Question: 25 marks Maxim Inc. is considering two mutually exclusive projects. Project 1 requires an investment of R40 000, while Project 2 requires an investment

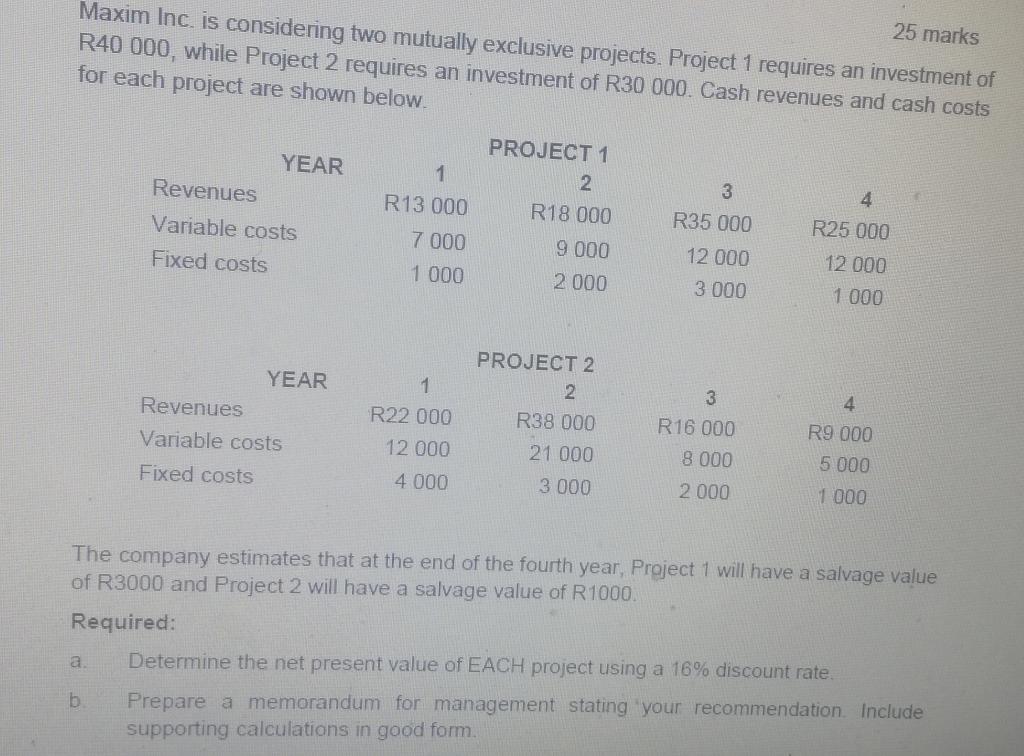

25 marks Maxim Inc. is considering two mutually exclusive projects. Project 1 requires an investment of R40 000, while Project 2 requires an investment of R30 000. Cash revenues and cash costs for each project are shown below. a. YEAR b. Revenues Variable costs Fixed costs YEAR Revenues Variable costs Fixed costs 1 R13 000 7 000 1 000 1 R22 000 12 000 4.000 PROJECT 1 2 R18 000 9.000 2.000 PROJECT 2 2 R38 000 21 000 3 000 3 R35 000 12 000 3 000 3 R16 000 8 000 2.000 4 R25 000 12 000 1.000 The company estimates that at the end of the fourth year, Project 1 will have a salvage value of R3000 and Project 2 will have a salvage value of R1000. Required: 4 R9 000 5.000 1 000 Determine the net present value of EACH project using a 16% discount rate. Prepare a memorandum for management stating your recommendation. Include supporting calculations in good form.

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Answer 1 I NPV of Project 1400001300070001000116180009000200011623... View full answer

Get step-by-step solutions from verified subject matter experts