Question: Is this answer right? Consider a company described by the following market data: the value of the company's assets is 5 million USD, the volatility

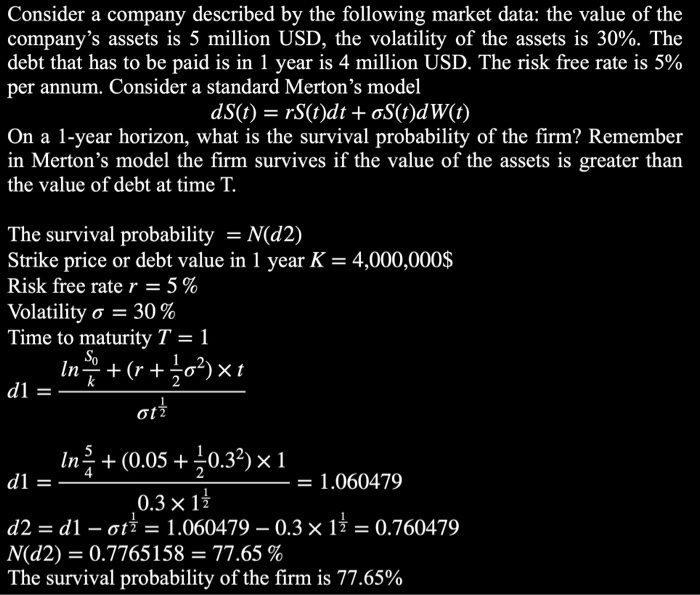

Consider a company described by the following market data: the value of the company's assets is 5 million USD, the volatility of the assets is 30%. The debt that has to be paid is in 1 year is 4 million USD. The risk free rate is 5% per annum. Consider a standard Merton's model ds(t) = rs(t)dt + oS(t)dW(t) On a 1-year horizon, what is the survival probability of the firm? Remember in Merton's model the firm survives if the value of the assets is greater than the value of debt at time T. The survival probability = N(D2) Strike price or debt value in 1 year K = 4,000,000$ Risk free rate r = 5% Volatility o = 30% Time to maturity T = 1 In +(r +102)xt d1 = - In+ (0.05 + 0.32)x1 d1 = = 1.060479 0.3 x 1 d2 = dl oti = 1.060479 0.3 x 11 = 0.760479 N(D2) = 0.7765158 = 77.65 % The survival probability of the firm is 77.65%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts