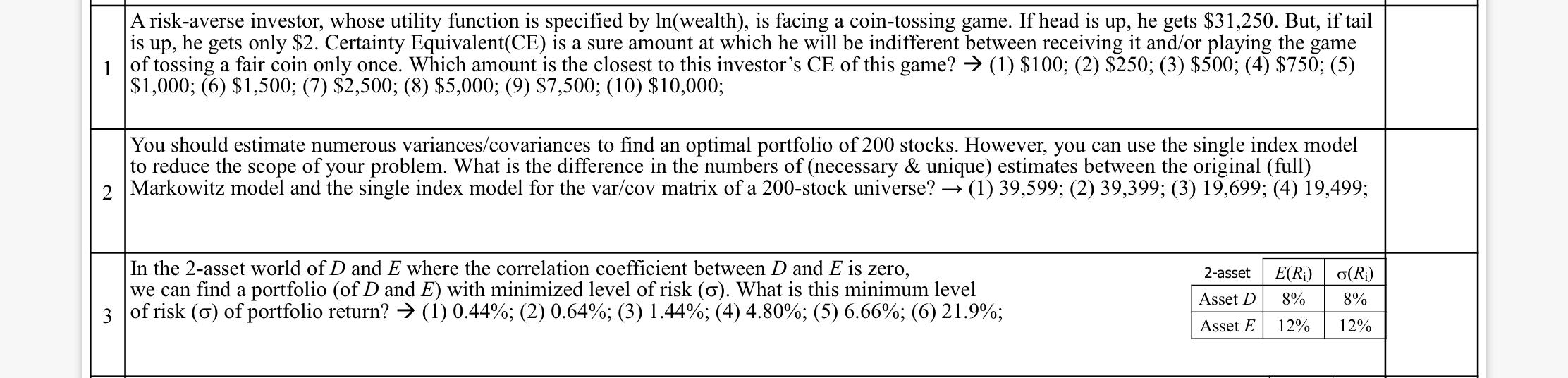

Question: is up, A risk-averse investor, whose utility function is specified by In(wealth), is facing a coin-tossing game. If head is up, he gets $31,250. But,

is up, A risk-averse investor, whose utility function is specified by In(wealth), is facing a coin-tossing game. If head is up, he gets $31,250. But, if tail he gets only $2. Certainty Equivalent(CE) is a sure amount at which he will be indifferent between receiving it and/or playing the game of tossing a fair coin only once. Which amount is the closest to this investor's CE of this game? (1) $100; (2) $250; (3) $500; (4) $750; (5) $1,000; (6) $1,500; (7) $2,500; (8) $5,000; (9) $7,500; (10) $10,000; You should estimate numerous variances/covariances to find an optimal portfolio of 200 stocks. However, you can use the single index model to reduce the scope of your problem. What is the difference in the numbers of (necessary & unique) estimates between the original (full) Markowitz model and the single index model for the var/cov matrix of a 200-stock universe? (1) 39,599; (2) 39,399; (3) 19,699; (4) 19,499; 2-asset In the 2-asset world of D and E where the correlation coefficient between D and E is zero, we can find a portfolio (of D and E) with minimized level of risk (o). What is this minimum level 3 of risk (o) of portfolio return? (1) 0.44%; (2) 0.64%; (3) 1.44%; (4) 4.80%; (5) 6.66%; (6) 21.9%; E(R) 8% o(R;) 8% Asset D Asset E 12% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts