Question: Is there a way to calculate without using the excel sheet and PV function? I am not sure how this total was computed? how do

Is there a way to calculate without using the excel sheet and PV function? I am not sure how this total was computed? how do you determine the balance without more information regarding issue price? Im lost

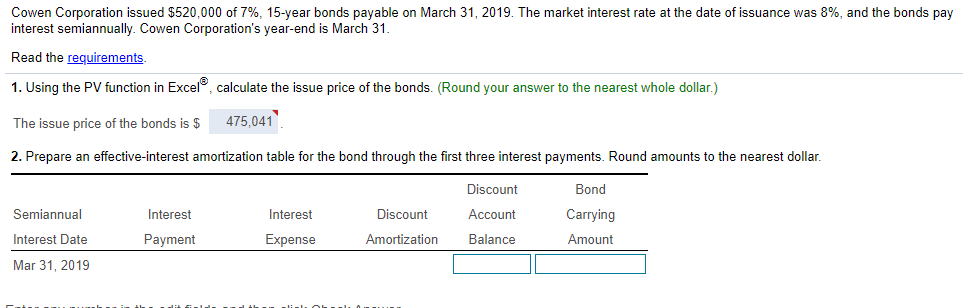

Cowen Corporation issued $520,000 of 7%, 15-year bonds payable on March 31, 2019. The market interest rate at the date of issuance was 8%, and the bonds pay interest semiannually. Cowen Corporation's year-end is March 31. Read the requirements 1. Using the PV function in Excel, calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is $ 475,041 2. Prepare an effective-interest amortization table for the bond through the first three interest payments. Round amounts to the nearest dollar. Discount Bond Semiannual Interest Discount Carrying Interest Payment Account Balance Interest Date Expense Amortization Amount Mar 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts