Question: is urgent ASSIGNMENT QUESTIONS 1. Using NPV analysis, advise Davidson as to whether or not Maqic should purchase the new Delta Finishing machine. The company

is urgent

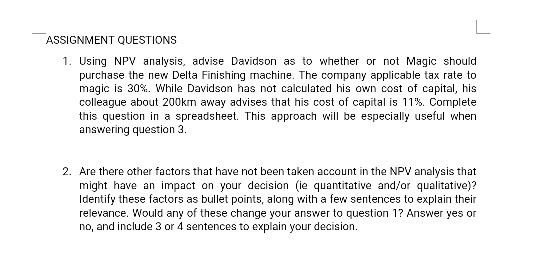

ASSIGNMENT QUESTIONS 1. Using NPV analysis, advise Davidson as to whether or not Maqic should purchase the new Delta Finishing machine. The company applicable tax rate to magic is 30%. While Davidson has not calculated his own cost of capital, his colleague about 200km away advises that his cost of capital is 11%. Complete this question in a spreadsheet. This approach will be especially useful when answering question 3. 2. Are there other factors that have not been taken account in the NPV analysis that might have an impact on your decision (ie quantitative and/or qualitative)? Identify these factors as bullet points, along with a few sentences to explain their relevance. Would any of these change your answer to question 1? Answer yes or no, and include 3 or 4 sentences to explain your decision. ASSIGNMENT QUESTIONS 1. Using NPV analysis, advise Davidson as to whether or not Maqic should purchase the new Delta Finishing machine. The company applicable tax rate to magic is 30%. While Davidson has not calculated his own cost of capital, his colleague about 200km away advises that his cost of capital is 11%. Complete this question in a spreadsheet. This approach will be especially useful when answering question 3. 2. Are there other factors that have not been taken account in the NPV analysis that might have an impact on your decision (ie quantitative and/or qualitative)? Identify these factors as bullet points, along with a few sentences to explain their relevance. Would any of these change your answer to question 1? Answer yes or no, and include 3 or 4 sentences to explain your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts