Question: Is the paragraph will affect the existing financial statements? CHAPTER CASE HAIR CARE COMPANY LIMITED, PART 2 air Care Company Limited was established in Year

Is the paragraph will affect the existing financial statements?

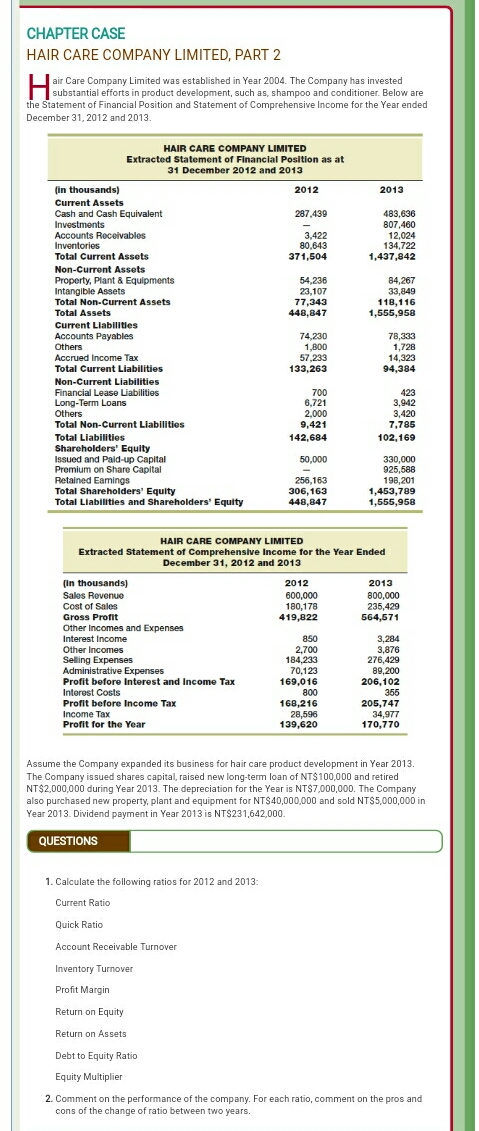

CHAPTER CASE HAIR CARE COMPANY LIMITED, PART 2 air Care Company Limited was established in Year 2004. The Company has invested substantial efforts in product development, such as, shampoo and conditioner. Below are the Statement of Financial Position and Statement of Comprehensive Income for the Year ended December 31, 2012 and 2013. HAIR CARE COMPANY LIMITED Extracted Statement of Financial Position as at 31 December 2012 and 2013 (in thousands) 2012 2013 Current Assets Cash and Cash Equivalent 287.439 483.636 Investments 807.460 Accounts Receivables 3,422 12.024 Inventories 80.643 134,722 Total Current Assets 371,504 1,437,842 Non-Current Assets Property, Plant & Equipments 54,236 34.267 Intangible Assets 23,107 33,849 Total Non-Current Assets 77,343 118, 116 Total Assets 448,847 1,555,950 Current Liabilities Accounts Payables 74 230 78,333 Others 1,800 1,728 Accrued Income Tax 57,233 14,323 Total Current Liabilities 133,263 94,384 Non-Current Liabilities Financial Lease Liabilities 700 423 Long-Term Loans 6.721 3,942 Others 2.000 3.420 Total Non-Current Liabilities 9,421 7.785 Total Liabilities 142,684 102,169 Shareholders' Equity Issued and Pald-up Capital 50.000 330,000 Premium on Share Capital 925,588 Retained Earnings 256,163 198,201 Total Shareholders' Equity 306,163 1,453,789 Total Liabilities and Shareholders' Equity 448,847 1,555,958 HAIR CARE COMPANY LIMITED Extracted Statement of Comprehensive Income for the Year Ended December 31, 2012 and 2013 (In thousands] 2012 2013 Sales Revenue 600,000 800,000 Cost of Sales 180,178 235,429 Gross Profit 419,822 564,571 Other Incomes and Expenses Interest Income 850 3,284 Other Incomes 2,700 3,876 Selling Expenses 184,233 276,429 Administrative Expenses 70,123 89,200 Profit before Interest and Income Tax 169,016 206,102 Interest Costs 800 355 Profit before Income Tax 168,216 205,747 Income Tax 28,596 34,977 Profit for the Year 139,620 170,770 Assume the Company expanded its business for hair care product development in Year 2013. The Company issued shares capital, raised new long-term loan of NT$100,000 and retired NT$2,000,000 during Year 2013. The depreciation for the Year is NT$7,000,000. The Company also purchased new property, plant and equipment for NT$40,000,000 and sold NT$5,000,000 in Year 2013. Dividend payment in Year 2013 is NT$231,642,000. QUESTIONS 1. Calculate the following ratios for 2012 and 2013: Current Ratio Quick Ratio Account Receivable Turnover Inventory Turnover Profit Margin Return on Equity Return on Assets Debt to Equity Ratio Equity Multiplier 2. Comment on the performance of the company. For each ratio, comment on the pros and cons of the change of ratio between two years