 .731 .703 676 650 625 601 577 555 534 513 494 .475 456 952 907 864 823 784 746 711 677 645 .614 585 557 530 505 481 458 436 416 396 377 943 890 .840 792 747 .705 665 627 .592 558 527 497 469 442 .417 394 371 .350 331 312 935 .873 816 763 .713 666 .623 582 544 .508 475 444 415 388 362 8% 926 857 .794 .735 681 630 583 .540 500 463 429 397 917 842 .772 .708 .650 596 547 592 460 422 388 356 326 299 275 252 231 212 194 178 368 340 315 339 292 15 16 17 18 19 20 270 317 296 277 258 250 232 215 Periods 10% 11% 14% 15% 20% 909 826 751 901 812 731 .659 593 535 .482 1 2. 3 4 5 6 7 8 9 10 "11 12 13 14 .870 756 658 572 497 12% 893 .797 .712 636 567 .507 452 404 361 322 287 257 229 .683 621 564 .513 467 424 386 .350 319 290 263 13% 885 783 .693 .613 543 .480 425 376 333 295 261 231 204 181 .877 769 675 592 519 .456 400 351 308 270 694 579 482 402 335 279 233 .376 327 284 247 215 .391 352 317 286 258 232 208 182 160 140 162 135 112 093 078 065 163 141 123 205

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts