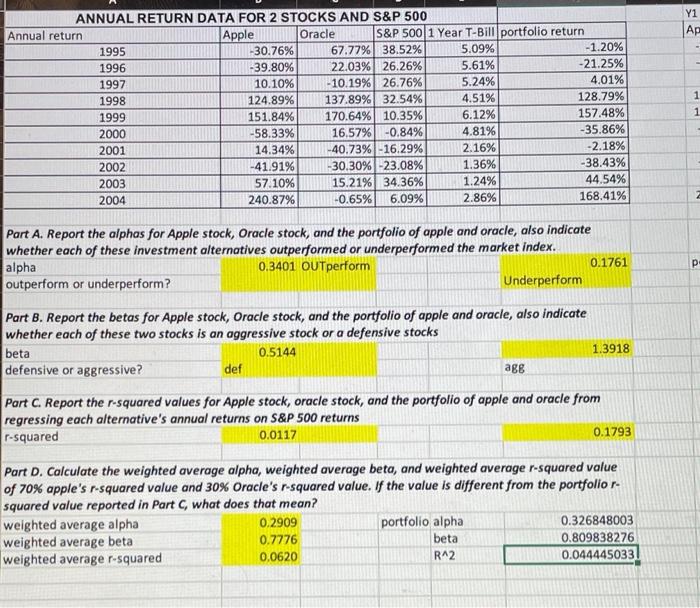

Question: is this correct? thank you! Y1 1 ANNUAL RETURN DATA FOR 2 STOCKS AND S&P 500 Annual return Apple Oracle S&P 500 1 Year T-Bill

Y1 1 ANNUAL RETURN DATA FOR 2 STOCKS AND S&P 500 Annual return Apple Oracle S&P 500 1 Year T-Bill portfolio return 1995 -30.76% 67.77% 38.52% 5.09% -1.20% 1996 -39.80% 22.03% 26.26% 5.61% -21.25% 1997 10.10% - 10.19% 26.76% 5.24% 4.01% 1998 124.89% 137.89% 32.54% 4.51% 128.79% 1999 151.84% 170.64% 10.35% 6.12% 157.48% 2000 -58.33% 16.57% -0.84% 4.81% -35.86% 2001 14.34% -40.73% -16.29% 2.16% -2.18% 2002 -41.91% -30.30% -23.08% 1.36% -38.43% 2003 57.10% 15.21% 34.36% 1.24% 44.54% 2004 240.87% -0.65% 6.09% 2.86% 168.41% 1 Part A. Report the alphas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these investment alternatives outperformed or underperformed the market index. alpha 0.3401 OUTperform 0.1761 outperform or underperform? Underperform Part B. Report the betas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these two stocks is an aggressive stock or a defensive stocks beta 0.5144 1.3918 defensive or aggressive? def age Port C. Report the r-squared values for Apple stock, oracle stock, and the portfolio of apple and oracle from regressing each alternative's annual returns on S&P 500 returns r-squared 0.0117 0.1793 Part D. Calculate the weighted average alpha, weighted average beta, and weighted average r-squared value of 70% apple's r-squared value and 30% Oracle's r-squared value. If the value is different from the portfolio r. squared value reported in Part what does that mean? weighted average alpha 0.2909 portfolio alpha 0.326848003 weighted average beta 0.7776 beta 0.809838276 weighted average r-squared 0.0620 R^2 0.044445033 Y1 1 ANNUAL RETURN DATA FOR 2 STOCKS AND S&P 500 Annual return Apple Oracle S&P 500 1 Year T-Bill portfolio return 1995 -30.76% 67.77% 38.52% 5.09% -1.20% 1996 -39.80% 22.03% 26.26% 5.61% -21.25% 1997 10.10% - 10.19% 26.76% 5.24% 4.01% 1998 124.89% 137.89% 32.54% 4.51% 128.79% 1999 151.84% 170.64% 10.35% 6.12% 157.48% 2000 -58.33% 16.57% -0.84% 4.81% -35.86% 2001 14.34% -40.73% -16.29% 2.16% -2.18% 2002 -41.91% -30.30% -23.08% 1.36% -38.43% 2003 57.10% 15.21% 34.36% 1.24% 44.54% 2004 240.87% -0.65% 6.09% 2.86% 168.41% 1 Part A. Report the alphas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these investment alternatives outperformed or underperformed the market index. alpha 0.3401 OUTperform 0.1761 outperform or underperform? Underperform Part B. Report the betas for Apple stock, Oracle stock, and the portfolio of apple and oracle, also indicate whether each of these two stocks is an aggressive stock or a defensive stocks beta 0.5144 1.3918 defensive or aggressive? def age Port C. Report the r-squared values for Apple stock, oracle stock, and the portfolio of apple and oracle from regressing each alternative's annual returns on S&P 500 returns r-squared 0.0117 0.1793 Part D. Calculate the weighted average alpha, weighted average beta, and weighted average r-squared value of 70% apple's r-squared value and 30% Oracle's r-squared value. If the value is different from the portfolio r. squared value reported in Part what does that mean? weighted average alpha 0.2909 portfolio alpha 0.326848003 weighted average beta 0.7776 beta 0.809838276 weighted average r-squared 0.0620 R^2 0.044445033

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts