Question: Is this correct? 3 Weekly homework assignment Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View + Share R12 V fx A

Is this correct?

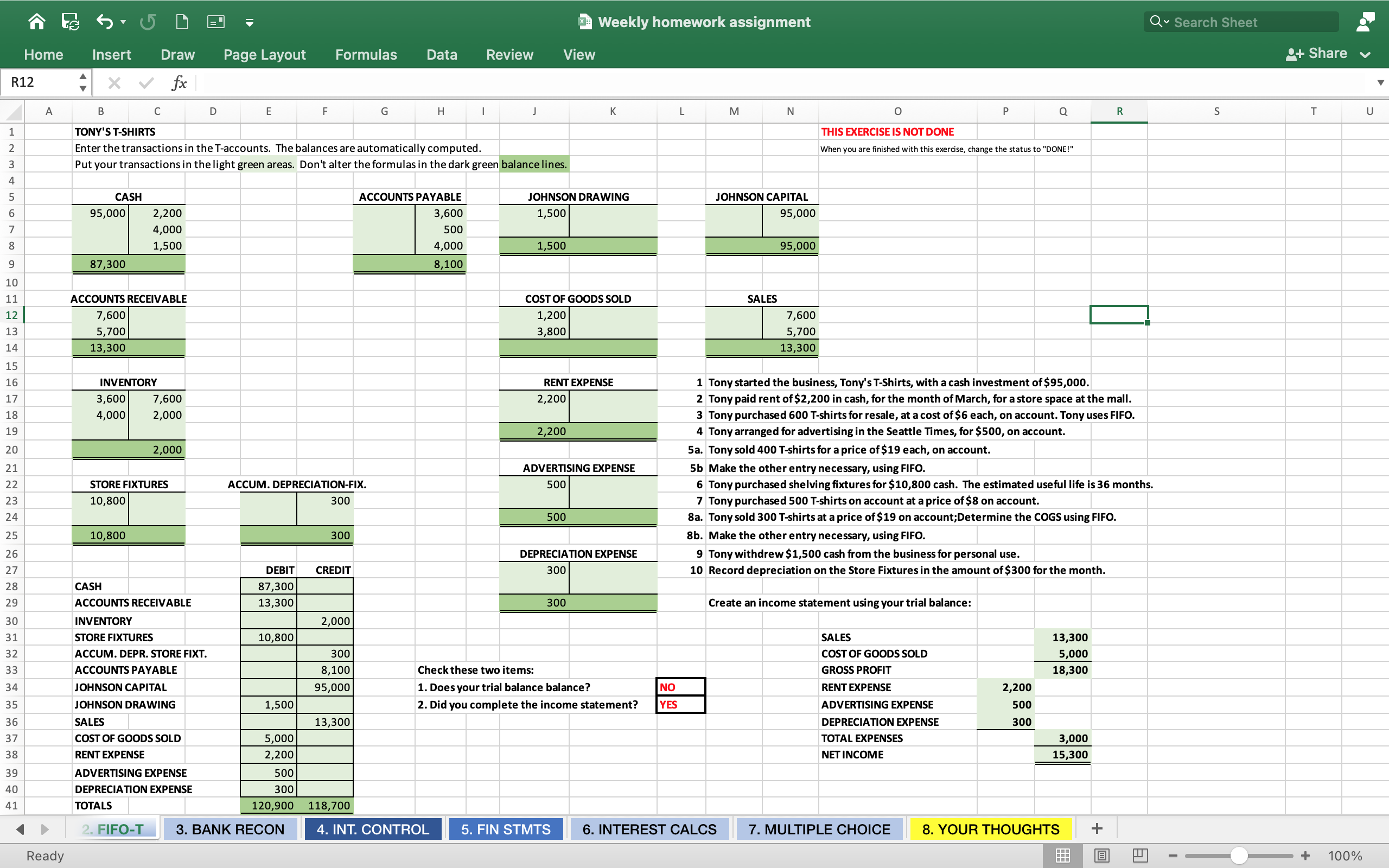

3 Weekly homework assignment Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View "+ Share R12 V fx A B D E G H K L M N O P Q R S T TONY'S T-SHIRTS THIS EXERCISE IS NOT DONE Enter the transactions in the T-accounts. The balances are automatically computed. When you are finished with this exercise, change the status to "DONE!" Put your transactions in the light green areas. Don't alter the formulas in the dark green balance lines. CASH ACCOUNTS PAYABLE JOHNSON DRAWING JOHNSON CAPITAL 95,000 2,200 3,600 1,500 95,000 4,000 500 1,500 4,000 1,500 95,000 87,300 3,100 10 11 ACCOUNTS RECEIVABLE COST OF GOODS SOLD SALES 12 7,600 1,200 7,600 13 5,70 3,800 5,700 14 13,300 13,300 15 16 INVENTORY RENT EXPENSE 1 Tony started the business, Tony's T-Shirts, with a cash investment of $95,000. 17 3,600 7,600 2,200 2 Tony paid rent of $2,200 in cash, for the month of March, for a store space at the mall. 18 4,000 2,000 3 Tony purchased 600 T-shirts for resale, at a cost of $6 each, on account. Tony uses FIFO. 19 2,200 4 Tony arranged for advertising in the Seattle Times, for $500, on account. 20 2,000 5a. Tony sold 400 T-shirts for a price of $19 each, on account. 21 ADVERTISING EXPENSE 5b Make the other entry necessary, using FIFO. 22 STORE FIXTURES ACCUM. DEPRECIATION-FIX. 500 6 Tony purchased shelving fixtures for $10,800 cash. The estimated useful life is 36 months. 23 10,800 300 7 Tony purchased 500 T-shirts on account at a price of $8 on account. 24 500 Ba. Tony sold 300 T-shirts at a price of $19 on account; Determine the COGS using FIFO. 25 10,800 300 8b. Make the other entry necessary, using FIFO. 26 DEPRECIATION EXPENSE 9 Tony withdrew $1,500 cash from the business for personal use. 27 DEBIT CREDIT 300 10 Record depreciation on the Store Fixtures in the amount of $300 for the month. 28 CASH 87,300 29 ACCOUNTS RECEIVABLE 13,300 300 Create an income statement using your trial balance: 30 INVENTORY 2,000 31 STORE FIXTURES 10,800 SALES 13,300 32 ACCUM. DEPR. STORE FIXT. 300 COST OF GOODS SOLD 5,000 33 ACCOUNTS PAYABLE 3,100 Check these two items: GROSS PROFIT 18,300 34 JOHNSON CAPITAL 95,000 1. Does your trial balance balance? NO RENT EXPENSE 2,20 35 JOHNSON DRAWING 1,500 2. Did you complete the income statement? YES ADVERTISING EXPENSE 500 36 SALES 13,300 DEPRECIATION EXPENSE 300 37 COST OF GOODS SOLD 5,000 TOTAL EXPENSES 3,000 38 RENT EXPENSE 2,20 NET INCOME 15,300 39 ADVERTISING EXPENSE 500 40 DEPRECIATION EXPENSE 300 41 TOTALS 120,900 118,700 2. FIFO-T 3. BANK RECON 4. INT. CONTROL 5. FIN STMTS 6. INTEREST CALCS 7. MULTIPLE CHOICE 8. YOUR THOUGHTS + Ready + 100%