Question: is urgent please 1. How do adverse selection and moral hazard affect the bank lending function? How can banks minimise such problems? (5 Marks) 2.

is urgent please

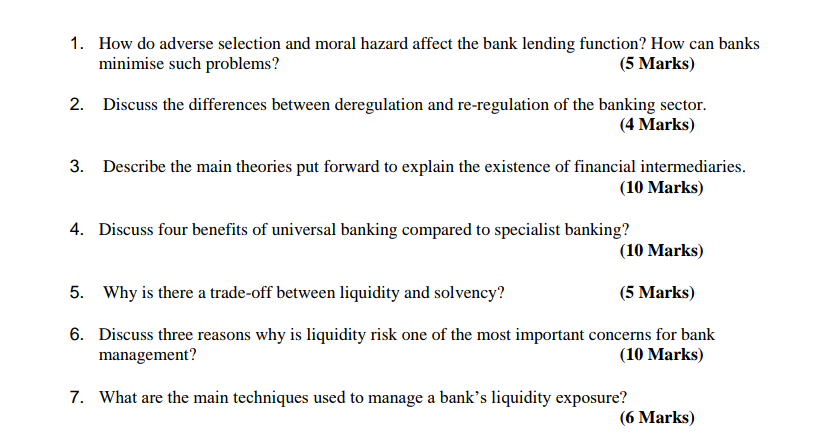

1. How do adverse selection and moral hazard affect the bank lending function? How can banks minimise such problems? (5 Marks) 2. Discuss the differences between deregulation and re-regulation of the banking sector. (4 Marks) 3. Describe the main theories put forward to explain the existence of financial intermediaries. (10 Marks) 4. Discuss four benefits of universal banking compared to specialist banking? (10 Marks) 5. Why is there a trade-off between liquidity and solvency? (5 Marks) 6. Discuss three reasons why is liquidity risk one of the most important concerns for bank management? (10 Marks) 7. What are the main techniques used to manage a bank's liquidity exposure? (6 Marks) 1. How do adverse selection and moral hazard affect the bank lending function? How can banks minimise such problems? (5 Marks) 2. Discuss the differences between deregulation and re-regulation of the banking sector. (4 Marks) 3. Describe the main theories put forward to explain the existence of financial intermediaries. (10 Marks) 4. Discuss four benefits of universal banking compared to specialist banking? (10 Marks) 5. Why is there a trade-off between liquidity and solvency? (5 Marks) 6. Discuss three reasons why is liquidity risk one of the most important concerns for bank management? (10 Marks) 7. What are the main techniques used to manage a bank's liquidity exposure? (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts