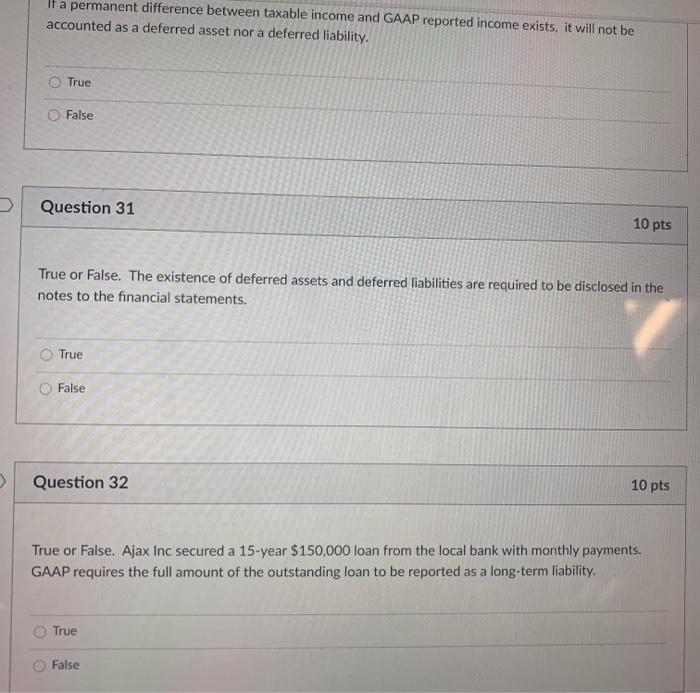

Question: It a permanent difference between taxable income and GAAP reported income exists, it will not be accounted as a deferred asset nor a deferred liability.

It a permanent difference between taxable income and GAAP reported income exists, it will not be accounted as a deferred asset nor a deferred liability. True False Question 31 10 pts True or False. The existence of deferred assets and deferred liabilities are required to be disclosed in the notes to the financial statements. True False Question 32 10 pts True or False. Ajax Inc secured a 15-year $150,000 loan from the local bank with monthly payments. GAAP requires the full amount of the outstanding loan to be reported as a long-term liability. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts