Question: it Alimentare Save Submit Assignment for Grading Questions Questions 2 2. Check My Work 3 O eBook 4 O 5. 6 Problem 21-01 HEM, Inc

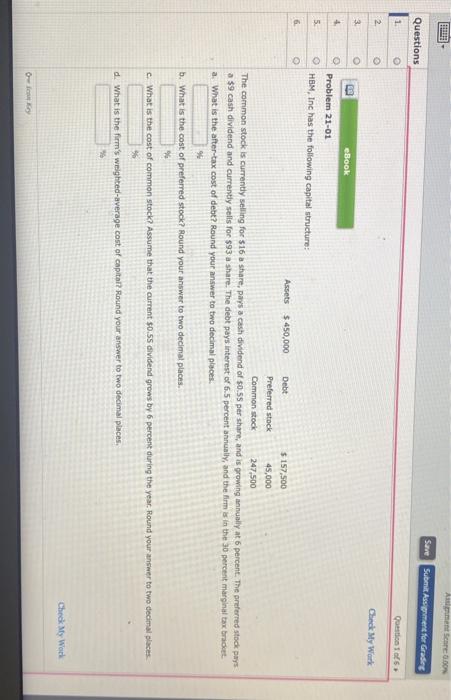

it Alimentare Save Submit Assignment for Grading Questions Questions 2 2. Check My Work 3 O eBook 4 O 5. 6 Problem 21-01 HEM, Inc has the following capital structure: Assets $450,000 Debt $157,500 Preferred stock 45,000 Common stock 247,500 The common stock is currently selling for $16 a share, pays a cash dividend of $0.55 per share, and is growing annually at 6 percent. The preferred stock pays a $9 cash dividend and currently sells for $93 a share. The debt pays Interest of 6.5 percent annually, and the firm in the 30 percent marginal tax bradet a. What is the after-tax cost of debt? Round your answer to two decimal places. b. What is the cost of preferred stock? Round your answer to two decimal plans. c. What is the cost of common stock? Assume that the current $0.Ss dividend grows by 6 percent during the year. Round your answer to two decimal places d. What is the firm's weighted-average cost of capital? Round your answer to two decimal places, Check My World Oy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts