Question: is this answer correct? A critical machine in BHP Billiton's copper refining operation was purchased 7 years ago for $160,000. Last year a replacement study

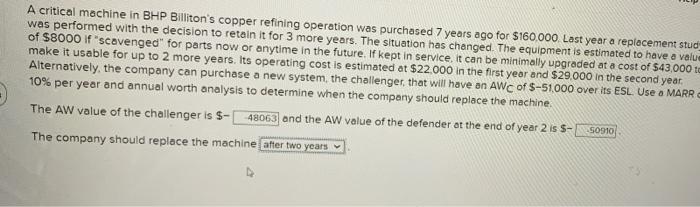

A critical machine in BHP Billiton's copper refining operation was purchased 7 years ago for $160,000. Last year a replacement study was performed with the decision to retain it for 3 more years. The situation has changed. The equipment is estimated to have a value of $8000 if "scavenged" for parts now or anytime in the future. If kept in service, it can be minimally upgraded at a cost of $43,000 to make it usable for up to 2 more years. Its operating cost is estimated at $22.000 in the first year and $29,000 in the second year. Alternatively, the company can purchase a new system, the challenger, that will have an AWC of $-51,000 over its ESL. Use o MARR 10% per year and annual worth analysis to determine when the company should replace the machine. 50910 The AW value of the challenger is $- 48063 and the AW value of the defender at the end of year 2 is S- The company should replace the machine after two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts