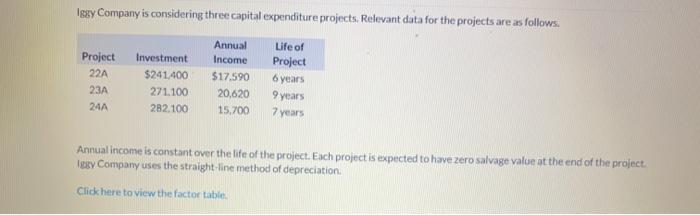

Question: Issy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Project 22A 23A 24A Investment $241.400 271.100 282,100 Annual

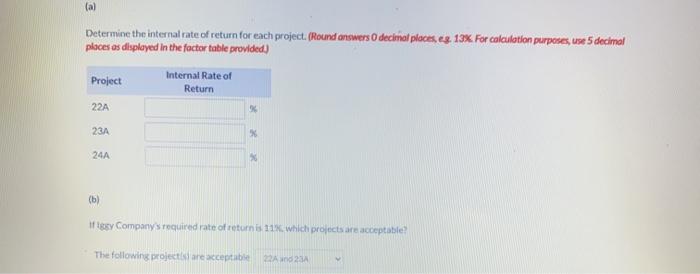

Issy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Project 22A 23A 24A Investment $241.400 271.100 282,100 Annual Income $17.590 20,620 15,700 Life of Project 6 years 9 years 7 years Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. texy Company uses the straight-line method of depreciation. Click here to view the factor table (a) Determine the internal rate of return for each project. (Round answers O decimal places, s 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided) Project Internal Rate of Return 22A 23A x 24A (b) If y Company required rate of returns 11 which projects are acceptable! The following projects are acceptable 22 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts