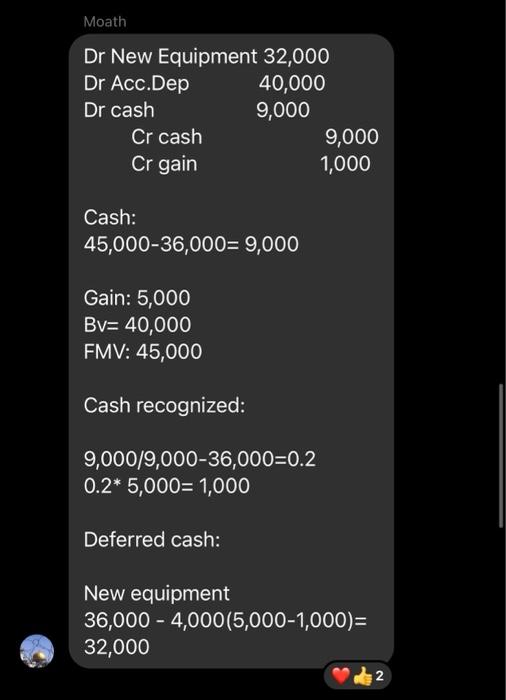

Question: is the solution in second photo true ? Assume the exchange lacks commercial substance. Anabtawi Co. exchanged a piece of equipment with an original cost

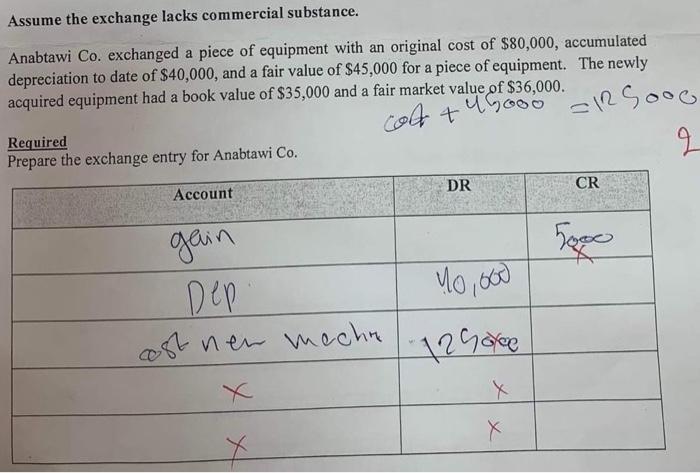

Assume the exchange lacks commercial substance. Anabtawi Co. exchanged a piece of equipment with an original cost of $80,000, accumulated depreciation to date of $40,000, and a fair value of $45,000 for a piece of equipment. The newly acquired equipment had a book value of $35,000 and a fair market value of $36,000. cott 49000 SIR soon Required Prepare the exchange entry for Anabtawi Co. = Sooo DR CR Account 500 1o,000 gain Dep cost new mecha 12906 X X Moath Dr New Equipment 32,000 Dr Acc.Dep 40,000 Dr cash 9,000 Cr cash 9,000 Cr gain 1,000 Cash: 45,000-36,000= 9,000 Gain: 5,000 Bv= 40,000 FMV: 45,000 Cash recognized: 9,000/9,000-36,000=0.2 0.2* 5,000= 1,000 Deferred cash: New equipment 36,000 - 4,000(5,000-1,000)= 32,000 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts