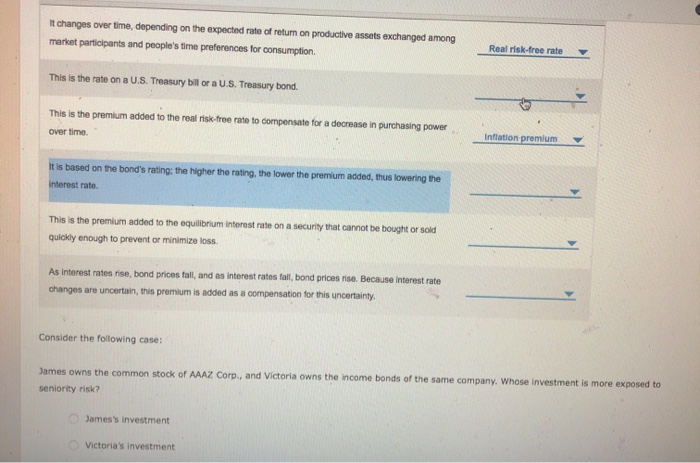

Question: It changes over time, depending on the expected rate of return on productive assets exchanged among Real risk-free rate market participants and people's time preferences

It changes over time, depending on the expected rate of return on productive assets exchanged among Real risk-free rate market participants and people's time preferences for consumption This is the rate on a U.S. Treasury bill or a U.S. Treasury bond This is the premium added to the real risk-free rate to compensate for a decrease in purchasing power inflation premium over time It is based on the bond's rating: the higher the rating, the lower the premium added, thus lowering the nterest rate. This is the premium added to the equilibrium interest rate on a security that cannot be bought or soid quickly enough to prevent or minimize loss. As interest rates rise, bond prices tall, and as interest ratos tall, bond prices rise. Because interest rate changes are uncertain, this premium is added as a compensation for this uncertainty Consider the following case: lames owns the common stock of AAAZ Corp, and Victoria owns the income bonds of the same company. Whose investment is more exposed to seniority risk? James's investment Victoria's investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts