Question: Is this answer right? The 1-, 2-, and 3-year CDS spreads are 110, 130, and 145 basis points, respectively. The risk-free rate is 3% for

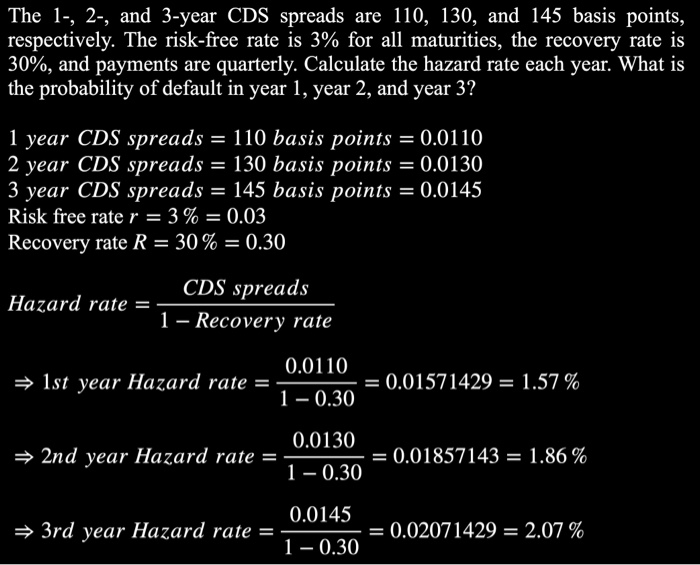

The 1-, 2-, and 3-year CDS spreads are 110, 130, and 145 basis points, respectively. The risk-free rate is 3% for all maturities, the recovery rate is 30%, and payments are quarterly. Calculate the hazard rate each year. What is the probability of default in year 1, year 2, and year 3? 1 year CDS spreads = 110 basis points = 0.0110 | 2 year CDS spreads = 130 basis points = 0.0130 | 3 year CDS spreads = 145 basis points = 0.0145 Risk free rate r = 3% = 0.03 Recovery rate R = 30% = 0.30 Hazard rate = CDS spreads 1 Recovery rate = 1st year Hazard rate = 0.0110 1 -0.30 = 0.01571429 = 1.57 % 2nd year Hazard rate = 0.0130 = 0.01857143 = 1.86 % 1 -0.30 3rd year Hazard rate = 0.0145 = = 0.02071429 = 2.07 % 1-0.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts