Question: ISE 307 - Section 6 - Practice Problem 7 (Chapter 9) Group: For all the questions below X is the average of the group IDs

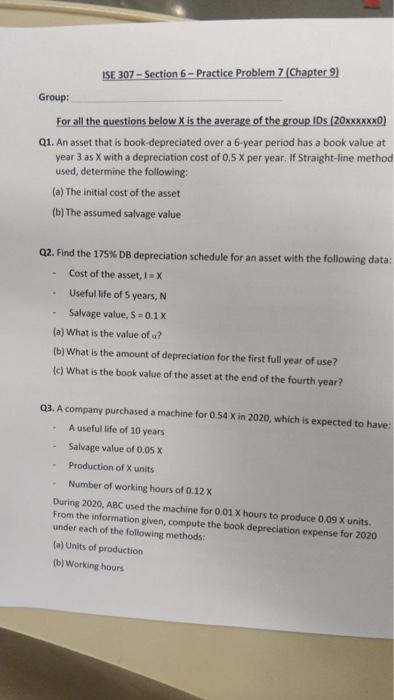

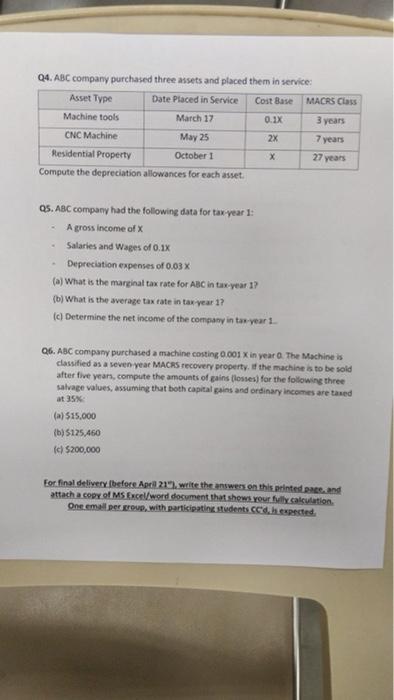

ISE 307 - Section 6 - Practice Problem 7 (Chapter 9) Group: For all the questions below X is the average of the group IDs (20xxxxxxO) Q1. An asset that is book-depreciated over a 6-year period has a book value at year 3 as X with a depreciation cost of 0.5 X per year. If Straight-line method used, determine the following: (a) The initial cost of the asset (b) The assumed salvage value Q2. Find the 175% DB depreciation schedule for an asset with the following data: Cost of the asset, I= X Useful life of 5 years, N Salvage value, S=0.1 X (a) What is the value of a? (b) What is the amount of depreciation for the first full year of use? (c) What is the book value of the asset at the end of the fourth year? Q3. A company purchased a machine for 0.54 X in 2020, which is expected to have: A useful life of 10 years Salvage value of 0.05 X Production of X units Number of working hours of 0.12 X During 2020, ARC used the machine for 0.01 X hours to produce 0.09 X units. From the information given, compute the book depreciation expense for 2020 under each of the following methods: la) Units of production (b) Working hours Q4. ABC company purchased three assets and placed them in service: Asset Type Date Placed in Service Cost Base MACRS Class Machine tools March 17 0.1X 3 years CNC Machine May 25 2x 7 years Residential Property October 1 X 27 years Compute the depreciation allowances for each asset. OS. A8C company had the following data for tax-year 1: A gross income of Salaries and Wages of 0.1x Depreciation expenses of 0.03 X (a) What is the marginal tax rate for ABC in a year 1? (b) What is the average tax rate in tax year 1? (c) Determine the net income of the company in taryear 1. Q6. ABC company purchased a machine costing 0.001 X in year. The Machine is classified as a seven year MACRS recovery property. If the machine is to be sold after five years, compute the amounts of gains losses) for the following three Salvage values, assuming that both capital gains and ordinary incomes are tased (a) $15.000 (b) 5125.460 to $200,000 For final delivery before Apr 21) write the answers on this printestate and attach a copy of MS Excel/Word document that shows your fully calculation One email per group, with participatine students Codexpected. ISE 307 - Section 6 - Practice Problem 7 (Chapter 9) Group: For all the questions below X is the average of the group IDs (20xxxxxxO) Q1. An asset that is book-depreciated over a 6-year period has a book value at year 3 as X with a depreciation cost of 0.5 X per year. If Straight-line method used, determine the following: (a) The initial cost of the asset (b) The assumed salvage value Q2. Find the 175% DB depreciation schedule for an asset with the following data: Cost of the asset, I= X Useful life of 5 years, N Salvage value, S=0.1 X (a) What is the value of a? (b) What is the amount of depreciation for the first full year of use? (c) What is the book value of the asset at the end of the fourth year? Q3. A company purchased a machine for 0.54 X in 2020, which is expected to have: A useful life of 10 years Salvage value of 0.05 X Production of X units Number of working hours of 0.12 X During 2020, ARC used the machine for 0.01 X hours to produce 0.09 X units. From the information given, compute the book depreciation expense for 2020 under each of the following methods: la) Units of production (b) Working hours Q4. ABC company purchased three assets and placed them in service: Asset Type Date Placed in Service Cost Base MACRS Class Machine tools March 17 0.1X 3 years CNC Machine May 25 2x 7 years Residential Property October 1 X 27 years Compute the depreciation allowances for each asset. OS. A8C company had the following data for tax-year 1: A gross income of Salaries and Wages of 0.1x Depreciation expenses of 0.03 X (a) What is the marginal tax rate for ABC in a year 1? (b) What is the average tax rate in tax year 1? (c) Determine the net income of the company in taryear 1. Q6. ABC company purchased a machine costing 0.001 X in year. The Machine is classified as a seven year MACRS recovery property. If the machine is to be sold after five years, compute the amounts of gains losses) for the following three Salvage values, assuming that both capital gains and ordinary incomes are tased (a) $15.000 (b) 5125.460 to $200,000 For final delivery before Apr 21) write the answers on this printestate and attach a copy of MS Excel/Word document that shows your fully calculation One email per group, with participatine students Codexpected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts