Question: ISSUE/PROBLEM I AM HAVING: 2022 Schedule C, Part II, Line 9 is giving me a difficult time. I have all of the other expenses completed

ISSUE/PROBLEM I AM HAVING:

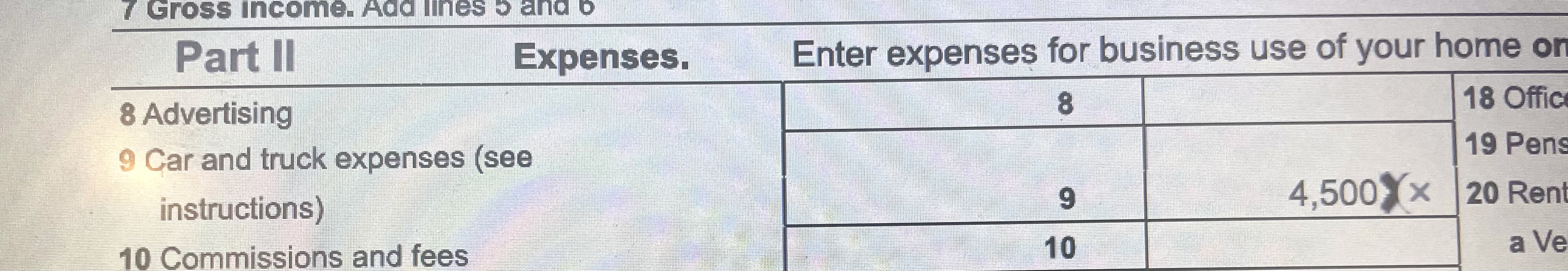

2022 Schedule C, Part II, Line 9 is giving me a difficult time. I have all of the other expenses completed and correct, but I cannot move on without getting line 9. I did use Form 4562 and the vehicle was used 77.143% of the time, if that matters. I have tried putting in the vehicle expense that is in the picture but that is wrong, I have also tried halving 27,000, which is 13,500, and then multiplying it by .585 for the first half of the year and the other half of 13,500 by .625, then adding those two together and got 16,335. That was a wrong answer as well. I have also tried the 35,000 this way, which was wrong. I tried 0 and that was wrong, I have tried adding 16,335 and the vehicle expense together and that was wrong.

Line 9 of Schedule C and how to figure it out is all I need. Without using the same answers as below.

Answers I have used but are wrong: 16,335, 0, 20829, 20835, 15795, 21,175, 4500 and 20,829.

INSTRUCTIONS:

Cassi (SSN 412-34-5670) has a home cleaning business she runs as a sole proprietorship. The following are the results from business operations for the tax year 2022:

| Gross receipts | $ 203,000 |

|---|---|

| Business mileage: 27,000 (miles incurred ratably throughout the year) 35,000 miles total during the year 2022 Van (over 6,000 pounds) placed in service 1/01/2022, cost 27,000 | |

| Postage | (500) |

| Wages | (26,000) |

| Payroll taxes | (1,950) |

| Supplies | (12,500) |

| Phone | (1,250) |

| Internet service | (600) |

| Rent | (2,400) |

| Insurance | (2,800) |

| Van expenses | (4,500) |

| Business assets | Date Purchased | Cost |

|---|---|---|

| Computer 1 | 5/18/22 | $ 2,200 |

| Computer 2 | 6/01/22 | 2,700 |

| Printer | 3/01/21 | 900 |

| Copier | 3/02/21 | 2,100 |

| Furniture | 3/01/21 | 6,000 |

Required:

Determine Cassis self-employment income and QBI deduction. Prepare Schedule C and Schedule SE. 179 expense is elected on all eligible assets ( 179 was not taken on assets purchased last year). (Use Table 6A-1.)

Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other intermediate computations. Round your final answers to the nearest whole dollar. Instructions can be found on certain cells within the forms.

(REMINDER)

LINE 9 INSTRUCTIONS FROM IRS:

You can take the standard mileage rate for 2022 only if you:

Owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or

Leased the vehicle and are using the standard mileage rate for the entire lease period.

If you take the standard mileage rate:

Multiply the business standard mileage rate from January 1, 2022, to June 30, 2022, by 58.5 cents a mile;

Multiply the business standard mileage rate from July 1, 2022, to December 31, 2022, by 62.5 cents a mile; and

Add to this amount your parking fees and tolls; and

Enter the total on line 9. Do not deduct depreciation, rent or lease payments, or your actual operating expenses.

If you deduct actual expenses:

Include on line 9 the business portion of expenses for gasoline, oil, repairs, insurance, license plates, etc.; and

Show depreciation on line 13 and rent or lease payments on line 20a.

For details, see chapter 4 of Pub. 463.

Information on your vehicle.

If you claim any car and truck expenses, you must provide certain information on the use of your vehicle by completing one of the following.

Complete Schedule C, Part IV, if (a) you are claiming the standard mileage rate, you lease your vehicle, or your vehicle is fully depreciated; and (b) you are not required to file Form 4562 for any other reason. If you used more than one vehicle during the year, attach a statement with the information requested in Schedule C, Part IV, for each additional vehicle.

Complete Form 4562, Part V, if you are claiming depreciation on your vehicle or you are required to file Form 4562 for any other reason (see Line 13, later).

(PLEASE HELP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts