Question: is this correct? Under a firm commitment agreement, Zeke, Co. went public and received $29.75 for each of the 6.7 million shares sold. The initial

is this correct?

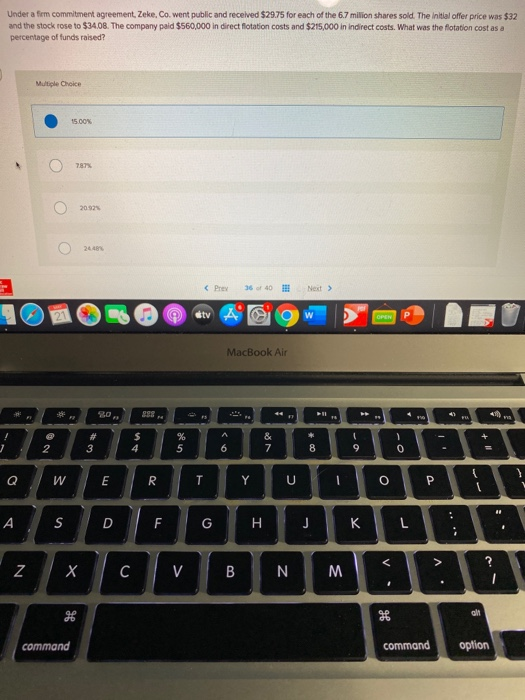

Under a firm commitment agreement, Zeke, Co. went public and received $29.75 for each of the 6.7 million shares sold. The initial offer price was $32 and the stock rose to $3408. The company paid $560,000 in direct flotation costs and $215,000 in Indirect costs. What was the flotation cost as a percentage of funds raised? Multiple Choice 15. CON 787 20.32% 244 dtv A OPEN MacBook Air 80 998 + 3 $ 4 % 5 & 7 2 6 8 9 0 Q W E R T Y U o P A S D F G H KL > A ? N B N M 36 a 9 command command option

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock