Question: Is this solution right? Why should they do an interesting rate agreement like this? They are paying more in the end aren't they?? When do

Is this solution right? Why should they do an interesting rate agreement like this? They are paying more in the end aren't they?? When do I know when to see it from the return perspective and when I should see it from the payign perspective??

Is this solution right? Why should they do an interesting rate agreement like this? They are paying more in the end aren't they?? When do I know when to see it from the return perspective and when I should see it from the payign perspective??

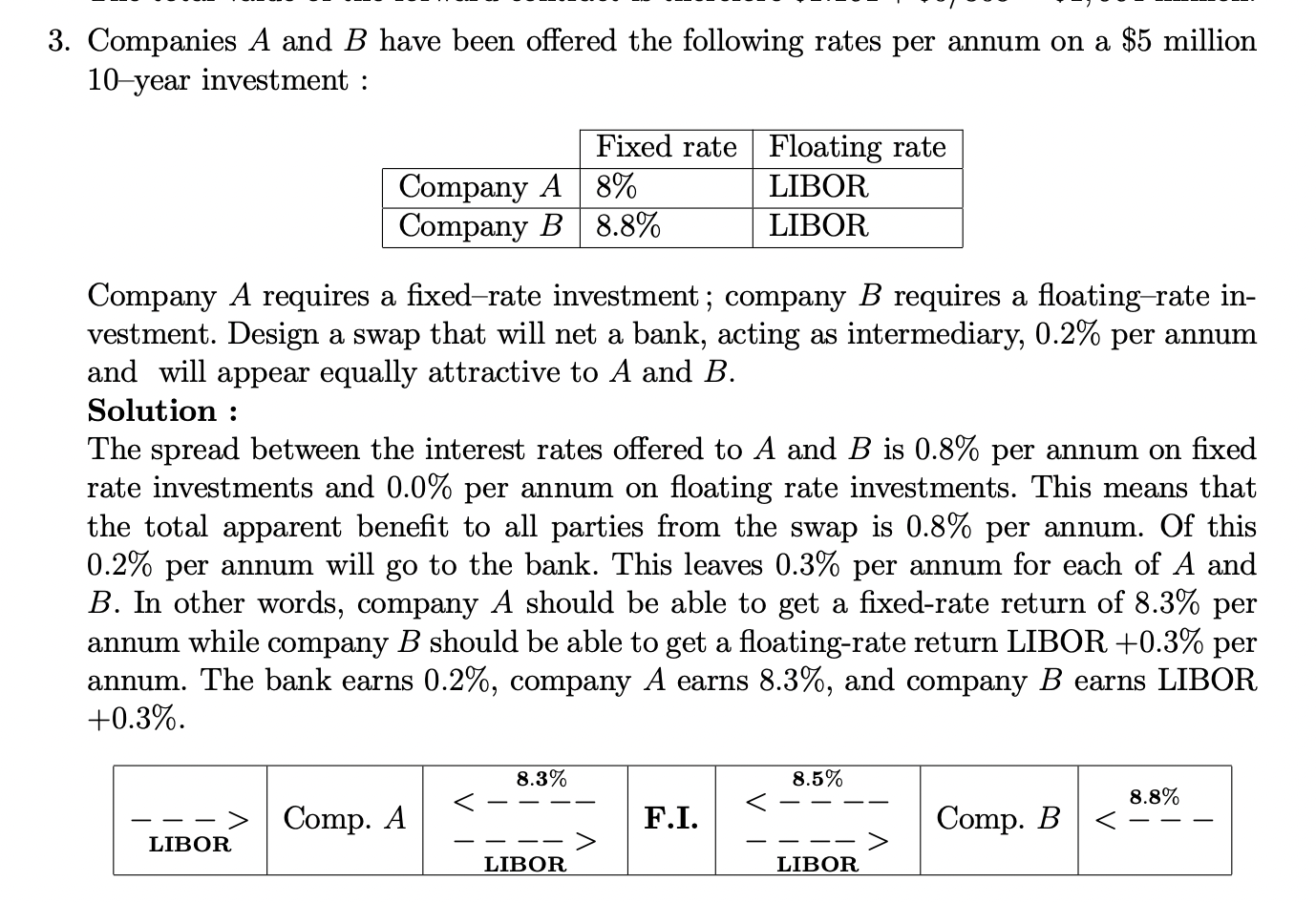

Companies A and B have been offered the following rates per annum on a $5 million 10-year investment : Company A requires a fixed-rate investment; company B requires a floating-rate investment. Design a swap that will net a bank, acting as intermediary, 0.2% per annum and will appear equally attractive to A and B. Solution : The spread between the interest rates offered to A and B is 0.8% per annum on fixed rate investments and 0.0% per annum on floating rate investments. This means that the total apparent benefit to all parties from the swap is 0.8% per annum. Of this 0.2% per annum will go to the bank. This leaves 0.3% per annum for each of A and B. In other words, company A should be able to get a fixed-rate return of 8.3% per annum while company B should be able to get a floating-rate return LIBOR +0.3% per annum. The bank earns 0.2%, company A earns 8.3%, and company B earns LIBOR +0.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts