Question: it also said that 720 was wrong Submitted 20.68/2 Required information [The following information applies to the questions displayed below) As part of a major

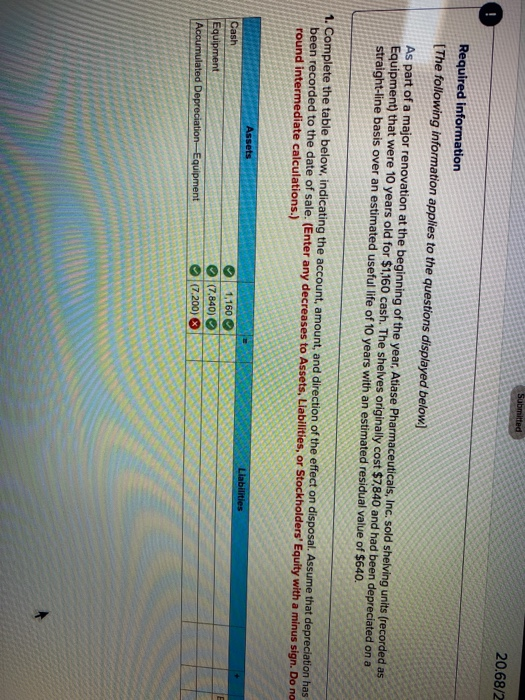

Submitted 20.68/2 Required information [The following information applies to the questions displayed below) As part of a major renovation at the beginning of the year, Atiase Pharmaceuticals, Inc. sold shelving units (recorded as Equipment) that were 10 years old for $1,160 cash. The shelves originally cost $7,840 and had been depreciated on a straight-line basis over an estimated useful life of 10 years with an estimated residual value of $640. 1. Complete the table below, indicating the account, amount, and direction of the effect on disposal. Assume that depreciation has been recorded to the date of sale. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign. Do no round intermediate calculations.) Assets Liabilities Cash Equipment Accumulated Depreciation Equipment 1,160 (7,840) (7.200) X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts