Question: isignment: CH11_HW Assignment Score: 0.00% iestions Problem 11-13 4 Question 4 of 5 Check My Work (2 remaining) The Buffalo Snow Shoe Company is considering

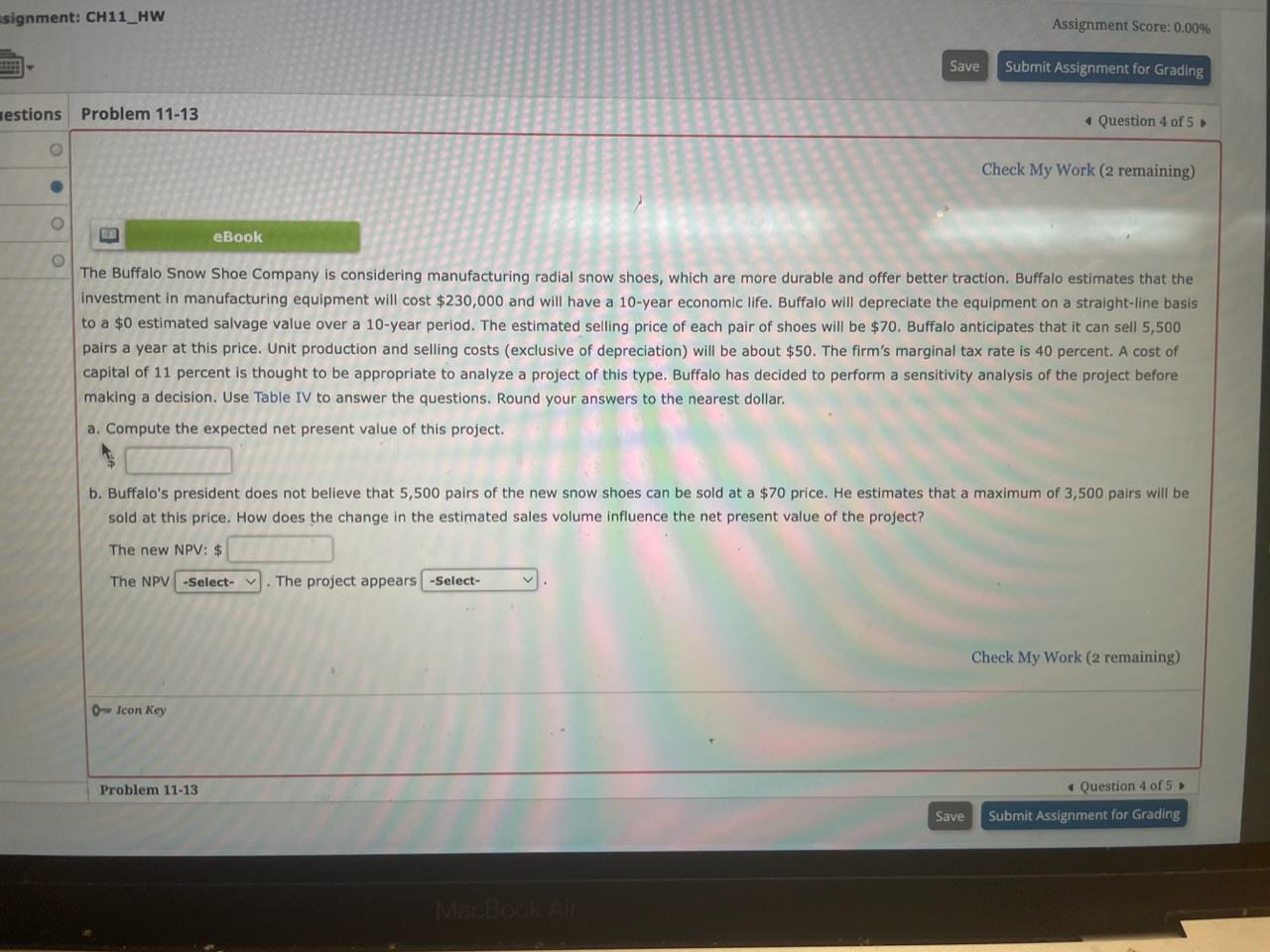

isignment: CH11_HW Assignment Score: 0.00% iestions Problem 11-13 4 Question 4 of 5 Check My Work (2 remaining) The Buffalo Snow Shoe Company is considering manufacturing radial snow shoes, which are more durable and offer better traction. Buffalo estimates that the investment in manufacturing equipment will cost $230,000 and will have a 10-year economic life. Buffalo will depreciate the equipment on a straight-line basis to a $0 estimated salvage value over a 10 -year period. The estimated selling price of each pair of shoes will be $70. Buffalo anticipates that it can sell 5,500 pairs a year at this price. Unit production and selling costs (exclusive of depreciation) will be about $50. The firm's marginal tax rate is 40 percent. A cost of capital of 11 percent is thought to be appropriate to analyze a project of this type. Buffalo has decided to perform a sensitivity analysis of the project before making a decision. Use Table IV to answer the questions. Round your answers to the nearest dollar. a. Compute the expected net present value of this project. b. Buffalo's president does not believe that 5,500 pairs of the new snow shoes can be sold at a $70 price. He estimates that a maximum of 3,500 pairs will be sold at this price. How does the change in the estimated sales volume influence the net present value of the project? The new NPV: $ The NPV - The project appears isignment: CH11_HW Assignment Score: 0.00% iestions Problem 11-13 4 Question 4 of 5 Check My Work (2 remaining) The Buffalo Snow Shoe Company is considering manufacturing radial snow shoes, which are more durable and offer better traction. Buffalo estimates that the investment in manufacturing equipment will cost $230,000 and will have a 10-year economic life. Buffalo will depreciate the equipment on a straight-line basis to a $0 estimated salvage value over a 10 -year period. The estimated selling price of each pair of shoes will be $70. Buffalo anticipates that it can sell 5,500 pairs a year at this price. Unit production and selling costs (exclusive of depreciation) will be about $50. The firm's marginal tax rate is 40 percent. A cost of capital of 11 percent is thought to be appropriate to analyze a project of this type. Buffalo has decided to perform a sensitivity analysis of the project before making a decision. Use Table IV to answer the questions. Round your answers to the nearest dollar. a. Compute the expected net present value of this project. b. Buffalo's president does not believe that 5,500 pairs of the new snow shoes can be sold at a $70 price. He estimates that a maximum of 3,500 pairs will be sold at this price. How does the change in the estimated sales volume influence the net present value of the project? The new NPV: $ The NPV - The project appears

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts