Question: Issues and Problem Areas: Summarize the key weaknesses in the proposed budget, given the established pricing, inventory, receivable, payable, dividend and cash management policies. Strategies:

Issues and Problem Areas:

Summarize the key weaknesses in the proposed budget, given the established pricing, inventory, receivable, payable, dividend and cash management policies.

Strategies:

Propose at least 3 changes to current policies that will address the weaknesses which you have identified.

Describe your reasoning for the suggestions you are making. For example, if you suggest raising the sales price in the off-season, why do you think it would make sense to the customer to pay more in January for a chair less likely to be used in the winter.

Prepare at least 1 set of alternative budgets reflecting the outcomes of the strategies you are suggesting.

You must comment on the impact of your suggestions on cost structure, profitability and cash flows.

You must assess the risks associated with your strategies and recognize the influence one set of suggestions will have on other parts of the budget. For example, what affect

will increasing the sales price have on sales volume? Would the impact be the same throughout the year? How would you increase the volume?

Try to incorporate some of the concepts we have covered so far in the class, such as contribution margin and break-even.

You should explain any strategies that you considered and rejected because they did not significantly improve the situation.

Conclusion

Provide a brief conclusion

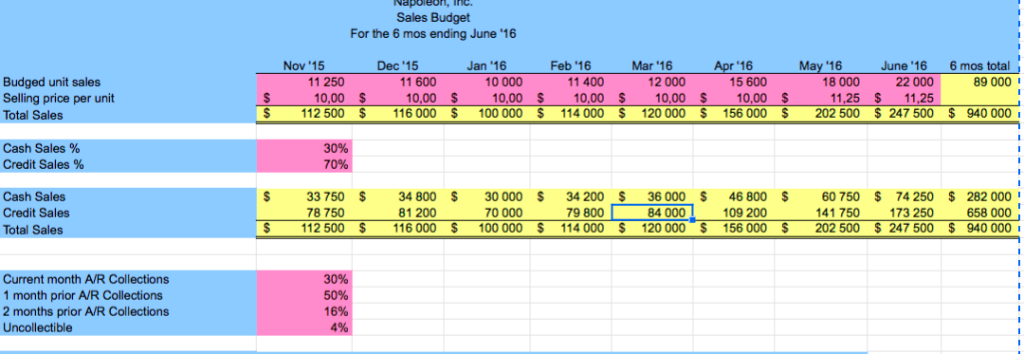

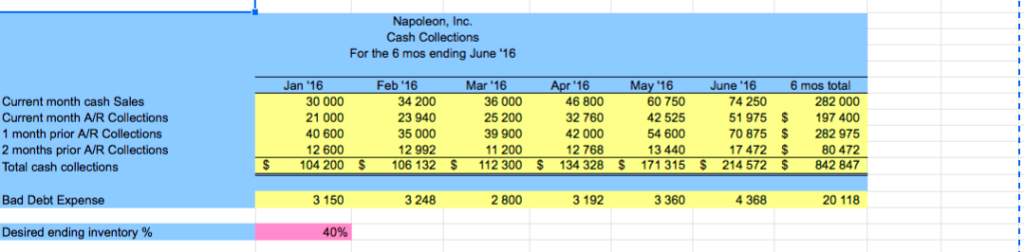

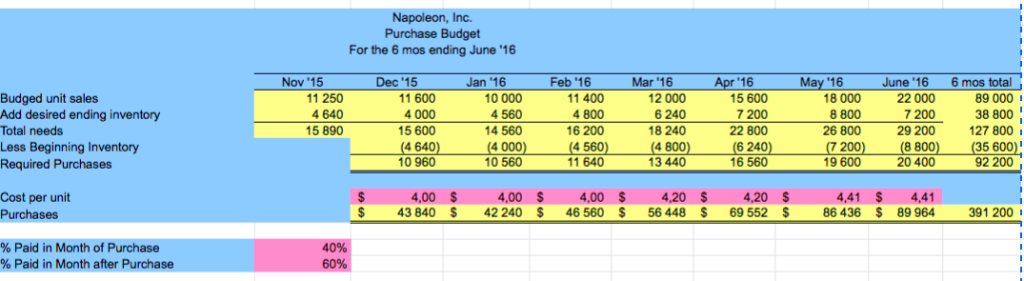

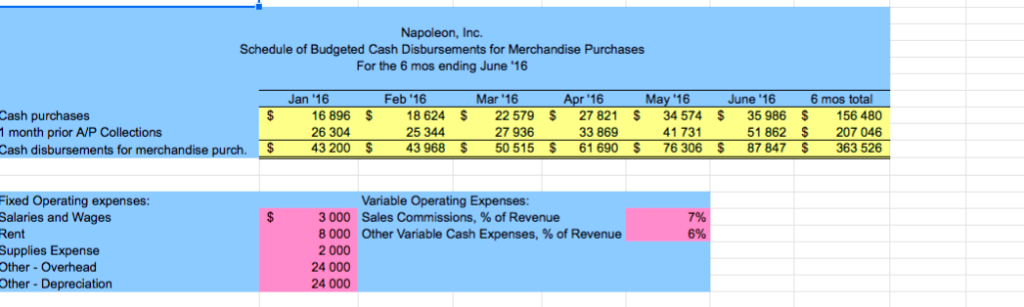

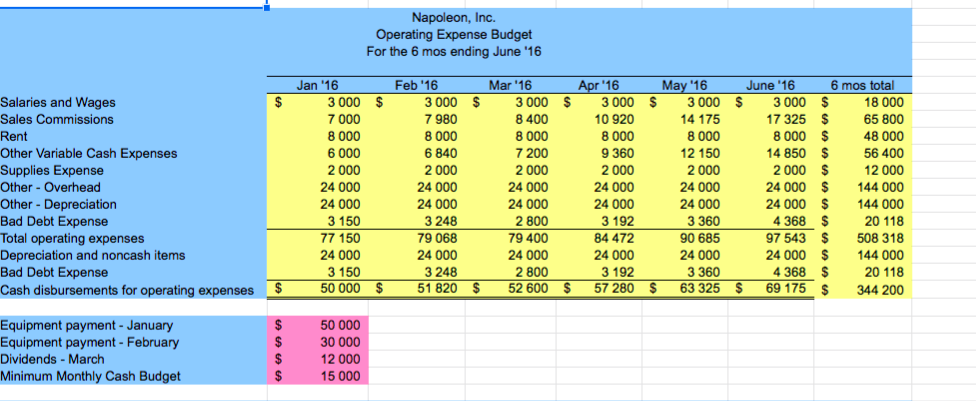

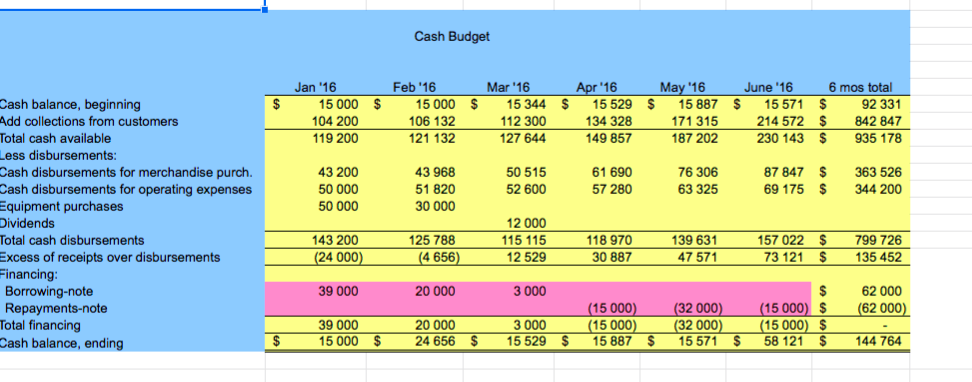

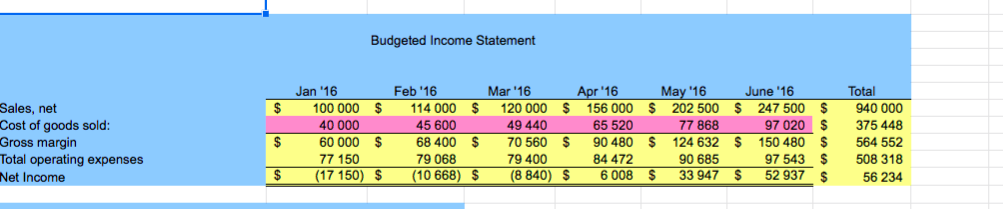

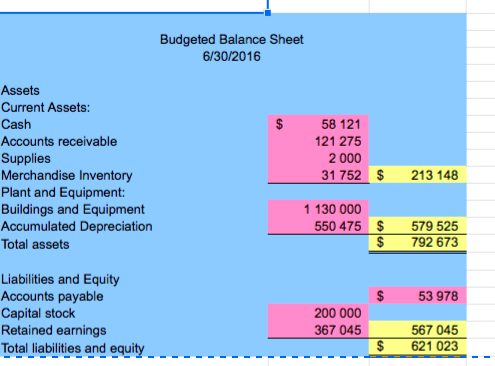

Sales Budget For the 6 mos ending June '16 Nov '15 Dec '15 Jan '16 Feb '16 Mar '16 Apr 16 May '16 June '16 6 mos total 2 000 Budged unit sales Selling price per unit Total Sales 11 250 22 000 11,25 S 11.25 116 000 $ 100000 S 114 000 S 120 000 S 156 000 $ 202 500 $ 247 500 11 600 10 000 11 400 18 000 89 000 0,00 S 0,00 S 10,00S 10,00 S 10,00 S 10,00 S 112 500 940 000 Cash Sales 96 Credit Sales % $ 33750 78 750 $ 112 500 34 800 81 200 116 000 30000 S34 200 $ 36 000 $ 46 800 $ 60 750 $ 74 250 $ 282 000 658 000 100000 S 114 000 $120 000 $ 156 000 202 500 S 247 500 940 000 Cash Sales 70 000 9 800 84 0001 109 200 41 750173 250 Total Sales Current month A/R Collections 1 month prior A/R Collections 2 months prior A/R Collections 16% Napoleon, Inc. Cash Collections For the 6 mos ending June 16 Mar 16 16 46 800 32 760 42 000 12 768 34 328 Jan '16 Feb '16 June '16 6 mos total 60 750 42 525 54 600 13 440 171 315 74 250 Current month cash Sales Current month A/R Collections 1 month prior A/R Collections 2 months prior A/R Collections Total cash collections 30 000 21 000 40 600 12 600 04 200 34 200 23 940 35 000 12 992 106 132 36 000 25 200 39 900 11 200 112 300 282 000 51 975 $ 197 400 70 875 $ 282 975 80 472 214 572 842 847 17 472$ Bad Debt Expense 3 150 3 248 2 800 3 192 3 360 4 368 20 118 Desired ending inventory % 40% Purchase Budget For the 6 mos ending June '16 Nov 15 Dec '15 Jan '16 Feb '16 Mar '16 May 16 June '16 6 mos total Budged unit sales Add desired ending inventory Total needs Less Beginning Inventory Required Purchases 16 15 600 200 22 800 624 16 560 11 250 4 640 15 890 11 600 4 000 5 600 4 640 10 960 10 000 4 560 14 560 4 000 10 560 11 400 4 800 16 200 4 560 11 640 12 000 6 240 18 240 4 800 13 440 18 000 8 800 26 800 7 200 19 600 22 000 7 200 29 200 8 800 20 400 89 000 38 800 127 800 35 600 92 200 4,00 S Cost per unit Purchases 4,00 S 4,00 S4,20 S 4,20 $ $43840 S 42 240 S 46 560 56 448 $ 69 552 $ 4,41 S4,4 86 436 $ 89964 91 200 % Paid in Month of Purchase % Paid in Month after Purchase 40% 60% Napoleon, Inc. Schedule of Budgeted Cash Disbursements for Merchandise Purchases For the 6 mos ending June 16 Jan '16 Feb '16 Mar '16 16 May '16 June '16 6 mos total Cash purchases 16 896 $ 26 304 43 200 S 624 S 22579 S 27 821 S 34 574 $ 35 986 $156 480 51 862 207 046 43 968 50515 $ 61 690 S76 306 87 847$ 363 526 18 0 41 731 month prior A/P Collections Cash disbursements for merchandise 25 344 27 936 33 869 Fixed Operating expenses Salaries and Wages ble Operating Expenses: 3 000 8 000 2 000 24 000 24 000 Sales Commissions, % of Revenue Other Variable Cash Expenses, % of Revenue Supplies Expense Other Overhead Other-Depreciation Napoleon, Inc. Operating Expense Budget For the 6 mos ending June '16 Jan '16 Feb '16 Mar '16 16 May 16 June'16 6 mos total Salaries and Wages Sales Commissions Rent Other Variable Cash Expenses Supplies Expense Other - Overhead Other -Depreciation Bad Debt Expense Total operating expenses Depreciation and noncash items Bad Debt Expense 7 980 8 000 6 840 2 000 24 000 24 000 3 248 79 068 24 000 3 248 Cash disbursements for operating expenses $50 000 $ 51 820 3 000 7 000 8 000 6 000 2 000 24 000 24 000 3 150 77 150 24 000 3 150 3000 $ 3000 S 3 000 10 920 8 000 9 360 2 000 24 000 24 000 3 192 84 472 24 000 3 192 57 280 8 400 8 000 7 200 2 000 24 000 24 000 2 800 79 400 24 000 2 800 52 600 3000 $ 3000 18 000 17 325 65 800 8000 48 000 56 400 S 12000 24 000 144 000 24 000 144 000 4368 $ 20 118 97 543 $ 508 318 24 000 144 000 20 118 63 325 S 69 175 $ 344 200 4 175 8 000 12 150 2 000 24 000 24 000 3 360 90 685 24 000 3 360 14 850 $ 4368 S $ Equipment payment - January Equipment payment-February Dividends -March Minimum Monthly Cash Budget $50 000 30 000 12 000 15 000 Cash Budget Jan '16 Mar '16 15000 $ 15 344 $ 15 529 Feb '16 16 May '16 June '16 6 mos total 15 000 104 200 119 200 15 887 $ 15 571 $92 331 842 847 935 178 Cash balance, beginning Add collections from customers Total cash available ess disbursements: Cash disbursements for merchandise purch. Cash disbursements for operating expenses Equipment purchases Dividends Total cash disbursements Excess of receipts over disbursements Financing Borrowing-note Repayments-note Total financing Cash balance, ending 106 132 121 132 112 300 27 644 134 328 149 857 171 315 187 202 214 572$ 230 143 $ 43 200 50 000 50 000 43 968 51 820 30 000 50 515 52 600 61 690 57 280 76 306 63 325 87 847 $ 363 526 69 175 $ 344 200 143 200 24 000 125 788 4 656 12 000 115 115 12 529 118 970 30 887 139 631 47 571 157 022 73 121 799 726 135 452 39 000 3 000 S 62 000 15000) S(62 000) 20000 39 000 15 000 15 000 15 000 24 656 $ 15 529 $15 887 32 000 32 000 20 000 3 000 (15 000) S 15 571 $58 121 $ 144 764 Budgeted Income Statement 16 65 520 84 472 Jan '16 Feb '16 Mar '16 May '16 June '16 Total Sales, net Cost of goods sold Gross margin Total operating expenses Net Income $100 000 $ 114000 45 600 247 500 $ 940 000 97 020 $ 375 448 68 400 $ 70 560 S 90 480 124632 150 480$ 564 552 508 318 (10668) (8 840)S 6008 S 33 947 S 52 937 $ 56 234 120 000 49 440 156 000 202500 77 868 40 000 60000 77 150 (17 150) 79 068 79 400 90 685 97 543 Budgeted Balance Sheet 6/30/2016 Assets Current Assets: Cash Accounta receivable Supplies Merchandise Inventory Plant and Equipment: Buildings and Equipment Accumulated Depreciation Total assets $ 58 121 121 275 2 000 31752 $ 213 148 130 000 550 475$ $ 579 525 792 673 Liabilities and Equity Accounts payable Capital stock Retained earnings Total liabilities and equity $ 53 978 200 000 367 045 567 045 621 023 $ Sales Budget For the 6 mos ending June '16 Nov '15 Dec '15 Jan '16 Feb '16 Mar '16 Apr 16 May '16 June '16 6 mos total 2 000 Budged unit sales Selling price per unit Total Sales 11 250 22 000 11,25 S 11.25 116 000 $ 100000 S 114 000 S 120 000 S 156 000 $ 202 500 $ 247 500 11 600 10 000 11 400 18 000 89 000 0,00 S 0,00 S 10,00S 10,00 S 10,00 S 10,00 S 112 500 940 000 Cash Sales 96 Credit Sales % $ 33750 78 750 $ 112 500 34 800 81 200 116 000 30000 S34 200 $ 36 000 $ 46 800 $ 60 750 $ 74 250 $ 282 000 658 000 100000 S 114 000 $120 000 $ 156 000 202 500 S 247 500 940 000 Cash Sales 70 000 9 800 84 0001 109 200 41 750173 250 Total Sales Current month A/R Collections 1 month prior A/R Collections 2 months prior A/R Collections 16% Napoleon, Inc. Cash Collections For the 6 mos ending June 16 Mar 16 16 46 800 32 760 42 000 12 768 34 328 Jan '16 Feb '16 June '16 6 mos total 60 750 42 525 54 600 13 440 171 315 74 250 Current month cash Sales Current month A/R Collections 1 month prior A/R Collections 2 months prior A/R Collections Total cash collections 30 000 21 000 40 600 12 600 04 200 34 200 23 940 35 000 12 992 106 132 36 000 25 200 39 900 11 200 112 300 282 000 51 975 $ 197 400 70 875 $ 282 975 80 472 214 572 842 847 17 472$ Bad Debt Expense 3 150 3 248 2 800 3 192 3 360 4 368 20 118 Desired ending inventory % 40% Purchase Budget For the 6 mos ending June '16 Nov 15 Dec '15 Jan '16 Feb '16 Mar '16 May 16 June '16 6 mos total Budged unit sales Add desired ending inventory Total needs Less Beginning Inventory Required Purchases 16 15 600 200 22 800 624 16 560 11 250 4 640 15 890 11 600 4 000 5 600 4 640 10 960 10 000 4 560 14 560 4 000 10 560 11 400 4 800 16 200 4 560 11 640 12 000 6 240 18 240 4 800 13 440 18 000 8 800 26 800 7 200 19 600 22 000 7 200 29 200 8 800 20 400 89 000 38 800 127 800 35 600 92 200 4,00 S Cost per unit Purchases 4,00 S 4,00 S4,20 S 4,20 $ $43840 S 42 240 S 46 560 56 448 $ 69 552 $ 4,41 S4,4 86 436 $ 89964 91 200 % Paid in Month of Purchase % Paid in Month after Purchase 40% 60% Napoleon, Inc. Schedule of Budgeted Cash Disbursements for Merchandise Purchases For the 6 mos ending June 16 Jan '16 Feb '16 Mar '16 16 May '16 June '16 6 mos total Cash purchases 16 896 $ 26 304 43 200 S 624 S 22579 S 27 821 S 34 574 $ 35 986 $156 480 51 862 207 046 43 968 50515 $ 61 690 S76 306 87 847$ 363 526 18 0 41 731 month prior A/P Collections Cash disbursements for merchandise 25 344 27 936 33 869 Fixed Operating expenses Salaries and Wages ble Operating Expenses: 3 000 8 000 2 000 24 000 24 000 Sales Commissions, % of Revenue Other Variable Cash Expenses, % of Revenue Supplies Expense Other Overhead Other-Depreciation Napoleon, Inc. Operating Expense Budget For the 6 mos ending June '16 Jan '16 Feb '16 Mar '16 16 May 16 June'16 6 mos total Salaries and Wages Sales Commissions Rent Other Variable Cash Expenses Supplies Expense Other - Overhead Other -Depreciation Bad Debt Expense Total operating expenses Depreciation and noncash items Bad Debt Expense 7 980 8 000 6 840 2 000 24 000 24 000 3 248 79 068 24 000 3 248 Cash disbursements for operating expenses $50 000 $ 51 820 3 000 7 000 8 000 6 000 2 000 24 000 24 000 3 150 77 150 24 000 3 150 3000 $ 3000 S 3 000 10 920 8 000 9 360 2 000 24 000 24 000 3 192 84 472 24 000 3 192 57 280 8 400 8 000 7 200 2 000 24 000 24 000 2 800 79 400 24 000 2 800 52 600 3000 $ 3000 18 000 17 325 65 800 8000 48 000 56 400 S 12000 24 000 144 000 24 000 144 000 4368 $ 20 118 97 543 $ 508 318 24 000 144 000 20 118 63 325 S 69 175 $ 344 200 4 175 8 000 12 150 2 000 24 000 24 000 3 360 90 685 24 000 3 360 14 850 $ 4368 S $ Equipment payment - January Equipment payment-February Dividends -March Minimum Monthly Cash Budget $50 000 30 000 12 000 15 000 Cash Budget Jan '16 Mar '16 15000 $ 15 344 $ 15 529 Feb '16 16 May '16 June '16 6 mos total 15 000 104 200 119 200 15 887 $ 15 571 $92 331 842 847 935 178 Cash balance, beginning Add collections from customers Total cash available ess disbursements: Cash disbursements for merchandise purch. Cash disbursements for operating expenses Equipment purchases Dividends Total cash disbursements Excess of receipts over disbursements Financing Borrowing-note Repayments-note Total financing Cash balance, ending 106 132 121 132 112 300 27 644 134 328 149 857 171 315 187 202 214 572$ 230 143 $ 43 200 50 000 50 000 43 968 51 820 30 000 50 515 52 600 61 690 57 280 76 306 63 325 87 847 $ 363 526 69 175 $ 344 200 143 200 24 000 125 788 4 656 12 000 115 115 12 529 118 970 30 887 139 631 47 571 157 022 73 121 799 726 135 452 39 000 3 000 S 62 000 15000) S(62 000) 20000 39 000 15 000 15 000 15 000 24 656 $ 15 529 $15 887 32 000 32 000 20 000 3 000 (15 000) S 15 571 $58 121 $ 144 764 Budgeted Income Statement 16 65 520 84 472 Jan '16 Feb '16 Mar '16 May '16 June '16 Total Sales, net Cost of goods sold Gross margin Total operating expenses Net Income $100 000 $ 114000 45 600 247 500 $ 940 000 97 020 $ 375 448 68 400 $ 70 560 S 90 480 124632 150 480$ 564 552 508 318 (10668) (8 840)S 6008 S 33 947 S 52 937 $ 56 234 120 000 49 440 156 000 202500 77 868 40 000 60000 77 150 (17 150) 79 068 79 400 90 685 97 543 Budgeted Balance Sheet 6/30/2016 Assets Current Assets: Cash Accounta receivable Supplies Merchandise Inventory Plant and Equipment: Buildings and Equipment Accumulated Depreciation Total assets $ 58 121 121 275 2 000 31752 $ 213 148 130 000 550 475$ $ 579 525 792 673 Liabilities and Equity Accounts payable Capital stock Retained earnings Total liabilities and equity $ 53 978 200 000 367 045 567 045 621 023 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts